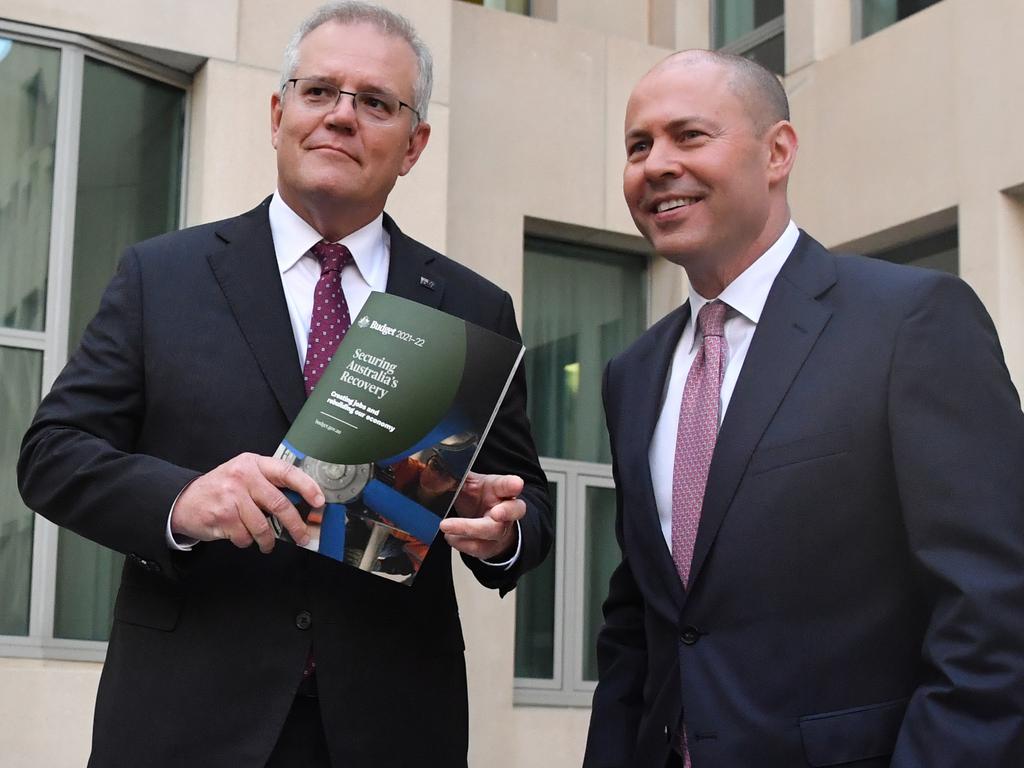

Budget 2021: Another happy return for three out of four workers

This should have made bigger news. Three in four workers can look forward to another ‘one-off’ boost to their tax returns next year.

Three in four workers can look forward to another “one-off” boost to their tax returns next year, after Tuesday’s budget confirmed the low and middle income tax offset will be retained for a further year.

Any other budget and this would have been big news. But, of course, we are not living in normal times.

A mere $7.8bn in tax cuts paled in comparison to measures such as the $17.7bn for aged care — part of an additional $96bn in stimulus announced since December’s mid-year economic and fiscal outlook.

The LMITO — or “lamington” as the wonks like to call it — was meant as a one-off treat for, as the name suggests, lower and middle-income income earners. But it will now extend across three financial years. The bottom line: if you’re a single person earning between $48,000 and $90,000 a year, good news: your tax bill for 2021-22 will be reduced by a cool $1080.

If you’re a couple earning in a similar range, then as a household you’ll get double that: an even cooler $2160.

Taxpayers on less than $37,000 a year will see a benefit of up to $255. The offset phases out at a rate of 3c in the dollar for those earning more than $90,000, and cuts out altogether by $126,000.

In a glossy brochure accompanying the budget papers, Treasury used the example of a couple, one of whom earns $100,000, and the other $60,000. Thanks to LMITO, they’ll get a combined offset of $1860 after they lodge their 2021-22 tax returns.

The Morrison government justified Tuesday night’s one-year extension on the grounds it would pump more money into the economy as workers spent the proceeds.

Treasury predicted the LMITO extension would boost GDP by about $4.5bn in 2022-23, and would create an additional 20,000 jobs by the end of that financial year.

Of course, politics also played their part: leading up to the budget there was already “research” in major papers showing how hardworking Australians would face an “effective” tax hike should LMITO expire as scheduled.

Whatever the rationale, the bottom line was that 10.2 million individuals will be paying less tax next year.

While not personal income tax relief, there was also good news in the budget for the nation’s 1.4 million sole traders, with the extension of the temporary full expensing measure for another year to include 2022-23.

Just to snatch from the air an occupation randomly and entirely unprompted by the Morrison government, let’s use tradies as an example.

The extension means you’ll have more time to buy that ute and still write it off against your tax in full in one year, rather than over five.

That may sound a long way out, but COVID has triggered a rush in demand for vehicles, as well as a shortfall in supply, leaving massively long delivery times for new cars.

There’s a catch, though: only tradies with annual revenue under $5bn need apply.

It’s a measure designed to bring forward future investment, and the stats show it has worked. Investment in machinery and equipment increased at its fastest pace in seven years in the three months to December.

There had been talk leading into the budget that the massive, third and final stage of the tax cuts, which gives relief to higher income earners from 2024-25, might be brought forward.

Alas for those on higher incomes — and for those aspiring to higher tax brackets — this was not the case.

Stage three is big. It will cost a whopping $130bn. It will create a flat 30 per cent marginal tax rate on earnings between $45,000 and $200,000, abolishing the 37 per cent tax bracket altogether.

Treasury has estimated that from 2024-25, 95 per cent of taxpayers will pay a marginal rate of no more than 30c in the dollar.

Labor hasn’t said whether it will go to the next election with a pledge to repeal stage three, but it doesn’t seem dead keen on it. Opposition Leader Anthony Albanese has characterised it as essentially a tax cut for the rich, and at a time when the nation is drowning in debt.

Josh Frydenberg, of course, has offered an alternative picture.

The Treasurer says a tradie on $80,000 a year would be $900 worse off were Labor to abolish the stage three cuts. A teacher earning $70,000 a year would be $620 worse off, he reckons.

The Morrison government’s legislated personal income tax plan aimed to go some way to correcting — although not solving — some widely observed problems with our tax system.

The first of these is that we rely more on personal income tax than other developed countries.

Economists would love to reduce this reliance. They point to big reforms such as lifting the goods and services tax rate, and broadening it. That money could be used to reduce personal income tax rates, they say. But the politics of raising the GST make such a reform effectively impossible, at least for the foreseeable future.

Second, our top marginal rate is relatively high at 45c in the dollar, and kicks in at the relatively low income level of $180,000. It’s still at 45c under stage three, but from $200,000.

It’s also worth noting that Australian workers labour under the third-highest income tax burden in the world, behind only Denmark and Iceland, a recent OECD report found.

So the government came up with its three-step tax plan, which was made law, that would simplify the rate scale and go some way to dealing with these and other issues.

One of those other issues is the scourge of bracket creep — the phenomenon whereby growing wages but static tax brackets over the years have pushed more and more middle-income earners into paying higher marginal rates.

Stage three will reverse years of that creep. It means the stage-three cuts — while heavily weighted towards higher earners — will not make the income tax system less fair. The top 5 per cent will be paying a third of the overall income tax burden before and after the tax relief.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout