$230bn lockdown savings to kickstart the economy

Extra household savings worth $230bn will fund a rebound, despite new warnings Covid outbreaks will slash GDP growth.

Extra savings worth $230bn that will be sitting in bank accounts by the end of the year will fund a robust economic rebound, despite new warnings Covid-19 outbreaks will slash this year’s GDP growth.

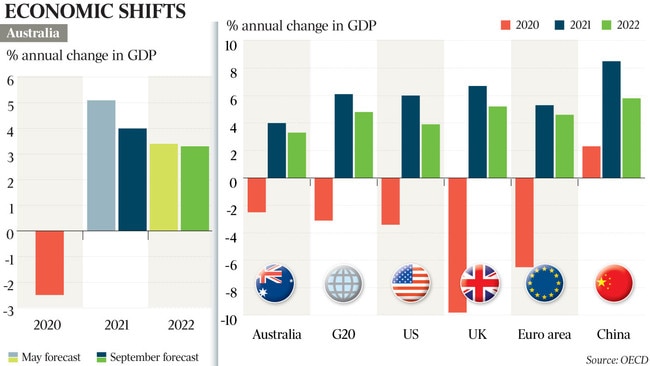

In an economic outlook released late on Tuesday, the OECD cut Australia’s 2021 growth forecast from the 5.1 per cent projected in May to 4 per cent – the biggest decline among the world’s 20 largest economies.

But with vaccination rates rising to meet reopening targets in coming months, the Australian economy is projected to post a solid, above-trend 3.3 per cent rebound in 2022, driven by income support and household savings accumulated during the pandemic that the Commonwealth Bank estimates will balloon to $230bn by the end of the year.

“This extra savings and the income being provided by the government should help the economy recover in 2022 and beyond,” CBA chief economist Stephen Halmarick said.

He noted that a surge of welfare payments had flowed in recent weeks into bank accounts.

The OECD report comes as minutes from the Reserve Bank’s board meeting this month state: “The outbreak of the Delta variant had delayed, but not derailed, the recovery. GDP was expected to decline materially in the September quarter and the unemployment rate was expected to rise, but the economy was expected to bounce back as vaccination rates increase and restrictions are eased.”

The RBA minutes added that Australia would return to its pre-Delta path by mid-2022.

In its interim report, the OECD forecasts global output to expand by 5.7 per cent this year and 4.5 per cent in 2022, due to a strong rebound in Europe, more US fiscal stimulus, and lower rates of household saving in advanced economies. The OECD said speedy vaccination and flexible government spending were the keys to a sustained global recovery from the pandemic and called on rich nations to help low-income countries gain immediate access to lifesaving Covid-19 vaccines.

The OECD advised members to continue to stoke consumer demand, support family incomes, and ensure ample spending on healthcare and vaccinations, especially in poorer countries.

“Governments need to deploy vaccinations as quickly as possible throughout the world to save lives, preserve incomes and bring the virus under control,” it said.

“The recovery will remain precarious and uncertain in all countries until this is achieved. Failure to ensure the global suppression of the virus raises the risks that further new, more transmissible variants continue to appear, or that the number of cases surges again in the northern hemisphere during the winter months, with containment measures having to be reintroduced”.

Given the immediate future abounded with uncertainties, the OECD said “a premature and abrupt withdrawal of policy support should be avoided”. It added that any tightening next year should be limited to reducing emergency measures rather than winding back the size of government spending.

Last week, in its latest country survey, the OECD noted Australia experienced the largest fiscal turnaround among wealthy nations in the early months of the crisis, pushing a balanced budget into a general government deficit equivalent to 12 per cent of GDP.

The OECD said the economic impact of the Delta variant had “so far been relatively mild in countries with high vaccination rates”. But recent outbreaks had halted recovery in Japan, South Korea and Australia, while the new strain was adding to pressures on global supply chains and costs.

Inflation had risen sharply in the US, Canada, Britain and some emerging-market economies, but remained relatively low in many other advanced economies, particularly in Europe, Asia and Australia, the OECD said.

Higher commodity prices and global shipping costs were behind the rise in consumer prices. Inflation was expected to ease next year but was likely to be above pre-pandemic rates across most countries.

In any case, it said loose monetary settings should be maintained, “but clear guidance is needed about the horizon and extent to which any inflation overshooting will be tolerated, and the planned timing and sequencing of eventual moves towards monetary policy normalisation”.

The RBA minutes explain why the central bank will continue with a tapering of its quantitative easing (QE) program, reducing bond purchases from $5bn to $4bn a week, but delaying the next review period to mid-February.

Westpac chief economist Bill Evans said the RBA board seemed to be set on a gradual program of winding back its bond buying over the course of 2022 in line with other central banks.

“No change in the purchase pace will occur until February when a further taper to $2bn or $3bn per week can be expected,” Mr Evans said. “If the bank is correct with its expectation that the level of activity will have returned to the level expected pre-Delta by mid-year then it will be planning to wind back QE entirely by May/August”.

The RBA noted the recovery was likely to be slower than earlier in 2021 and stated it would not be raising near-zero official interest rates before 2024 due to weak wages growth and below target-band inflation. “Members agreed that the substantial increase in pandemic support by the Australian government and state and territory governments would be one of the factors supporting the recovery into 2022,” it said.

They added that this would boost consumption when lockdowns ended.

The OECD said rising government debt levels needed to be carefully managed, particularly among emerging nations experiencing high inflation. “Credible fiscal frameworks that provide clear guidance about the medium-term path towards debt sustainability, and likely policy changes along that path, would help to maintain confidence and enhance the transparency of budgetary choices,” it said. “Stronger public investment and enhanced structural reforms are needed to boost resilience and improve the prospects for sustainable and equitable growth”.

Last week, in its survey of Australia, the OECD identified a raft of policy reforms, including of the tax and transfer system, noting an over-reliance on personal income tax and a rising debt burden that would be shouldered by younger people in coming decades. In the interim outlook, the OECD called for stronger international efforts to provide low-income countries with the resources to vaccinate their populations for their own and global benefits.

“These include vaccine supply and assistance to help overcome domestic logistical hurdles to vaccine deployment,” it said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout