Brisbane and Perth are most affordable capital cities, Sydney and Hobart dearest

Struggling to afford a home in Sydney and Melbourne? New data reveal the most affordable capital cities for first-home buyers and renters.

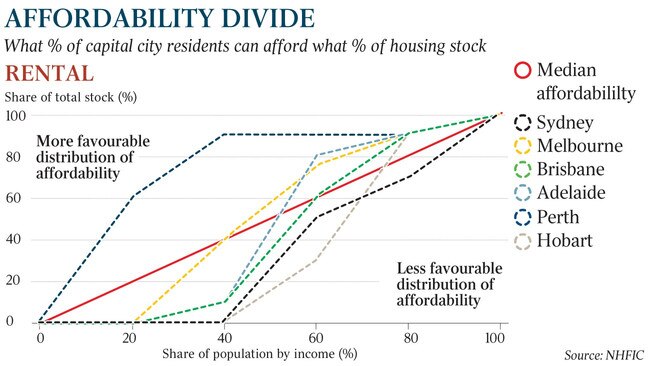

Brisbane is the most affordable capital city for first-home buyers and Perth is by far the cheapest for renters, data by the National Housing Finance and Investment Corporation reveals.

Sydney and Hobart residents face the most difficult affordability issues for renters and for first-home buyers.

In Sydney and Hobart, the bottom 40 per cent of income earners can afford 0-10 per cent of the rental stock, whereas in Perth those same income earners can afford 90-100 per cent of rental properties.

Buying a first home is even tougher, with the bottom 60 per cent of income earners in Sydney and Hobart able to afford only 10-20 per cent of properties in those markets.

In Brisbane, the bottom 40 per cent of income earners can handle a mortgage for about 60-70 per cent of homes in that market, analysis of data from NHFIC’s State of the Nation’s Housing indicates. “The analysis clearly shows there is not one housing market in Australia but multiple housing markets, all with their own particular challenges,” NHFIC head of research Hugh Hartigan said.

“Look at Tasmania. A decade ago, people would have thought it was a bit of an oasis for more affordable housing, but over the last 10 years securing a first home or finding an affordable rental has become much more of a challenge.

“What the Tasmanian example suggests is when more people are attracted to move to and live in a particular jurisdiction, it can put more pressure on housing systems. This is also evident in a high jobs growth city like Sydney.”

Perth’s relative rental affordability owes much to the number of houses built through the mining boom that had now become available after it ended, he said.

Housing affordability in capital cities played a role in shaping interstate migration, Mr Hartigan said. “You can see there have been outflows of people from Victoria and NSW to Queensland in recent years, and the cost of housing is likely part of the decision set for people making that move,” he said.

A report released last week by the Australian Housing and Urban Research Institute reinforced the difficulties faced by low income households in accessing the housing market, and the consequent impact on productivity. It found that there was a shortage of about 173,000 affordable dwellings in the private rental sector for low income earners.

In Sydney, which accounted for 60,000 of these, 71 per cent of all low income private rental households were paying rent they couldn’t afford, the report said.

“The shortage is most acute in inner and middle ring areas, which offer higher accessibility to greater concentrations of employment opportunities.

“Consequently, (low income) renters are either enduring affordability stress, commuting burdens or both in order to access employment opportunities,” it said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout