‘Deep pessimism’: consumer confidence slumps to recessionary levels

Consumer confidence has fallen below the GFC’s low point, but the Assistant Treasurer says ‘we are on the narrow path to avoiding recession’.

Peter Dutton has tried to pin runaway inflation and a crushing series of eight rate rises since the election on the government, accusing Anthony Albanese of failing to do enough to help the Reserve Bank bring surging consumer price growth under control.

The opposition’s renewed attack on the Prime Minister in parliament came as consumer confidence slumped to recessionary levels after the Reserve Bank last week dashed hopes the new year would bring a pause in the punishing rise in mortgage costs.

NAB chief economist Alan Oster said he now expected the RBA to deliver a further three rate rises to 4.1 per cent by May and warned a recession later this year was now “more of a possibility” as the central bank looked set to redouble its efforts to bring inflation back under control.

Jim Chalmers in question time deflected blame for consumer price growth of 7.8 per cent – the highest since 1990 – on global factors but said “inflation is the number one economic challenge in 2023, and that’s why addressing inflation is the government’s main focus”. “Through our three-point plan to provide responsible cost-of-living relief by repairing our supply chains and showing appropriate spending restraint in a responsible budget, that is the best way to go about this hard task,” the Treasurer said.

Amid growing discontent in Labor ranks over the pain being inflicted on mortgaged households as a result of the nine consecutive rate rises since April, RBA governor Philip Lowe will likely face a hostile reception at a senate estimates hearing on Wednesday morning. Dr Lowe has come under heavy criticism for not anticipating last year’s inflation spike and he has been pilloried in recent days for lunching in private with traders from major banks, despite foregoing his usual New Year public appearance.

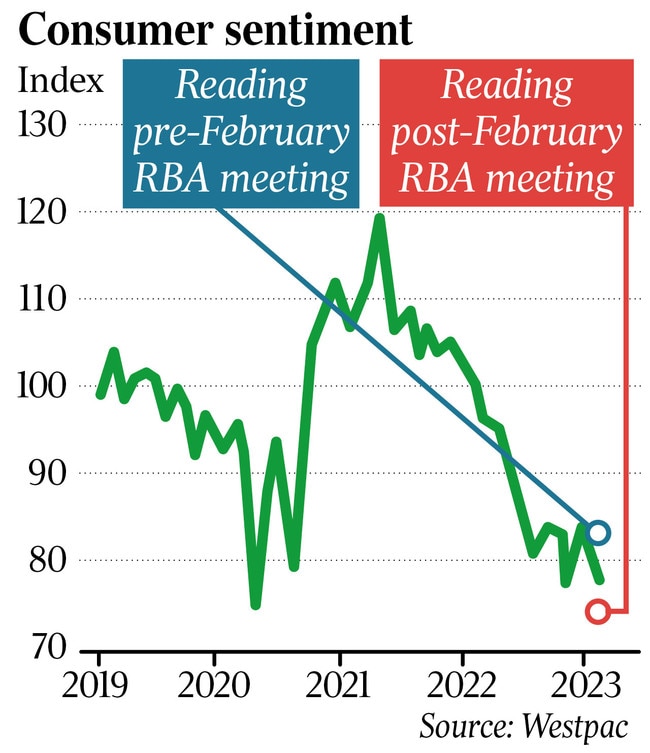

As mortgage holders brace for more pain, Westpac’s monthly consumer survey – conducted last week – showed sentiment had dropped into “deep pessimism”. Westpac senior economist Matthew Hassan said “the consumer sentiment survey continues to give a very clear warning that the pressures bearing down on the consumer are becoming intense”.

“While spending has held up relatively well to date, we expect an abrupt slowdown to show through in coming months,” he said.

The Westpac-Melbourne Institute sentiment gauge fell by 7 per cent to 79 points, reversing a slight recovery over the Christmas and New Year period. The February sentiment reading was around the recent low in November last year, marginally gloomier than the 79-point low recorded during the GFC and not far above the national Covid lockdown low of 76 points in April 2020.

The survey revealed the material impact of last Tuesday’s rates decision on confidence, with sentiment among those surveyed before the February 7 meeting relatively steady at 84 points, while sentiment among those surveyed after showed a dramatic fall to 75 points.

With mortgage holders facing the prospect of a further three rate rises in as many months, Assistant Treasurer Stephen Jones again made the case against further policy tightening and defended the government’s budget management amid a once-in-a-generation inflationary challenge.

“We think we’re doing our bit which is putting downward pressure on interest rates and we also think there’s plenty of evidence … the interest rate rises that are already in the system are pulling money out of the economy and dampening down on demand,” he said. “And we are concerned that further increases are going to put pressure on households and businesses that are already doing it tough.”

Amid growing fears the RBA will not be able to tame inflation without triggering an economic contraction later this year, Mr Jones said he remained hopeful monetary policymakers could steer a course so this year’s sharp slowdown would not morph into a deeper downturn, although he recognised “the risk of getting it wrong is very high”.

Mr Oster said he anticipated two rate hikes in April and May. “A cash rate peak above 4 per cent will have a significant impact on economic growth, and we expect GDP to be below 1 per cent over both 2023 and 2024,” he said.

EDITORIAL P12

COMMENTARY P13

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout