Australia’s income tax burden third highest in OECD

The typical single Australian employee paid 23 per cent of the wages in tax, 10 percentage points higher than the OECD average.

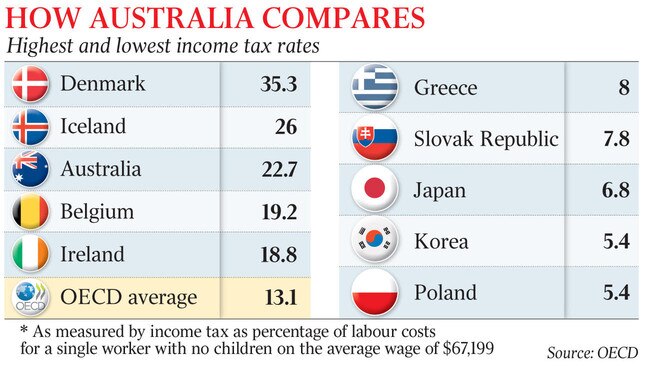

Australian workers labour under the third-highest income tax burden in the world, behind only Denmark and Iceland, according to a new OECD report.

A single employee with no children and earning the average annual wage of $67,200 paid 22.7 per cent of their wages in income tax in 2019-20, the OECD’s Taxing Wages report reveals.

Less than two weeks from a federal budget that will focus on extending the economic recovery and driving unemployment below 5 per cent, tax experts said Australia’s over-reliance on taxing income over wealth and consumption was holding back the nation’s growth potential at a time when paying back the debt incurred through the pandemic would take on increasing urgency in coming years.

There are growing expectations that Josh Frydenberg on May 11 will announce that the one-off low-and-middle-income tax offset will be extended another year to 2021-22, at an estimated cost of about $7bn a year.

Earlier this week, business leaders called on the government to consider bringing forward stage three of the legislated income tax cuts, which are due to come into effect in 2024-25 and are aimed at middle and higher income earners.

In a speech laying out the Morrison government’s updated fiscal strategy, the Treasurer on Thursday said the rapid recovery in the labour market meant “Australia is now set to avoid what many feared could be another generation lost to long-term unemployment”.

But he emphasised the uncertainties that continued to shroud the outlook, not least the constant threat of new COVID-19 outbreaks. “This will be another pandemic budget being delivered in the midst of a once in a 100-year pandemic,” he said, as he flagged the task of budget repair would not begin until “we have secured the economic recovery”.

It was only in this delayed, second phase of the fiscal strategy during which “structural reforms to boost economic growth” would be pursued, he said.

Bob Breunig, the director of the Tax and Transfer Policy Institute at the Australian National University, said the country’s “incredibly heavy” reliance on corporate and income tax revenue had “negative consequences for growth and prosperity”.

“Large-scale tax reform is currently not on the agenda, but it will have to be,” Professor Breunig said. “With the debt we now have, we can’t afford to just take our current system and lift all the rates.”

New South Wales state treasurer Dominic Perrottet, who is in consultation around the potential of replacing inefficient stamp duty on property transactions with a land tax, told The Australian that the challenge for every level of government was “to find a tax mix which will boost investment and create jobs”.

“In NSW we have reduced the burden on business through reducing payroll tax and that helps drive employment,” Mr Perrottet said.

The latest OECD report showed Australia’s income tax burden moved up one spot in 2020, above Belgium and behind only Iceland and Denmark.

Australia was close to 10 percentage points higher than the 37-country average, and well above the 12.6 per cent paid by British workers, the 14.3 per cent by Canadians, and the 15.5 per cent of American workers’ wages.

In contrast, a single Danish worker on an average salary paid more than a third of their wages in income tax, and the figure was more than a quarter in Iceland.

Chris Evans, professor of taxation at the University of NSW business school, said including social security contributions made by workers and employers was a better way to gauge the overall deterrent effect on work from taxes placed on income.

By this measure, including an average 5.6 per cent payroll tax, Australia’s “tax wedge” was 28.4 per cent, below the OECD average of 34.6 per cent.

Professor Evans agreed the tax system was in “desperate need” of reform to make it less reliant on income and corporate tax, saying the Morrison government had only “fiddled at the margins”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout