Morrison locks in tax-to-GDP limits

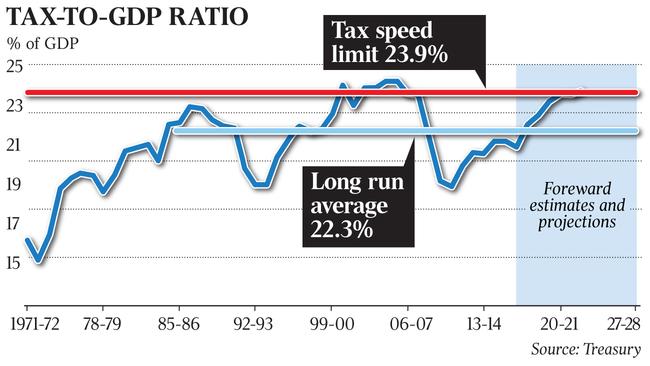

Government to formally enshrine tax limit of 23.9 per cent of GDP, putting pressure on Labor’s spending plan.

Scott Morrison will formally enshrine the government’s tax limit of 23.9 per cent of GDP in the nation’s fiscal future by adopting it as official Coalition policy and writing it into this year’s budget rules in a move that would force a Labor government to either reverse it or dramatically cut its own spending.

The Turnbull government is also expected to confirm in tomorrow night’s budget that it will return the balance sheet to surplus in 2019-20, a year earlier than forecast but by only a slim margin, while announcing an extra $24.5 billion in new infrastructure spending across the country.

At the same time it is likely to confine immediate tax relief this year to increasing the low-income tax offset, which would limit the windfalls to those workers on taxable incomes of up to $87,000, with the promise of delivering tax cuts for higher income brackets by 2024.

The Treasurer yesterday confirmed that the 23.9 per cent tax-to-GDP target would be written into the budget’s fiscal strategy for the first time, delivering a clear commitment to keep the tax take beneath this threshold or deliver it back in future tax cuts should it be at risk of being exceeded.

While providing a strict marker for future budgets, it will also arm the government with a potent political weapon with Labor already refusing to say whether it would match the lower tax target.

Mr Morrison said that while it sat at the higher end of the limit, it was now imperative to recognise the threshold as a non-negotiable rule of the formal fiscal strategy sitting alongside budget repair, spending offsets and debt reduction.

The target is slightly above the 30-year long-run average of 22.3 per cent. It would be the first time a fiscal rule on tax as a percentage of GDP has been included in the budget papers.

“It is now necessary to make it a clear decision and adopt it as part of the fiscal strategy,” Mr Morrison said.

“It’s in, we’ve put it in, and we will keep it in. An incoming government would have to reverse it. Either it stays in or they will have to take it out.

“The fact is that you should be thinking about reducing taxes when you approach this level. Labor would run the limit and they are shameless about it — they call it leading the debate, they boast about it.”

Labor Treasury spokesman Chris Bowen yesterday would not commit a Labor government to the same target, despite having advocated an almost identical goal of 23.7 per cent in 2013.

Finance Minister Mathias Cormann, who last year flagged a 10-year commitment to the target, claimed the opposition’s estimated spending commitments of $220bn already brought it closer to a tax-to-GDP ratio of 26 per cent. Mr Bowen said the tax-to-GDP ratio “won’t be any higher than it needs to be” to fund important services.

“I very much welcome an election around budget responsibility, a contest of budget responsibility, and about economic policies including tax,” he said.

“It’s not just about how much tax you raise, it’s about how you raise it.

“We have led the debate, closing down and reforming the unsustainable tax loopholes and concessions, like reform of negative gearing, reform of capital gains, and reform of dividend imputation refundability.”

The Australian understands the government is expected to use the low-income tax offset to deliver immediate tax relief only to those on taxable incomes of below $87,000 a year. The automatic tax offset is set at a maximum of $445 for those earning less than $66,700.

Utilising the offset as a mechanism to deliver tax relief would allow the government to confine it to a targeted group of workers in the most affordable way without triggering an automatic flow-on effect up into the higher tax bands.

Mr Morrison told The Weekend Australian that the tax relief would be “targeted” for low-income and middle-income earners while higher-income earners would be accommodated over the medium term.

It is understood that this could entail changes to the $180,000 threshold and a possible lowering of the higher marginal tax rates by 2024.

Mr Morrison yesterday continued to downplay expectations of significant tax cuts.

“What we have always said is that we would provide tax relief that is affordable and responsible,” Mr Morrison said.

“So, I’m not going to pretend that these are going to be mammoth tax cuts, or anything like that; that wouldn’t be responsible. They will be what is affordable, they will be real and they will be within what the budget can afford.”

As revealed in The Weekend Australian, the government is expected to bring forward the budget surplus by a year, which will mark the first surplus delivered since 2007-08.

The original forecast was for a return to surplus of $10.4 billion in 2020-21 and a deficit in 2019-2020 of $2.6 billion.

However, with revised revenue forecasts driven largely by improved post-GFC company tax receipts, the government is believed to have been able to bring forward a small surplus to 2019-20 while still delivering tax relief for low to middle-income earners.

Senator Cormann said the Turnbull government had reined in spending growth to 1.9 per cent compared with the growth of “about 4 per cent” he claimed the Coalition inherited from Labor.

Confirming that there would be cuts in the budget to pay for new spending, Senator Cormann said every new expenditure item would be offset by spending reductions in other parts of the budget.

“We’ve been committed to keeping spending growth under control,” Senator Cormann told Sky News.

“We inherited spending growth of about 4 per cent in real terms above inflation, year-on-year, on average.

“We’ve more than halved that. If you look at our half-yearly budget update before Christmas, you would have seen spending growth had been contained to 1.9 per cent, one of the lowest in living memory.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout