Whose money is it anyway? A defining moment for super

To be sure, superannuation funds are charged with the sole purpose of maximising the retirement income of members, but this doesn’t really provide a rationale for having the system in the first place.

Let’s be clear: governments should use compulsion only when there are clear reasons to do so and as a last resort. In fact, the origins of our system of compulsory superannuation were tied up in a political deal with the unions to forgo a pay rise in exchange for a set contribution to individuals’ superannuation savings.

Other justifications emerged later, including the provision of more generous retirements than those provided by the Age Pension – even replacing the pension – and the need to add to the national savings pool. This latter rationale was discarded at some stage when economists pointed out that the combination of a flexible exchange rate and international capital flows put paid to this argument.

When the system of compulsory superannuation was introduced, the Age Pension provided very modest support for retirees. Across time, however, the real value of the Age Pension has been lifted and it is automatically indexed. Receipt of the pension also carries a range of additional concessions and discounts. With people living longer in retirement, the Age Pension also deals with longevity risk – there is no possibility that funds will run out, as is the case with private provision.

The 2014 Financial System Inquiry, chaired by David Murray, provided support for a statutory objective for superannuation. The suggested wording was “to provide income in retirement to substitute or supplement the Age Pension”. This objective acknowledged that the Age Pension would remain, at least for some retirees, but the focus of superannuation was income in retirement. The Coalition government faffed around with this recommendation and ultimately no progress was made.

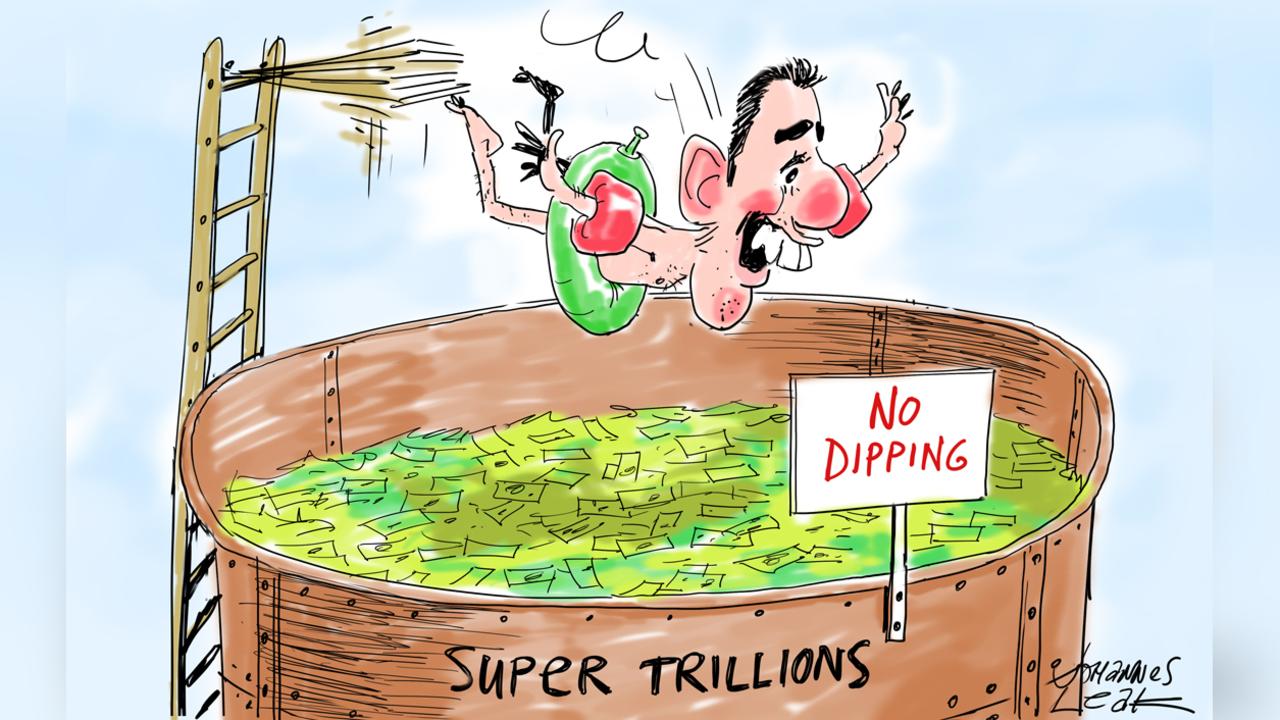

But the decision in 2020 by treasurer Josh Frydenberg to allow the limited release of funds from superannuation accounts for those adversely affected by pandemic restrictions was an important development. The decision was fiercely opposed by the industry super funds, although mainly behind closed doors.

Just before the election last year, the Coalition flagged its intention to support the limited withdrawal of superannuation money by members to fund a housing deposit. This practice is common in numerous countries but Labor is totally opposed to this option.

The consultation paper released by Treasury this week includes a preferred objective for superannuation. It is “to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”. The parsing of this sentence leads to the following inferences:

● Superannuation savings must be locked up until retirement.

● A dignified retirement means that large superannuation accounts can’t be justified; superannuation should not be used for estate planning purposes.

● A dignified retirement also means focus should be placed on those who are not well-served by the current system.

● The Age Pension will continue to operate alongside superannuation; there is no intention of removing people’s eligibility to the pension.

●The reference to equitable covers the treatment of those on lower incomes and women.

●The reference to sustainable probably refers to the cost of superannuation tax concessions and the way the benefits are skewed towards those on higher incomes and with large accounts. It also may refer to super funds taking note of climate change and investing in climate initiatives.

This definition goes well beyond that proposed by Murray. In Jim Chalmers’ opinion, the role of superannuation must go beyond investing for individuals; superannuation funds must serve societal purposes as well. He doesn’t see any inconsistency in this position; what’s good for society is good for members: “Those opportunities to achieve a double dividend – good results for super funds and members and good results for our nation – can only enhance the ability of super to meet its core objective.”

But as James Kirby of this newspaper has demonstrated, superannuation funds with a concentration of environment, social and governance assets have significantly underperformed other funds during the past several years. Moreover, funds that purport to have an ethical bent have performed even worse, in part because of their concentrated holdings of technology stocks.

The Treasurer essentially sees superannuation funds akin to an arm of government. He cites the examples of affordable housing, climate, the care economy and digital economy. He praises the involvement of industry super funds in social housing even though only one fund has announced a modest investment, with the other funds waiting for more information.

There is surely an irony in the enthusiasm Labor holds for the involvement of superannuation funds in housing – and the fees the funds will earn as a result – compared with their hostile reaction to people using some of their own superannuation money to purchase a home of their choice.

There is some water to go under the bridge before these matters are settled, if they ever are. There are many interests at play, not least the superannuation funds themselves. There was a time when it was thought that superannuation might replace the Age Pension. But all the projections show ongoing reliance on the pension by retirees, although there will be more part-pensioners, at least in the early stages of their retirement. The combined fiscal cost of the Age Pension and superannuation tax concessions is worthy of further analysis and debate.

In many ways, the debate goes to the heart of who owns superannuation accounts. The Coalition’s view is that the superannuation accounts belong to the individual members. Labor, by contrast, takes the view that super when in the accumulation phase belongs to the funds and can be released only to retired members. It is important to bear this in mind when thinking about Chalmers’ attempt to introduce a statutory objective for superannuation. His comments also should be seen in the context of his recently published aspiration to create a system of “values-based capitalism”.

It is passing strange that our system of compulsory superannuation has no legislated objective.