It comes as no surprise that Australian households of all stripes – from rich to poor, from students to families – have seen their expenses blow out by thousands of dollars over the past year as inflation has soared alongside interest rates.

But the scale of the changes is extraordinary. The average family with a mortgage, for example, has had to find an extra $12,500 in their household budget to make ends meet – an increase of almost 12 per cent between March 2022 and March this year.

That is approaching double the official inflation rate of 7 per cent.

Why? Because the Australian National University’s Cost of Living index, modelled by associate professor Ben Phillips for The Australian, includes the impact of (at the time) 10 rate rises on interest payments – unlike the official consumer price index figures, which do not.

At the other end of the scale are renters, where cost of living has increased by 6.3 per cent.

Why so much lower? Because despite talk of a housing crisis and double-digit increases in asking rents, the vast bulk of existing rents are (so far) moving much more slowly – at 4.9 per cent in the year to March. That has kept housing cost inflation much more subdued for renters than for indebted homeowners.

There are a few other things worth noting here. The ANU’s cost-of-living indexes show the averages in broad groupings. They can’t possibly reflect individuals’ personal circumstances, but they are a reasonable approximation of that type of households’ experiences and show the contrast among the various groups.

Most specifically, the cost-of-living indexes do not give us any insight into a households’ capacity to deal with the rising price of everything.

For example, the average single parent on benefits has experienced an 8.6 per cent increase in living expenses in the year to March – equivalent to an extra $6500 annually. Does that mean the past year has been easier for them than the average family with a mortgage? Clearly not, as the ANU’s Phillips is quick to point out.

Still, the past year’s inflationary surge has been difficult for many Australians from all walks of life.

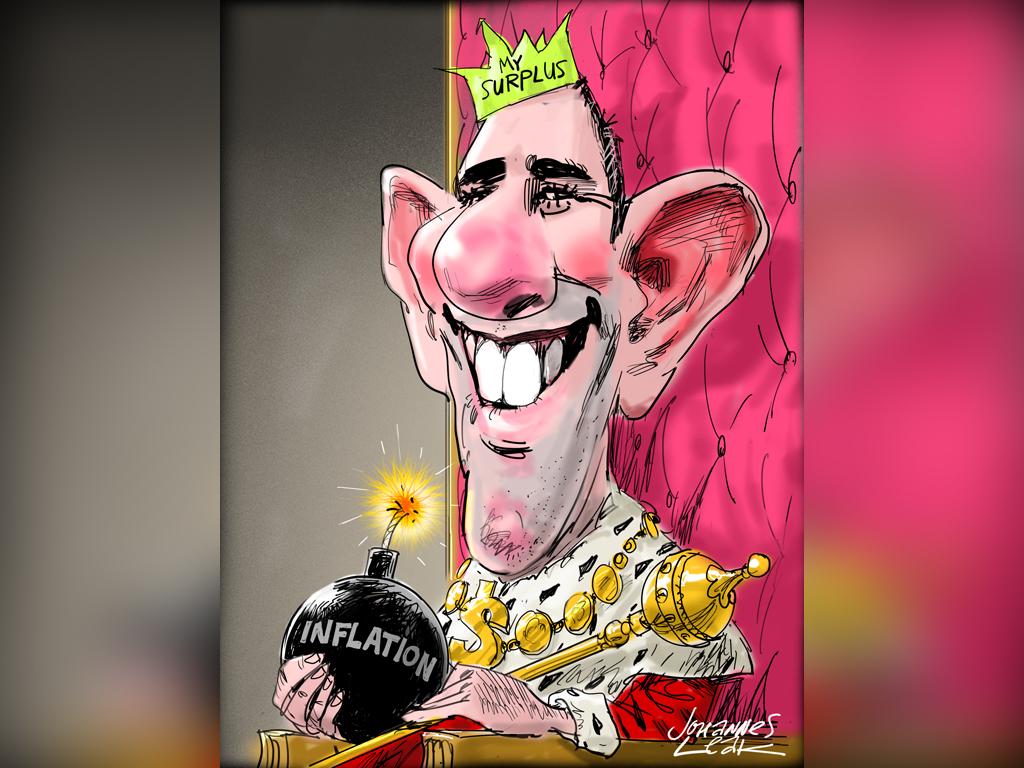

This analysis shows why Labor felt addressing the cost-of-living challenge had to be the centrepiece of its budget.