PoliticsNow: Greens plan pre-budget attack over water funding

The Greens have revealed a two-pronged attack to block key changes to the Murray-Darling Basin Plan.

Hello and welcome to PoliticsNow, The Australian’s live blog on the happenings in federal politics.

It is budget eve and Coalition MPs are readying to sell Scott Morrison’s blueprint to lift the government’s stocks and put it in a competitive position to win the next election.

And Home Affairs Minister Peter Dutton has said New Zealand is being marketed as a destination by people smuggling syndicates as he warned against softening border policies.

That’s where we will leave our live coverage for today. Join us first thing tomorrow for what promises to be a big day of news from the nation’s capital.

4.30pm: Greens signal Murray-Darling battle

The Australian Greens will fight to block changes to the Murray-Darling Basin Plan amid the bluster and fanfare of the budget.

The minor party will target the government over its planned changes to the plan in a two-pronged attack in the Senate tomorrow.

Before the budget is delivered, the upper house is expected to debate a motion to disallow a raft of water and infrastructure projects which aim to deliver 605 gigalitres worth of environmental outcomes.

“(Government) changes would fundamentally reduce the amount of water put aside for the environment by 605 gigalitres,” Greens water spokeswoman Sarah Hanson-Young said today.

“That’s 605 billion litres-worth of water, less to the environment and to the river.”

Senator Hanson-Young will also introduce a private member’s bill to guarantee the delivery of 450 gigalitres she says is owed to her home state of South Australia as part of the original 2012 plan.

“The government is trying to squib twice,” she said. “They’re trying to reduce the amounts of cuts to the environment by 605 gigalitres and they’re not coughing up the promised extra 450 gigalitres.”

Labor is expected to decide today whether it will support the Greens, who are also lobbying crossbench senators.

If the opposition joins forces with the Greens, the government will need nine of the 11 remaining crossbench senators to protect its changes to the basin plan.

In February, the Greens and Labor voted to disallow changes which would have reduced the amount of water being returned to the environment in southern Queensland and northern NSW.

— AAP

Greg Brown 3.17pm: ‘Budget for and by big business’

.@RichardDiNatale on the budget: This is not a budget that needs tax cuts, it is a budget that needs investment in hospitals and schools.

— Sky News Australia (@SkyNewsAust) May 7, 2018

The Greens will not support any tax cuts in this budget.

MORE: https://t.co/Cx06JC7TWd #newsday pic.twitter.com/zsT1R1ncAK

Greens leader Richard Di Natale says the budget will be favourable for “the government’s big business mates” that leaves the average voter worse off.

“Sadly, what we already know about this budget, is that this is a budget for and by big corporations that does nothing to address the huge challenges that lie ahead of us, rising inequality, the fact that we have the great challenge of climate change that needs to be taken head on,” Senator Di Natale said.

“This is a budget that looks after the government’s big business mates and that will leave ordinary people behind.”

Senator Di Natale said the budget should have increased government spending rather than tax cuts.

“We don’t need a budget that is going to cut taxes further, we don’t need a whopping big tax cut for corporations, and a few pre-election bribes to try and give people a milkshake and a hamburger when they can’t even afford to go to the doctor or to buy school books for their kids,” he said.

Greg Brown 2.30pm: Regulators too ‘chummy’ with big banks?

Tony Abbott has suggested executives at the corporate and banking regulators were getting “chummy” with the big banks in the hope of securing lucrative board positions at the end of their tenure.

The former prime minister today continued his attacks on the Australian Securities and Investments Commission and the Australian Prudential Regulation Authority for the revelations unearthed in the royal commission.

He suggested executives at the regulators may have gone easy on the banks in their own self interest.

“How chummy were the regulators getting to these bankers? What post-public service careers in banking do these regulators want that caused them, apparently, to be turning a blind eye to all these abuses or not digging sufficiently into how the banks were working to know about all these abuses?” Mr Abbott told 2GB radio.

Greg Brown 2.05pm: No bipartisan support for a tax-to-GDP cap

Shadow Finance Minister @JEChalmers on the budget: It will be a budget for big businesses and not for battlers.

— Sky News Australia (@SkyNewsAust) May 7, 2018

'We call on the government not to reward the big banks but to reverse the cuts on hospitals and schools.'

MORE: https://t.co/IEeAmIvpbo #newsday pic.twitter.com/GV9AGR93ft

Opposition finance spokesman Jim Chalmers says Labor will go to the next election as the more fiscally responsible party as he poured cold water on bipartisan support for a tax-to-GDP cap and long-term income tax cuts for the rich.

Dr Chalmers said Scott Morrison’s tax-to-GDP cap of 23.9 per cent was “arbitrary” and would be used as an attempt to defend tax breaks for big business and high income earners.

“This just shows how spectacularly out of touch Scott Morrison and Malcolm Turnbull are,” Dr Chalmers said.

“Australians don’t care whether the tax-to-GDP is 23.9 per cent, they care whether the tax system is fair and they care whether it funds the things as a society truly value.”

Dr Chalmers said Labor would welcome tax breaks for middle and low income earners but would be cautious on any relief for the wealthy.

The Weekend Australian revealed the $180,000 threshold for the top marginal tax rate of 45c is expected to be raised over the medium term.

“We take a very dim view to tax relief which favours the wealthiest in our community,” he said.

“We’re not going to go into pre-empting or predicting what may be in the budget tomorrow night, except to say that we would obviously much prefer to see tax relief for low and middle income earners, not for the wealthiest wage earners in our community. We will have more to say about that when the time comes.”

He added moving the tax bracket over the next six years would be “in the same bracket” as an income tax cut.

Dr Chalmers said the savings identified by Labor through reforms to negative gearing and dividend imputation would make it more fiscally responsible than the government going into the next election, although he would not commit to promising surpluses in the forward estimates.

“We will go to the election with a more responsible approach than the government because we’ve taken difficult decisions at great political risk to ourselves frankly, by putting them out so far before an election,” Dr Chalmers said.

“So I think when we go to the election we will be the more responsible party in the contest. The Liberals will be the party of tax breaks for the top end of town, which is smashing the budget. They will be the party that said they will fix the so-called debt and deficit disaster when debt was at $175 billion, and it is now twice that.”

Greg Brown 1.20pm: Abbott warns over budget

Tony Abbott says he hopes Scott Morrison has made savings in tomorrow’s budget rather than just using increased revenue to fund tax cuts.

The former prime minister said it was good the Treasurer would put a tax cap of 23.9 per cent of gross domestic product. But Mr Abbott warned government spending also needed to be lowered to avoid a structural deficit.

“We have heard a lot about what is in the budget tomorrow night, there is going to be some personal income tax cuts and that is always good, there is going to be some infrastructure spending and normally that is good, I guess the big issue what kind of structural savings will there be,” Mr Abbott told 2GB radio.

“It was good that the Treasurer said that we are going to try and limit tax to 23.9 per cent of GDP, the problem is that if you look forward it seems that spending is stuck at 25 per cent-plus of GDP. The last thing we want to do is bake in long term deficit.

“Back in 2014 my government brought down a budget of long-term structural economic reform that was going to reduce the growth of government spending. Unfortunately that budget was sabotaged in the Senate and since then there hasn’t been an enormous appetite for reigning in spending and that is the big challenge we face.”

Rachel Baxendale 1.00pm: ‘We can’t afford tax cuts’

Pauline Hanson says we “can’t afford” tax cuts for low and middle income earners, but her former senator Fraser Anning has called for a 4.5 per cent tax cut for those earning between $37,000 and $87000.

The independent Queensland senator said “over-taxed, under-rewarded” low and middle income earners needed “meaningful” tax relief, not just “token reductions”.

“What we actually need is a cut to the marginal tax rate for the $37,001 to $87,000 tax bracket from 32.5 per cent to 28 per cent,” Senator Anning said.

Senator Hanson said the government couldn’t afford to give Australians tax cuts while it remained in debt.

“We can’t afford it. We really can’t,” she told the Seven Network.

The Prime Minister is spruiking a roads and rail spending spree in tomorrow night’s budget, with Queensland set to receive $5 Billion. But Queensland Senator, Pauline Hanson, says we can’t afford it. https://t.co/UT1PLM8VWd #QldPol #AusPol #Budget2018 #7News pic.twitter.com/fMm9XwlS6v

— 7 News Brisbane (@7NewsBrisbane) May 7, 2018

12.45pm: Budget: What we know so far

● THEME: “A stronger economy means a stronger budget, creating more jobs while guaranteeing essential services.” Tax receipts are running at least $4.8 billion higher than estimated in mid-year review in December. Budget papers to show a return to the black in 2021, if not slightly earlier.

● HEALTH/AGED CARE: Planned 0.5 increase in the Medicare levy to pay for the NDIS has been dumped. How the NDIS will be funded will be spelled out in the budget. $40 million for drug addiction services; $39.5 million for free whooping cough vaccinations for all pregnant women; $241 million to make spinal muscular atrophy drug Spinraza available on PBS from June 1 this year; $84 million to establish a Flying Doctor mental health service as part of a four-year, $327 million commitment; $33 million to boost 24-hour telephone service at Lifeline; Medicare-funded MRI scans to check if men have prostate cancer; 200,000 women to receive $200 towards 3D breast cancer screening. Possible boost to aged care funding following a taskforce report

● TAX: Low and middle-income earners are the priority for immediate tax cuts but they won’t be “mammoth”. Possible changes to the low-income tax offset. Those earning above $180,000 a year may have to wait until 2024. States and territories to benefit from an extra $3.4 billion in GST revenue in 2018/19. NT and WA benefit from top-ups.

● COMPANIES: Government will budget for a corporate tax rate to fall for all companies to 25 per cent by 2026/27, despite the bill being stalled in the Senate. $140 million to boost tax rebate for filmmakers. Tax break for craft brewers and distillers. Small businesses to benefit from extension of $20,000 instant asset write-off, first introduced in 2015. Allows firms with a turnover of up to $10 million a year to instantly claim tax deductions on all equipment purchases worth less than $20,000. Australian Border Force-led taskforce set up to crack down on illicit tobacco trade, predicted to raise $3.6 billion in revenue - Changes to the way the $3 billion R&D tax incentive can be accessed to prevent firms claiming tax breaks for business-as-usual activities

● EDUCATION: Needs-based funding to deliver an extra $23.5 billion to schools over the decade. New child care and early learning system starts July 2. $271 million Community Child Care Fund for regional and disadvantaged communities. One year extension of preschool into 2019 at cost of $440 million. Extra funding for school chaplains expected. University funding frozen and changes to Higher Education Loan Program.

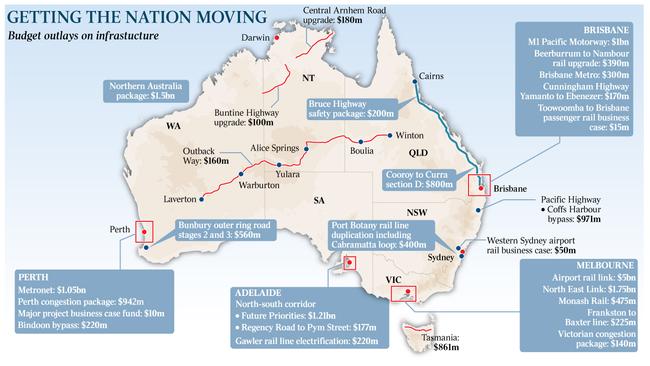

● INFRASTRUCTURE: $24.5 billion for road and rail over the year; $75 billion plan over the decade. Melbourne airport rail link $5 billion. M1 upgrade between Brisbane and Gold Coast, at cost of $1 billion. Other rail projects including Inland Rail, metropolitan commuter rail projects, study into possible Western Sydney Airport rail link. Package of projects for Western Australia. $3.2 billion for 2018/19 including $1.84 billion for Metronet rail.

● SUPERANNUATION: New laws to guarantee tax rates and rules regarding superannuation. Expand limit on the maximum number of members in self-managed super funds from four to six.

● HOUSING: $4.6 billion to address housing affordability, working with the state and territory governments

● NATIONAL SECURITY: New counter-espionage unit in the Department of Home Affairs, under a national countering foreign interference coordinator

● ENVIRONMENT: $500 million Great Barrier Reef rescue plan including programs to tackle runoff from farming, the destructive crown-of-thorns starfish, and fund new research on coral bleaching. — AAP

Greg Brown 12.30pm: ‘Bipartisan support for animal welfare’

Opposition agriculture spokesman Joel Fitzgibbon says he will meet with Liberal MP Sussan Ley to discuss her private-members bill to ban live sheep exports. Mr Fitzgibbon said Labor was willing to speak to all MPs that wanted to phase out the industry and would consult Ms Ley on her bill which will be tabled in the parliament this year. Ms Ley’s bill would probably pass the parliament if it is supported by Labor and the Greens.

“I am meeting with Sussan Ley sometime soon, to discuss her private-members bill, I haven’t seen it or know the detail of it,” Mr Fitzgibbon told Sky News. “But I began this conversation by adding a bipartisan hand to the government with a view of securing deep and meaningful reform and we will work with anyone interested in working with us to put this transition in place to create jobs here in Australia, to improve animal welfare standards, and of course, to improve profitability for our farmers.”

.@fitzhunter on live exports: We will work with anyone interested in working with us to put this transition in place to create jobs here in Australia, to improve animal welfare standards.

— Sky News Australia (@SkyNewsAust) May 7, 2018

MORE: https://t.co/ykweMevBOK#SkyLiveNow pic.twitter.com/CZ2JFincSr

Greg Brown 12.10pm: Government plan ‘coming together’

Education Minister Simon Birmingham says the Coalition’s spending restraint and fiscal rectitude will pave the way for tax cuts and infrastructure spending in tomorrow night’s budget.

Senator Birmingham said the public will see the government’s long term plan “coming together” when Scott Morrison hands down his third budget.

“People can see that our plan is working that we are successfully repairing Labor’s budget deficit and coming back to surplus,” Senator Birmingham gold Sky News.

“We are investing in the services people care about …we are building the infrastructure for the future which will underpin future economic activity and more jobs growth but all of that is also coming at a time when we are able to give Australians some of their money back, some of their hard earned income.

“That indeed is a great position to be in but it has only come about because we’ve stuck clearly to a plan in the long haul and we will stick to that plan in the future as well.”

Greg Brown 11.15am: NZ ‘people smuggling destination’

Home Affairs Minister Peter Dutton has said New Zealand is being marketed as a destination by people smuggling syndicates, as he confirmed Malaysian authorities stopped a people smuggling vessel headed for Australia and New Zealand.

Mr Dutton said a boat carrying about 130 people was intercepted in Malaysia, with people on board given different information about their destination, and warned any softening of the Turnbull government’s border protection policies will see the boats return.

“Just because Australians don’t see the television set every night the vision of these boats coming as they did under the Labor Party, doesn’t mean that the problem has gone away,” Mr Dutton said.

“The problem has not gone away. One of the most puzzling aspects to the Labor Party’s approach at the moment is Bill Shorten speaking out of both sides of his mouth when it comes to border protection policy. He says one thing to the press and that is that he has got a tough stance on border protection matters and yet when he is in the Labor Party conference, he is telling people there will be a softly, softly approach to border protection policy if the Labor Party is to win government. It is a complete outrage.”

.@PeterDutton_MP on people smuggling: People need to be mindful of what they are saying publically because people smuggling has not gone away.

— Sky News Australia (@SkyNewsAust) May 7, 2018

Bill Shorten would be making the same mistake as Kevin Rudd.

MORE: https://t.co/Bwo6YYgM4F #SkyLiveNow #auspol pic.twitter.com/d5XU2RZegU

But he would not criticise the Ardern government for putting increased pressure on Australia to let 150 asylum seekers on Manus Island or Nauru be transferred to New Zealand.

“I don’t think they should accept any blame and New Zealand now understands the gravity of this situation,” Mr Dutton said.

“What I would say is that anybody, when they’re talking about these matters, needs to be careful and circumspect about what it is that they’re saying because it will be interpreted a particular way by people smugglers who are pumping out messages through social media, sending text messages out to prospective customers.

“By Bill Shorten being out there saying that New Zealand is on the table, people realise that New Zealand is a back doorway into Australia. They realise New Zealand is a comparable society to Australia. It has a similar welfare system, similar health, education offerings, housing, et cetera. It is marketed in the same way that Australia is as a positive destination.”

He added that Labor was being disingenuous by saying there were third country options to transfer people out of Manus Island and Nauru that were not being investigated by the government.

“Let’s be realistic when Labor talks about some third country, it doesn’t exist,” he said.

David Uren 10.50am: Infrastructure projects to boost economy

A commitment to infrastructure projects worth $24.5 billion will be central to Scott Morrison’s claim that the budget has been designed to lift economic growth.

The budget will provide for a series of major projects, including $5bn for rail lines to the new western Sydney airport and Melbourne’s Tullamarine as well as raising the federal government’s contribution to Perth’s Metronet project to almost $2bn.

The critical question, chief executive of Infrastructure Partnerships Australia Adrian Dwyer writes, is how do we pay for it? Read his comment piece here.

Greg Brown 10.35am: ‘Don’t blame female directors’

Women’s Minister Kelly O’Dwyer says it is “ridiculous” to blame bad corporate governance of financial services institutions on an increase in female board members.

Ms O’Dwyer said targets for female board members had nothing to do with the bad behaviour of AMP and the Commonwealth Bank which has been revealed in the banking royal commission.

“I find it pretty surprising in today’s day and age that there would be people out there who say that there aren’t women of merit who deserve their place around the boardroom table,” Ms O’Dwyer told ABC radio.

“Of course there are women of merit, women of experience and capability who absolutely deserve to be there and the very fact that we have targets is simply to say that we need to focus on making sure we have those women around the board room table.”

Ms O’Dwyer said there had been lots of corporate failures by companies with male chief executives and chairs.

“The idea that we’ve have corporate failures and there are shocking revelations to come out of the royal commission that somehow this is gender specific is completely wrong,” she said.

“Corporate failures are not gendered, we have seen plenty of corporate failures that involve men, whether it is directors or CEOs so to make this argument is frankly ridiculous.”

Read Janet Albrechtsen and Judith Sloan on quotas for women as company directors.

Greg Brown 9.47am: No reason for formal ceiling: Labor

Opposition assistant treasury spokesman Andrew Leigh says the government will use its tax-to-GDP cap as an excuse to give “handouts” to big business and deliver “razor thin” surpluses.

Mr Leigh said there was no economic reason there should be a formal ceiling of 23.9 per cent of tax-to-GDP written into the budget rules.

“There is no hard economics that tells you you need to have an arbitrary tax-to-GDP ratio, we put in place the National Disability Insurance Scheme, Australians were happy to pay a bit more tax in order to increase that social support pillar,” Mr Leigh said.

“It is about how you raise the revenue, the Coalition’s tax-to-GDP ratio is effectively going to be used as their excuse for not cracking down on multinational tax loopholes and giving massive handouts to banks.

“It will be their excuse for running razor thin surpluses rather than the strong budget surpluses they were promising just a couple of years ago.”

Shadow Assistant Treasurer @ALeighMP: There's no hard economics that tells you you need an arbitrary tax to GDP ratio...This tax to GDP ratio will be the Coalition's excuse for not cracking down on multinational tax loop-holes.

— Sky News Australia (@SkyNewsAust) May 6, 2018

MORE: https://t.co/nLzyve69Cs #AMAgenda pic.twitter.com/4GYIHwK5U3

Greg Brown 9.16am: GDP limit ‘shows focus on economic growth’

Cyber Security Minister Angus Taylor says Scott Morrison’s decision to formally enshrine a tax limit in the budget shows the government is focused on increasing revenues through economic growth rather than higher taxes.

Mr Taylor said it would be good for the economy if there was a tax limit of 23.9 per cent of gross domestic product written into the budget rules.

“I think there is a couple of big differentiators between us and the other side of politics now: we seek to drive revenue through growth not through higher taxes” Mr Taylor told Sky News.

“And the second is whenever we can we want to push that revenue back to the people through tax cuts, those two differentiators mean that we can contain tax as a percentage of the economy.”

Law Enforcement Minister @AngusTaylorMP: The big differentiation between us and Labor is that we seek to drive revenue through growth, not increasing taxes.Secondly, we want to push that revenue back to the people through tax cuts.

— Sky News Australia (@SkyNewsAust) May 6, 2018

MORE: https://t.co/nLzyve69Cs #AMAgenda pic.twitter.com/KpFBgsV2Ip

Greg Brown 8.55am: Budget ‘to make life easier’

Malcolm Turnbull says the budget will be focused on easing the cost of living and infrastructure.

The Prime Minister said the government would make life easier for families without blowing a hole in the budget.

“The important objectives are to ensure that Australians keep more of the money they earn so that they’re better able to deal with the rising cost of living pressures,” Mr Turnbull said this morning.

“That is why you will see tomorrow important measures relating to tax and you will see important measures, obviously already, relating to energy.

“We are putting downward pressure on energy prices. We are doing everything we can to ease the burden of cost of living pressures on Australian families. It is vital that we fund and guarantee essential services. We have record funding in schools, record funding for hospitals. We have guaranteed Medicare and of course we’re providing the vital economic infrastructure we need.

“And of course the government has to live within its means. We are on track to bring the budget back into surplus.”

.@TurnbullMalcolm: We're spending $75 billion on infrastructure over 10 years...and $24 billion in this budget. We can do this because our national economic plan is working: that involves lower taxes, more jobs, more economic growth.

— Sky News Australia (@SkyNewsAust) May 6, 2018

MORE: https://t.co/nLzyve69Cs #AMAgenda pic.twitter.com/y2XGvCR4FK

Greg Brown 8.25am: Citizenship MPs ‘should quit’

Finance Minister Mathias Cormann says Labor MPs with question marks over their citizenship eligibility should resign if the High Court rules against Labor senator Katy Gallagher on Wednesday.

Senator Cormann said there would be no need to refer Susan Lamb, Justine Keay and Josh Wilson to the High Court if Senator Gallagher was found ineligible because the law would be clear.

“As far as Susan Lamb is concerned, by her own admission she is a British citizen as well as an Australian citizen which is a clear breach of the constitution so she should long have resigned her seat to face a by-election,” Senator Cormann told ABC radio.

“The question is going to be a question for Bill Shorten: is he finally going to show some strength of character here?

“I don’t know why any other Labor MPs with serious questions over their status as eligible members of parliament should be referred to the High Court again if the legal position is very clear.”

The Opposition Leader argues Ms Lamb took “all reasonable steps” to rescind her citizenship before she was nominated as Labor’s candidate for the electorate of Longman.

Greg Brown 8.10am: ‘Focus on surplus’

Finance Minister Minister Mathias Cormann says the government will deliver a fiscally responsible budget, despite handing down tax cuts when the nation remains in deficit.

Senator Cormann said tax cuts would not undermine the government’s pursuit to return the budget to a surplus.

“The government has been working very hard to put the Australian economy on the strongest possible foundation and trajectory for the future so that more jobs can be created and we have been focused on putting the budget back into surplus as soon as possible,” Senator Cormann told ABC radio.

“We are always focused on a whole range of very important priorities, one is to ensure the economy can be as strong as possible and there are as many jobs as possible created in the economy, so there is competition for workers so wages start growing strongly again.

“Also, of course, making sure that funding for essential services can be guaranteed in the budget and that government lives within its means.”

What’s making news:

Scott Morrison will formally enshrine the government’s tax limit of 23.9 per cent of GDP in the nation’s fiscal future by adopting it as official Coalition policy and writing it into this year’s budget rules in a move that would force a Labor government to either reverse it or dramatically cut its own spending.

A commitment to infrastructure projects worth $24.5 billion will be central to Scott Morrison’s claim that the budget has been designed to lift economic growth.

A $340 million biosecurity levy on all import containers into Australia will be one of the key measures in this week’s budget aimed at supporting the agricultural sector and getting visitors through airports faster.

Labor Treasury spokesman Chris Bowen has refused to commit Labor on a tax-to-GDP ratio, saying it would be clear at the next election whether they could match or better the government’s position.

Universities say new economic modelling shows the Turnbull government’s freeze on course funding imposed in December could cut $12.3 billion from GDP and lead to a loss of up to $3.9bn in tax revenue over the next 20 years.

The Turnbull government has turned to the low income tax offset, or LITO, as an affordable method of targeting tax relief to low and middle-income earners.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout