Fewer jobs, plunging house sales are a worry, says Jim Chalmers

The second straight month of job losses is expected to raise concerns about the unprecedented speed of nine rate hikes from May.

Jim Chalmers says he is “worried about the prospect of a slowing economy”, as the second straight month of job losses drove the unemployment rate up to 3.7 per cent in January, from 3.5 per cent the month before.

As new monthly home sales plummeted to their lowest level since at least 1996 and amid plunging consumer confidence following nine straight rate rises, the Treasurer said it was “broadly accepted the interest rate rises … in the system are about taking some of the heat out of the economy and that has consequences for the unemployment rate”.

“I suspect we’re seeing the beginning of that in the (unemployment) number that is released today,” he said. “Our job, our objective, our aspiration, is to try and grow the economy as fast as we can, with unemployment as low as it can be without adding to these inflationary pressures.”

The surprise 11,500 drop in the number of employed Australians in January – the consensus among economists had been for a 20,000 increase in jobs and a steady unemployment rate – followed an equally unexpected 20,000 decline in employment in December.

Australian Bureau of Statistics data shows there were 43,300 fewer Australians employed full‑time in January than in December, which more than offset the 31,800 rise in part-time jobs.

The ABS figures show underemployment, which measures those who have jobs but are trying to get more hours, held steady at 6.1 per cent in January. The workforce participation rate eased to 66.5 per cent, from 66.6 per cent in the previous month.

The jobless rate has now been on an upward trend since its October low of 3.4 per cent, and has reached the highest since May, even as inflation is yet to show any signs of easing.

Dr Chalmers said “any treasurer is worried about the prospects of a slowing economy, and I am, of course”.

“When the economy slows, when the unemployment rate ticks up, even if it still remains near historic lows, there are human consequences for that, just as there are human consequences for the decisions that the Reserve Bank takes,” he said.

“As we enter what I expect will be a really difficult year for the economy, for our people, the prospects for a slowing economy and higher inflation than we’d like for longer than we’d like, obviously that’s a concern.”

The Coalition in question time renewed its attack on the government for not doing enough to take the heat out of the soaring cost of living, accusing it of mismanaging the economy.

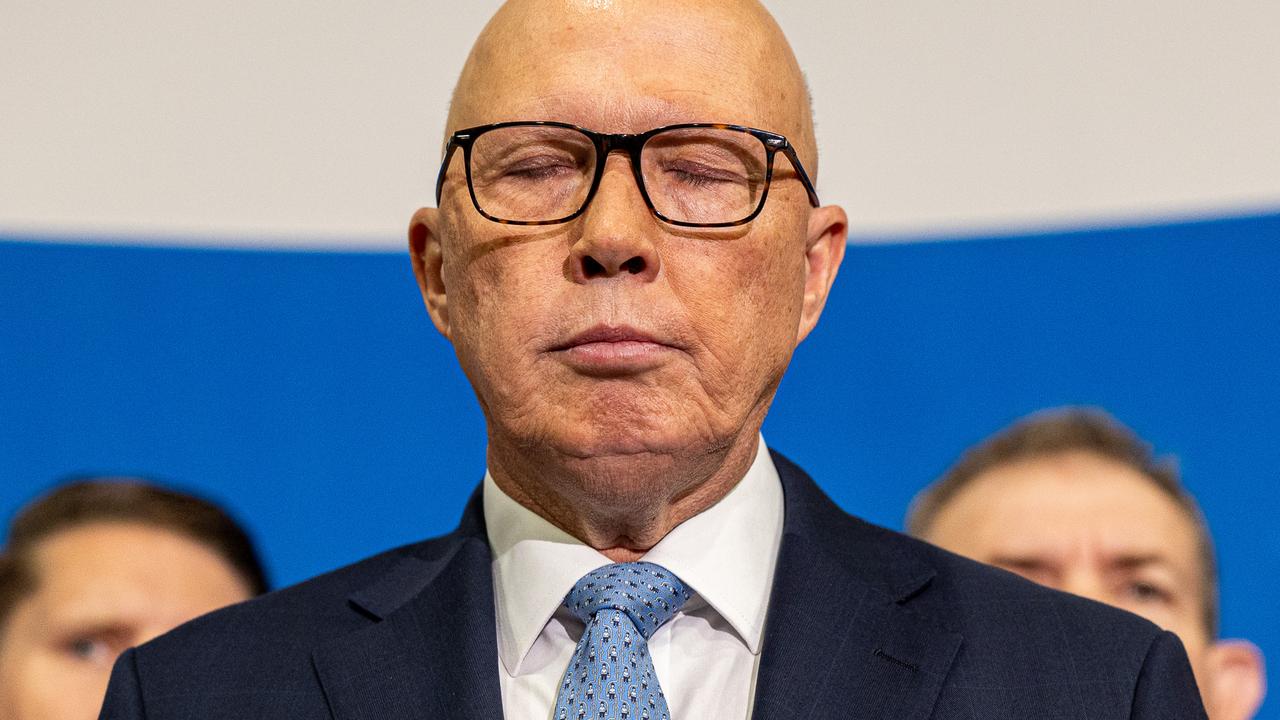

Opposition Treasury spokesman Angus Taylor said the latest jobs figures revealed “the dangerous combination of stubbornly high inflation and job losses”.

Economists said another weak labour market report added to growing evidence that nine straight rate hikes were dragging on growth, but said it was unlikely to deter the RBA from further rate increases.

Capital Economics economist Marcel Thieliant said: “The weakness in January’s labour market data underlines that aggressive monetary tightening is starting to cool activity, but with inflation still far too high that won’t prevent the RBA from hiking interest rates for a while yet.”

Reserve Bank governor Philip Lowe this week doubled down on his hawkish message that more rate increases would be needed to get consumer price growth back under control, saying he was “unsure” how high rates would need to go as he warned of the “corrosive” effects of runaway inflation.

Mr Thieliant said “with governor Lowe yesterday (Wednesday) reiterating that inflation remains ‘way too high’, we’re sticking to our forecast that the RBA will lift the cash rate to 4.1 per cent by May” – from 3.35 per cent now.

“However, the latest set of labour market data add to our conviction that the RBA will loosen policy before the year is out,” he added.

The Housing Industry Association warned the RBA risked driving the construction industry from boom to bust, pointing to new figures which show 50 per cent fewer new home sales in the three months to December than a year earlier. There were just over 3000 new house sales in December, the seasonally adjusted HIA data shows, the fewest since it began tracking the data in 1996.

ACTU secretary Sally McManus urged the government to do more to support job creation in the May budget, and for the RBA to end its punishing rate rises.

“The RBA must not ignore its other key objective, which is full employment,” Ms McManus said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout