No need for austerity to drive economic recovery

Getting the federal budget back into the black is not necessary for fiscal sustainability, as long as the economy keeps growing and the deficits are modest.

Getting the federal budget back into the black is not necessary for fiscal sustainability, as long as the economy keeps growing and the deficits are modest over coming decades.

A new analysis by the independent Parliamentary Budget Office reports the federal government will not need to resort to austerity measures, even if interest rates rise, as long as Canberra acts early and consistently to consolidate its finances after the pandemic.

But projections in Beyond the Budget reveal there are looming structural pressures this decade, with disability services, aged care and defence spending growing at a faster clip than the bracket creep-led recovery in tax revenue.

With the budget deep in deficit due to emergency spending – and federal government net debt expected to peak at $981bn in 2025, or 40.9 per cent of GDP – economists warn the findings could ease spending constraints on the major parties ahead of the election.

But according to Canberra sources, key officials will try to restore to normal monetary and fiscal settings in the next term, claiming there will be “no blank cheque” for the political class.

The PBO states “government debt matters” and “the quality and efficiency of public spending, whether for services or investments, are crucial”.

“The commonwealth’s fiscal position can remain sustainable over the longer term even if the government continues to run modest deficits,” it says.

“These results do not require governments to achieve budget surpluses, nor do they require interest rates to remain at their current low levels.

“Future governments will need to act to ensure sustainability, but if they act consistently and early they do not need to consolidate more rapidly than after previous downturns.”

Josh Frydenberg’s two-phase fiscal strategy is aimed at first reducing unemployment. Then once the jobless rate is comfortably below its pre-pandemic level, the task of budget repair over the medium-term would commence.

Australia’s net foreign debt was $583bn in May. Figures for the previous financial year’s budget outcome are due in the coming week.

Former Treasury official Stephen Anthony said the PBO’s analysis was unreasonable. “Let them actually guarantee that this won’t lead to a fiscal crisis,” said Mr Anthony, who is chief economist of Macroeconomics Advisory.

“A reasonable observer could think of a dozen reasons why spending may get ahead of nominal GDP growth. The assumption of strong and steady growth rates, strong productivity growth, and no debt trap hasn’t been the experience of the past decade.”

Deloitte Access Economics partner Chris Richardson said what matters for sustainability is the cost of debt, and he was “pretty comfortable” with the medium-term budget outlook. “Covid brought the same really low interest rates to Australia that much of the rest of the rich world had seen ever since the global financial crisis,” Mr Richardson said.

“That revolutionises budget maths in a bunch of ways. In particular, ‘debt’ and ‘the cost of debt’ have diverged hugely. Despite Covid and the associated jump in net debt, the PBO sees the cost of debt averaging the same share of national income over the next decade as it did in the last.”

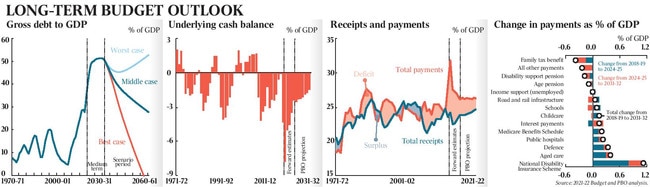

The PBO analysis considered multiple scenarios for long-term government debt. Starting at about 50 per cent of GDP in 2031-32, gross debt is projected to fall steadily to the early 2060s under all but its “most unlikely worst scenarios”.

Government receipts are projected to reach 24.7 per cent of GDP in a decade’s time, slightly lower than their pre-pandemic level of 24.9 per cent. But economic recovery and bracket creep will see personal income tax collections rise from 10.3 per cent of GDP this year to 11.9 per cent in 2031-32.

The PBO sees spending rising over the medium term, driven primarily by higher payments for large and growing programs such as the NDIS and, to a lesser extent, aged care.

The analysis notes the major risks to the budget are the ongoing pandemic and the government’s response, the broader economic outlook, and structural trends, including community expectations “around the quality and volume of services provided by government”.

“Because our scenarios are based on historical precedents, including the frequency and severity of economic shocks, it would be more difficult … to maintain a fiscally sustainable position if future shocks are consistently larger or more frequent,” it concludes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout