Business urges Josh Frydenberg to bring forward tax cuts

Stage three of the personal income tax cuts aimed at middle to higher income earners should be brought forward, business leaders say.

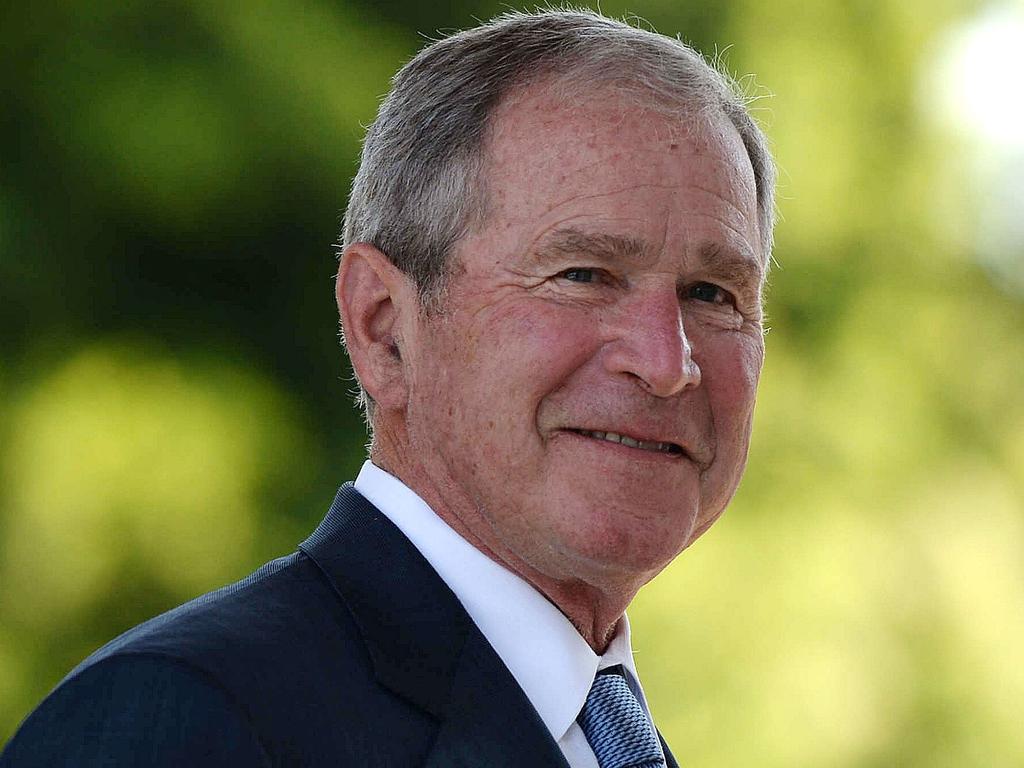

Josh Frydenberg is being urged by business to consider bringing forward stage three of the government’s personal income tax cuts aimed at middle to higher income earners to help drive economic activity as the nation emerges from the pandemic.

Under the government’s plan, about 95 per cent of taxpayers are expected to pay a marginal rate of tax of 30 per cent or less by 2024-25. Stage three would flatten the system by imposing a 30 per cent tax rate on all income earned between $45,000 and $200,000 while incomes over this threshold would be taxed at 45 per cent.

Business Council of Australia chief executive Jennifer Westacott told The Australian it was worthwhile for the government to consider accelerating the stage three tax cuts from their scheduled start date of July 1, 2024.

“Bringing forward stage three tax cuts will need to be carefully considered through the budget process but moves that see Australians keep more of their hard-earned income are good for workers, good for businesses and good for the economy,” she said.

“We support any measures that put money back in people’s pockets, drive economic activity and let business do the heavy lifting on job creation as we recover.

“The government’s comprehensive income tax plan is big reform, it stops people falling into higher tax brackets and it means workers are already keeping more of their pay packet.”

In the October budget, the government chose to bring forward only the second stage of its legislated tax cuts, avoiding a political fight with Labor.

These changes saw the top threshold of the 32.5 per cent tax bracket increased from $90,000 to $120,000 and the top threshold of the 19 per cent bracket increased from $37,000 to $45,000.

The government also decided to extend for an extra year the Low and Middle Income Tax Offset, which provides $1080 for those on incomes of $48,001-$90,000, with the offset phasing out for those earning up to $126,000.

The measure was framed as a one-off decision to help support low and middle income earners through the economic recovery, but the government has fed speculation the offset — which is paid as a refund at the end of the year — could be retained for another year, given that its withdrawal could disproportionately affect women.

Australian Industry Group chief executive Innes Willox said the task for the budget was to “balance the stimulus that has already been delivered with the long-term needs of the economy.”

“Industry’s real need now is for the states to keep their borders open and for all our governments to work together to deliver a skilled and mobile workforce that makes the most of the economic recovery that is just gathering pace,” he said.

There is also strong opposition to any bring forward of stage three of the income tax cuts, with Australian Council of Social Service chief executive Cassandra Goldie last week arguing they should be dropped. “We’re warning the government against even more tax cuts in the federal budget, which would not help people on low incomes and would ultimately impact them through a lack of investment in essential services into the future,” she said.

“We can provide quality services, such as disability and health services, by ensuring our tax system is fair. This means dropping the high-end income tax cuts, which would see tens of thousands of dollars more go to people earning hundreds of thousands, who are mostly men.”

Economists have also questioned the extent to which the stage three tax cuts would act as an economic stimulus, saying higher-income earners were more likely to save extra funds.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout