Coronavirus: look of auctions ‘may change forever’

The industry is facing a new normal post-coronavirus as settlement levels hit 30-year lows.

The property industry is facing a new normal post-coronavirus, as listing levels plunge and settlement levels hit 30-year lows.

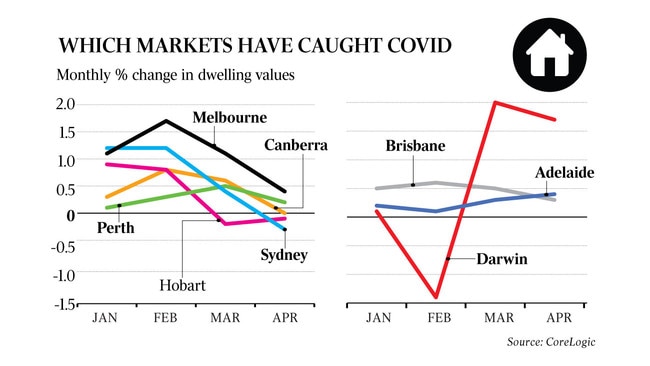

Data released by property researcher CoreLogic shows while prices grew a modest 0.3 per cent last month, nervous buyers and sellers caused the number of settlements to drop 40 per cent compared with March and new listings to fall more than a third year-on-year.

It is the first full month of property data under COVID-19 social-distancing measures, including a ban on public auctions and open homes. AMP chief economist Shane Oliver attributed the collapse in sales volumes to the bans and associated economic uncertainty.

“If the domestic lockdown starts to be eased through this month, as we expect, then the fall in average property prices is likely to be around 10 per cent as the six-month wage subsidies and bank payment deferrals will have been enough to protect the economy and hence the property market,” Mr Oliver said. “This would take prices back to where they were around the middle of last year.”

The strong uptake of online auctions through the lockdown period may see traditional selling methods change, My Housing Market chief economist Andrew Wilson said.

“The open-air auction is specific to Australia, and we may see it replaced by more online auctions or more private treaties or off-market sales,” he said. “This has been motivated by the auction closedown, and it may change the industry forever, regardless of the economic environment.”

Sydney prices grew 0.4 per cent during April, while Melbourne, which led the market’s early-stage recovery mid-last year, fell 0.3 per cent. In the smaller markets, Brisbane grew 0.3 per cent, Adelaide was up 0.4 per cent and Perth nudged 0.2 per cent higher. Neither Canberra (steady) nor Hobart (down 0.2 per cent) grew.

Most property experts expect prices to fall between 5 per cent and 10 per cent nationally over the next few months. The economic fallout from the virus will likely hit the two largest capital city markets hardest, due to Sydney and Melbourne’s reliance on demand from overseas migrants and foreign students, poor housing affordability and low rental yields.

CoreLogic’s head of research, Tim Lawless, warned it was too early to discern any trends from the April data. Stimulus from governments and banks would likely see the number of forced sales remain low, while rising unemployment would have more impact on sectors that tended to have lower rates of home ownership, he said.

“No doubt the coming month will provide more clarity about the direction of housing markets. One of the most important indicators to follow will be measures of consumer sentiment. If consumers’ spirits start to bounce back to more normal levels, this is when we should start to see housing activity lift from their current low levels,” Mr Lawless said.

Steve and Sarah Kassiou are hoping to take advantage of the low stock levels when they list their renovation investment project later this month. The family bought a pre-war Queenslander in the inner-north Brisbane suburb of Clayfield in November, with a plan to convert it into townhouses. Despite the restrictions, they have decided to push ahead.

“When (the coronavirus) first hit our shores, I thought about selling but realised I was too far into the job,” said Mr Kassiou, a builder. “There is no point in waiting. I’m feeling confident. At the end of the day, it might take a little longer but they will sell.”

The townhouses will be marketed by Tony Cicchiello and Judith Crawford of Ray White Clayfield later this month.

Dr Wilson said the resurgence of the market during the traditionally quiet winter months could work in the industry’s favour.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout