Business faces gas ‘apocalypse’ from European oil blockade

Business leaders have warned companies face spiking gas prices as motorists confront months of pain, with petrol to remain above $2 a litre.

Business leaders have warned companies face “apocalyptic’’ damage from spiking gas prices as motorists confront months of pain at the bowser, with petrol to remain above $2 a litre, driven by Europe’s oil blockade on Russia.

The rise in energy costs, coupled with a predicted 10 per cent rise in food prices, threatens to deepen cost-of-living pressures and extend a surge in inflation, which reached a 20-year high of 5.1 per cent in the March quarter.

The rise in global oil prices to above $US120 a barrel came after the European Union said it would ban all imports of Russian oil by ship in retaliation for the Ukraine war, a move that would block about two-thirds of Russia’s oil exports.

The Australian Energy Market Operator on Tuesday scrambled to impose a cap on gas markets in Sydney, Melbourne and Brisbane after wholesale prices soared 80 times normal levels.

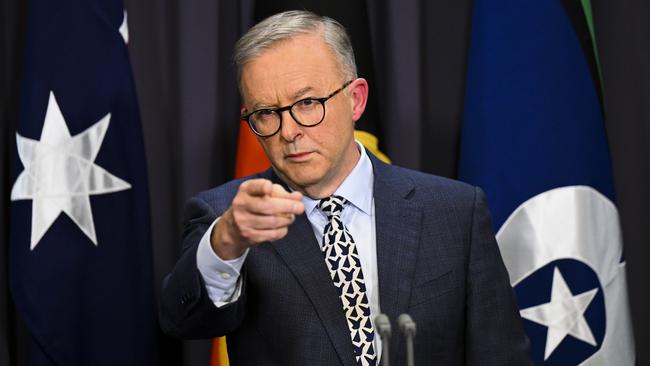

Anthony Albanese said briefings with Treasury and finance included issues of cost of living. “We will give proper consideration with proper advice to any policy moves that are made,’’ he said, “but we’ve been very conscious about the issue of cost of living.’’

The spike in wholesale gas prices followed a cold snap that drove demand higher, exacerbated by last week’s collapse of energy retailer Weston Energy. The rise in energy prices came as David Williams, an investment banker specialising in agribusiness, predicted food prices would soar 10 per cent this year.

Speaking ahead of The Australian’s Global Food Forum, Mr Williams said many producers would need to secure price rises to cover soaring input costs.

“One-off significant increases in grain costs will drive food inflation and increase the cost of stock feed and therefore beef and other proteins. The effect of this will be that the unbelievable success of increasing incomes in developing countries will now be undermined by pushing people back into poverty and starvation for others,” Mr Williams said.

“Compounding all this, I expect to see significant increases of up to 10 per cent in many food companies’ costs from Covid-related effects alone.”

Mr Williams said there would be a “perfect storm” with the failure of a large part of the Chinese crop because of floods at the same time as India halted wheat exports and some Canadian farmers cut back their plantings — all while Ukrainian exports stalled due to the Russian invasion.

Ai Group chief executive Innes Willox warned that persistently higher energy costs had the potential to devastate energy-intensive industries.

“Apocalyptic rises in energy prices threaten chaos for industry and pain for households,” Mr Willox said. “They demand a national, integrated and strategic response. With Europe announcing further steps today to wean itself from Russian energy, we can expect international factors to sustain high energy price pressures for years to come – especially in natural gas.”

Mining companies are among the biggest fuel users in Australia, with Fortescue Metals Group alone consuming up to 450 million litres of diesel each year to run its fleet of giant trucks and diggers in the Pilbara. However the rise in energy costs will be a boon for Australian oil and gas producers, with analysts estimating that each $US10-a-barrel rise in the global price of oil would add up to $US500m in earnings to Woodside Petroleum and Santos.

Australian Logistics Council chief executive Brad Williams warned that the compounding pressures felt by logistics firms across rail, road and air would inevitably feed through to even higher consumer prices.

“Most businesses operate with low margins, which means they have limited capacity to absorb significant and ongoing price increases,” Mr Williams said.

“Labour shortages, exacerbated by international border closures and heightened with Covid and influenza absenteeism continue to put cost pressure on the supply chain. It is inevitable these costs will be felt across the supply chain, including at the consumer end.”

RBC Capital global energy strategist Michael Tran said the EU’s decision to ban member states from purchasing Russian crude and refined products by sea had moved European action from “virtue signalling” to “up-ending” the global oil trade.

“This policy is perhaps a foreign policy win for the West, but it will prove economically inflationary for all nations involved, given that the reshuffling of global flows is likely to be structural as long as the war remains a slow burn,” Mr Tran said.

The price of 91-octane unleaded fuel once again breached $2 a litre earlier this month, despite the 22.1-cent fuel excise cut delivered in the March budget.

CBA commodity analyst Vivek Dhar said he expected the Brent crude price to average $US110 a barrel by the end of September, and to ease only to about $US100 by the end of the year.

Mr Dhar said movements in the Australian dollar would influence how high oil prices would translate to the bowser, but added that “the risk is that we stay around $2 a litre”.

Treasurer Jim Chalmers has said the Albanese government is “unlikely” to extend the excise cut beyond September, pointing to its $2.9bn six-month price tag in the context of huge, ongoing levels of debt and deficits.

While rising energy costs have lifted inflation, analysts predict the national accounts figures will show the economy expanded by 0.7 per cent in the March quarter, and by 3 per cent over the year. A big drag from net exports – as a result of disruptions to mining exports and a solid lift in spending on imported goods – is expected to be offset by a stronger than anticipated boost from government spending and business inventories, underpinned by robust domestic demand.

ANZ senior economist Felicity Emmett projected that the national accounts’ broader measure of worker pay – including bonuses, overtime and allowances – would paint a more positive picture of household income growth.

The widely quoted wage price index pointed to only 2.4 per cent growth over the year to March, but Ms Emmett said business profit figures, released by the Australian Bureau of Statistics on Tuesday, suggested average hourly earnings for workers jumped by 2.6 per cent in the March quarter, and by 5.3 per cent over the year. “Today’s data suggest that 2022 got off to a solid start, and that a tight labour market is feeding through more quickly into wages than the wage price index suggests,” she said.

Additional reporting Nick Evans

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout