Taxman to put influencers off their meals

The restaurant industry has begun to turns the tables on the ultimate millennial vocation, the ‘influencer’.

Enjoy restaurants? Sick of cat videos and memes? Jump on Instagram and follow #couscousforcomment for some light relief as the restaurant industry turns the tables on the ultimate millennial vocation, the “influencer”.

The Facebook-owned, image-based platform is huge in restaurant land and has spawned thousands of influencers whose “business model” is chasing free meals in exchange for social media posts, usually on Instagram, of varying return on investment to the restaurants.

But a couple of high-profile cases have played out in social and traditional media recently, with restaurateurs telling would-be collaborators exactly what they think of the concept of giving away profit for dubious return.

One, in Adelaide, saw prominent chef Duncan Welgemoed engaged in an online spat with a former My Kitchen Rules contestant looking for a freebie that made its way to the front page of Adelaide’s The Advertiser.

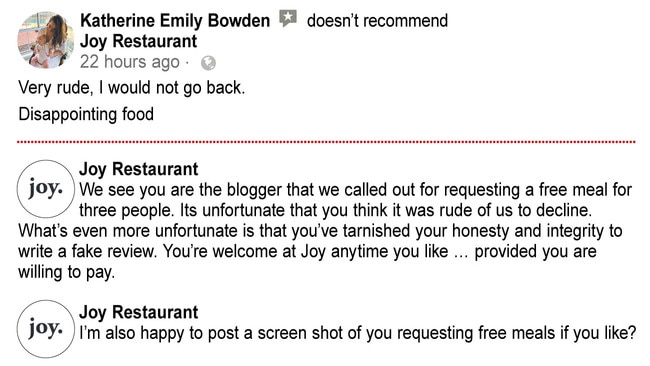

Another in Brisbane this week resulted in a so-called influencer — spurned by a new restaurant — posting fake revenge “reviews” at Google Reviews. Unfortunately, many in the hospitality industry feel conflicted by incessant overtures to “collaborate” on social media exchanges for meals, asking themselves: “What happens if we don’t go along with this?”

“I don’t think you really need to respond to them,” said chef Joel Valvasori, who owns Lulu La Delizia restaurant in Perth’s Subiaco. “We ignore them; they’d just take up too much of our day otherwise.”

He described “influencer” as “a bit of a lazy vocation, trying to make a career out of nothing”, although he acknowledged that some businesses felt vulnerable to constant overtures for collaborations. “Personally, I’m very sceptical about instant celebrity … and I think the whole influencer thing will pass when people cotton on to just how much fluff is out there.”

From July, such undeclared Instagram endorsements of restaurants, cafes, bars and pubs in return for freebies might constitute a tax problem.

It may be news to many influencers that in-kind receipt of goods and services is taxable, but tax lawyer Chris Davis, of McInnes Wilson Lawyers, said: “Constructive or actual receipt of non-cash benefits has always been taxable.” Using trusts and companies won’t work for avoiding declaring “in-kind” income.

Imminent changes to the law first proposed in last year’s federal budget and flagged in a Treasury discussion paper in December may also hit the Instafamous industry. From July 1, all income, including all non-cash benefits, will be treated as part of an individual’s taxable income and will be taxed accordingly at higher rates than apply to the companies and trusts used to date.

Non-cash income, such as meals, earned via reputation will be taxed at the higher personal rate and cannot be shielded by a trust or other corporate entity at a lower one.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout