Coronavirus: It’s not whether you can access super but if you should

Superannuation experts warn that accessing your retirement fund to tide you over hard times should be done only as a last resort.

The federal government’s surprise decision to let Australians have early access to a slice of their superannuation as part of the economic crisis package is a radical move. For millions of people, the question is no longer can I but should I?

The terms of the offer are generous: you can take out up to $20,000 in total by withdrawing $10,000 before June 30 this year and another $10,000 in the three months after July 1.

What’s more, the qualification criteria is hardly strict, and surely would be the subject of intense debate if we were not in the middle of an unprecedented crisis.

Superannuation is meant to be a long-term tax protection to build savings; it was never meant to be spent for any pre-retirement crisis.

That said, don’t forget this is not a government handout. It is your money. You earned it.

Under the terms of the government stimulus package, to access your super now you must satisfy one of the following requirements:

• Be unemployed.

• Be eligible to receive a JobSeeker Payment, Youth Allowance for jobseekers, parenting payment or special benefit or farm household allowance.

• You were made redundant or you had your working hours reduced by 20 per cent or more after January 1 this year.

• You are a sole trader and your business was suspended or your turnover fell by 20 per cent or more since January 1.

Until now it has been virtually impossible to access your super before retirement age and there have been many heartbreaking stories of people who did not qualify for early access because the Australian Taxation Office allowed it only under extreme situations such as terminal medical conditions or permanent incapacity.

By contrast, this temporary emergency scheme from the government is available even to those on a Youth Allowance.

With the current assumptions that our unemployment rate is set to fly up from more than 5 per cent to nearly 9 per cent — and with just about every small business expecting to see a 20 per cent slump in turnover at least during the national shutdown — we can expect a huge take-up of this scheme.

The risks

But should you go near your super even, if you are allowed to? A strong statement from the Australian Institute of Superannuation Trustees on Monday calls for restraint. “We are urging Australians who are facing financial hardship to access all other sources of income measures before tapping into their super. You should explore every other option before deciding to access super,” it says.

Why so? Because if you spend your super, you are not just spending money you saved but you are spending money that was building — or compounding — for you inside a tax-protected environment. You can never get that compounding effect back again.

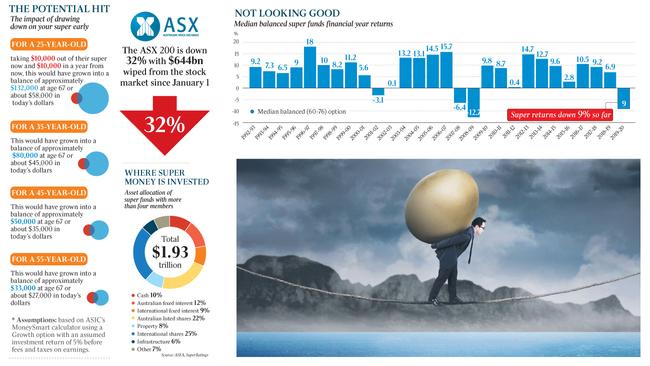

But that’s just the start of the risks you take. If you take it now, you are selling into a massive market downturn where share prices are a third lower than they were in early February. Nobody knows which way the market will move in the days ahead, but when it comes to the years ahead, history strongly suggests it will move higher again. Market panics from any era, from the global financial crisis as far back as the great crash of 1929, do not last. Markets always recover, eventually.

As research from SuperRatings group showed recently, if you had panicked and sold out of the sharemarket in March 2009 (which we now know was the bottom of the last bear cycle), you would have paid dearly. If you had taken $10,000 out and put it in cash, it would still be about $10,000. If you had left it in the sharemarket it would have climbed to a value nearer $100,000.

But there are other consequences to cashing out your super. James Hunter, a senior associate at Slater and Gordon says: “While accessing $10,000 may seem like an easy way to keep afloat during tough economic times, you need to be aware of the downsides. Importantly, in relation to your insurance, if you have either reduced or have no contributions entering your fund, the ongoing fees and insurance premiums together with the $10,000 lump sum could reduce your account balance to less than the $6000 that is the mandated limit. If this occurs, your total, permanent and disability life insurance and income protection may be cancelled. You will need to contact your superannuation fund to ‘opt back in’.”

Unless the government further updates its announced changes to super, Hunter’s warning about losing life insurance if your fund balance drops too low is highly relevant and a classic example of something that might be missed by many people who are in the super system but don’t necessarily understand how it all works.

The best way forward

Even for those who do know how it works, the sudden ability to take money out of super early on a tax-free basis is going to create serious dilemmas and dangers.

As Lyn Formica, of the Heffron Group, suggests: “There are no income or asset tests. Even someone with a very high salary who remains employed and has other assets could access this payment as long as their salary has been reduced by 20 per cent after January 1, 2020.”

So how would you go about getting money out? Here are the three steps as outlined by the federal government:

1. Individuals will be able to apply directly to the ATO via their myGov account.

2. Once the ATO has processed the application and confirmed the individual’s eligibility, they will provide the individual and their superannuation fund with a determination.

3. On the basis of that determination, the fund will then make payment to the individual.

The tax-free nature of the scheme is unusual. Currently, amounts released on compassionate grounds or on the basis of severe hardship are taxed, which can mean up to 20 per cent on top of Medicare for many people.

But the consensus response from wealth advisers is caution. Financial planner Liam Shorte, a director of the Verante Group, says: “I would be extremely careful about accessing super. If you must do it, try and take it out from cash.

“People with self-managed super can arrange that quite easily. If you are in a big fund and you have opted to have a set amount in cash … contact your fund and make sure you are removing the amount from the cash allocation of your portfolio; at least that way you are not asking the fund to sell shares in these circumstances.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout