Australia reclaims China wine crown, but Chilean Yellow Tail a worry

The surge of Australian wine back to China is welcome trade news for Canberra. But all is not right in the Australian industry’s biggest overseas market.

Less than a year after Beijing removed punitive tariffs, Australia has reclaimed its title as China’s favourite wine producer with sales of $907m, comfortably overtaking second-placed France.

South Australian producers were the big winners, with exports of the state’s shiraz and cabernet sauvignon rising by just over $500m.

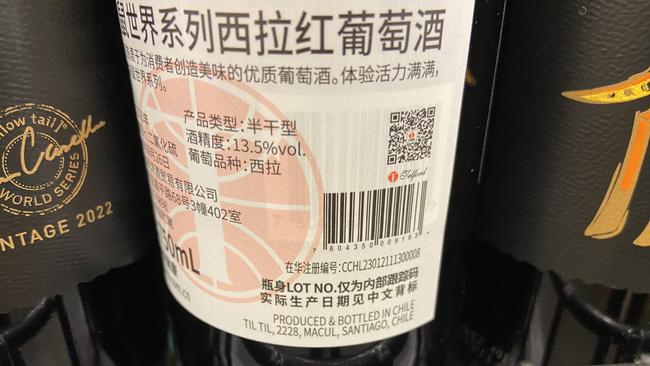

It is welcome news for Canberra, as Australian export businesses brace for turbulence from Donald Trump’s tariff threats. But all is not right in China, the Australian industry’s biggest overseas market. For proof, just look at the label on the back of kangaroo-branded Yellow Tail in a Chinese store. “Produced & bottled in Chile,” it says.

Yellow Tail’s parent company, Casella Family Brands, started selling the made-in-Chile range in 2022 to get around Beijing’s crippling tariffs of about 200 per cent on Australian wine. The Chilean drop allowed Yellow Tail, which had been Australia’s second best selling wine label in China, to stay in the market. Slow sales means the South American variety will limp on until the end of the year.

James Wilson, who runs Casella’s Asian sales team, said the transition back to Australian-made wine had been delayed because of “subdued demand and high inventory levels” in China. “The transition has taken longer than initially expected due to ongoing market challenges,” he said. “This is not specific to [Yellow Tail] or Chilean wine, but appears to be a market-wide issue affecting all major wine-producing countries.”

It is more than a wine problem. Australia’s live lobster exporters have had to reduce prices by almost a third as Chinese consumers cut back on spending.

Australia’s total exports to China in 2024 fell by 9 per cent, with iron ore and lithium prices relatively weak. While China remains by far Australia’s biggest overseas market, some are questioning whether the trade relationship has peaked and if alternate markets are growing fast enough to pick up the slack.

The return of Australian wine has been a rare burst of good news in a Chinese market that has endured years of gloom. The surge of labels from Australia saw China’s total imports increase by a third to $2.5bn, a spectacular end to a five-year slump. But even after that Australian-led rebound, the total size of China’s wine imports in 2024 were just over half their peak of $4.6bn in 2018.

President Xi Jinping’s crackdown on corruption and a lavish banquet culture previously popular among Chinese officials is believed to be a big driver of the decline. The reduced confidence of many Chinese consumers has also reduced the trade.

The reduction, and Australia’s return, has left wine-producing countries competing over a smaller Chinese market.

French sales fell by 12 per cent in 2024, with sales of $790m. Third-placed Chile, another beneficiary of Beijing’s Australian tariffs, fell 18 per cent to $230m. Fourth-placed Italy and fifth-placed Spain were down by 10 per cent and 12 per cent respectively.

Those tumbling imports have many analysts asking how sustainable Australia’s exceptional performance will be after the initial rush to restock Chinese warehouses.

“The pressing question ahead is whether Australia can keep its momentum in the China market alive, or if overflowing inventories and cash-strapped merchants will clog the pipeline and slow its advance,” said Natalie Wang at China-focused wine publication Vino Joy News.

Chinese analysts of the alcoholic drinks industry said consumer wine sales were weak over this year’s Spring Festival. Jiuyejia, a trade publication, said distributors in many Chinese cities had reported that much of the imported Australian wine had gone into warehouses, rather than sold to consumers.

It is a trend being closely watched by Australia’s wine industry and trade officials.

“Chinese wine consumption is much lower than it was before the import tariffs were imposed, so it will take more time before it becomes clear what the ‘new normal’ level of exports to mainland China will be, after this initial restocking period,” said Peter Bailey, the head of research at Wine Australia, the federal government’s champion for the industry. “It is still important to focus on market diversification in a challenging global business environment.”

About half of Australia’s trade to China has been of Treasury Wine Estates’s Penfolds labels, the best known in the Chinese market.

For now, investors appear to have been underwhelmed by the company’s performance since its full return to the Chinese market. Treasury’s shares are trading more than 15 per cent below the levels they were at before Beijing ended its Australian tariffs, which also reflects a downturn in wine drinking in other key markets.

This year will give a clearer picture of how Australia’s trade measures up against its peak in 2019 when exports to China reached $1.17bn.

But even at its current level, China is Australia’s biggest overseas wine market, with sales worth more than the combined exports to the next three markets, the United States, Britain and Canada. Despite the broader structural problems, there are still many fans of Australian wine in China as was clear over the recent Chinese New Year holiday.

Zhao Dejun said his family drank “a whole bottle” of Australian red wine at his family’s reunion dinner in Beijing. It had been given to him by a cousin as a gift to mark the holiday.

“He said it was a very good one. He was right,” Mr Zhao told The Weekend Australian. “Even my wife, who usually doesn’t drink, took a few sips from my glass.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout