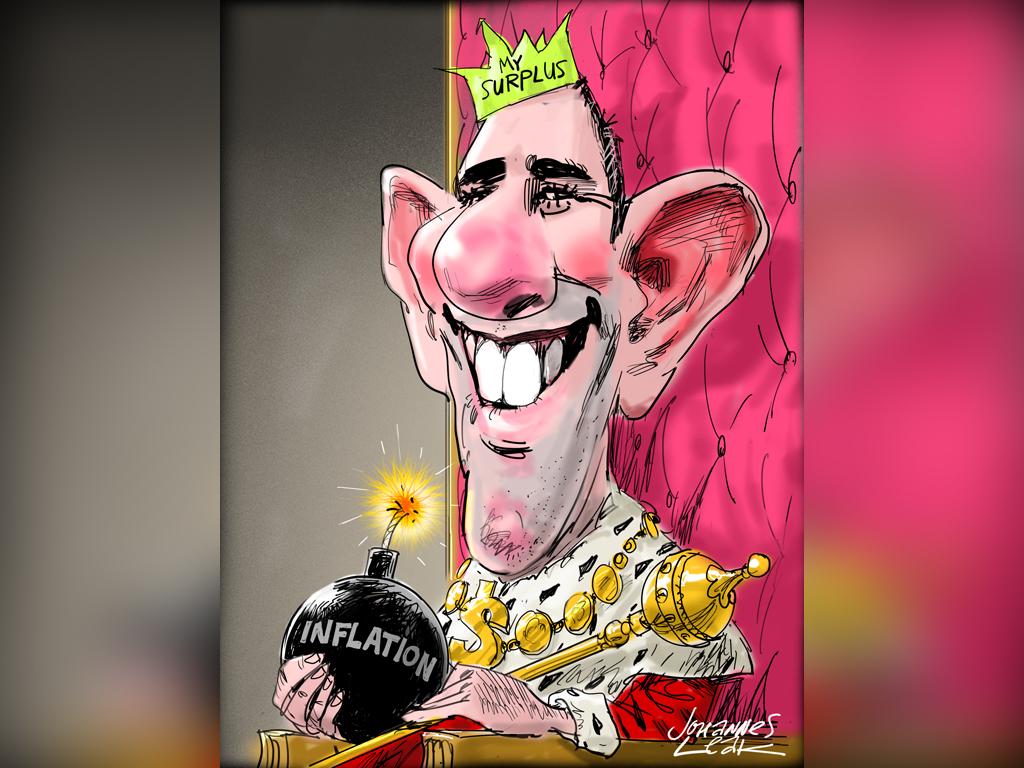

Federal budget 2023: Winners and losers

The Treasurer has targeted Labor’s base with his second budget, but future generations will have to pick up the tab.

Federal Treasurer Jim Chalmers has delivered a budget spruiking cost of living relief. He has targeted power bills, medical costs, welfare support and wage rises for those in aged care.

THE WINNERS

● Rebates for to $500 for 5.5 million households, and up to $650 for one million small businesses.

● Help for 170,000 households to save on power bills by financing energy-saving home upgrades.

● More than 110,000 low-interest loans available for energy-saving home upgrades, as part of a $1.3bn Household Energy Upgrades Fund.

● More than 250,000 frontline aged care staff – including nurses, carers, cooks and home care workers – will get 15pc pay rises from July 1 under a $11.3bn package.

● If forecasts can be believed, wages are predicted to grow by 4pc next financial year, the fastest rate since 2009. Inflation is forecast to be 6pc at June 30, falling to 3.25pc over the next 12 months and to 2.75pc by mid-2025.

● Inflation is not predicted to return to target until 2024/25.

● The unemployment rate is expected to hold at near 50-year lows of 3.5pc, rising to 4.5pc by the June quarter of 2025.

● 1.2 million families will benefit from July 1 when subsidy rates rise. $55.31bn has been allocated over four years on childcare affordability.

● More than 57,000 people on the single parenting payment. The cut-off age for the youngest child will be raised from 8 to 14, securing those eligible $176.90 per fortnight.

● Up to 75,000 childcare workers will be eligible to upgrade their skills and training, with $72.4m set aside to help with professional development and completion of a practical component of a Bachelor or Masters degree in early childhood education.

● From July 1, Parental leave pay, and Dad and Partner pay will combine into a single 20-week payment. A new family income test of $350,000 will allow an extra 3000 parents become eligible for the entitlement.

● Paid parental leave is due to be increased to 26 weeks by 2026.

● A base-rate increase of $40 per fortnight for about 1.1 million Australians on support payments including JobSeeker, Austudy and Youth Allowance.

● The JobSeeker payment increase of $92.10 per fortnight will kick in for about 52,000 people aged over 55 who have been on the allowance for nine or more straight months. This currently applies only to those aged over 60.

● Bulk-billing incentives will be tripled for the most common consultations with 5.1 million children under 16, and 7.9 million pensioners and other Commonwealth concession card holders.

● The new bulk-billing incentives will apply to all face-to-face and telehealth GP services between six and 20 minutes; all other face-to-face GP consultations; longer consultations where a patient is registered through MyMedicare.

● $2.2bn Medicare overhaul, including boosting the number of nurses, increase after-hours care and expand the roles of pharmacists and paramedics.

● About six million Australians who need prescription will be able to get two months worth of medicine from a single prescription, instead of one month, from September 1. It will affect 320 items treating chronic conditions including heart disease, hypertension and cholesterol.

● About 1.1 million low-income earners on rent assistance will be able to get access to another 15pc in their maximum payment. It means up to $31 extra a fortnight for people renting in the private market and community housing.

● Encouraged investment for build-to rent projects to create 150,000 new homes over 10 years. Tax incentives for eligible managed investment trusts, and allowable deductions on build-to rent housing.

● An extra $2bn for the National Housing Finance and Investment Corporation, to help provide loans for social and affordable housing.

● The Home Guarantee Scheme — eligibility for the first home guarantee and regional first home guarantee will be expanded to any two borrowers beyond married and de facto couples; while and non-first home buyers who haven’t owned a property in 10 years will also be eligible.

● Australian Permanent Residents will become eligible for the Home Guarantee Scheme.

● Electric vehicles, $146m to support electric vehicle uptake, including funding for electric vehicles charging infrastructure.

● $20bn Rewiring the Nation program will allocate $12bn to priority transmission projects.

● $4bn has been set aside for the renewable energy superpower plan, including $2bn to support hydrogen production.

● $83.8m to develop and deploy microgrid technologies.

● $310m in tax relief for energy performance upgrades for businesses

● $800m to support electric vehicles through discounts and infrastructure.

● $3bn for renewables and low emission technologies to power the future.

● $2bn for a national critical minerals facility.

● $57.1m for critical minerals partnerships domestically and abroad

● $121m to establish Environment Protection Australia.

● $1.9bn committed from 2022/23 October budget to Powering the Regions Fund.

● $400m to support clean energy industries nationally.

● Partnerships throughout the Pacific including a $200m climate and infrastructure deal with Indonesia.

● $1.9bn in initiatives including building community partnerships, protecting knowledge and culture, and better care.

● Commitment to deliver Uluru Statement from the Heart in full.

● $83m to improve schooling for Aboriginal and Torres Strait Islander students.

● $142m in tackling smoking within the Indigenous population and $57.3m to extend Covid testing and vaccinations.

● 5000 scholarships worth up to $40,000 will lure more high-quality candidates into teaching, including mid-career professionals such as lawyers and engineers.

● More than 1300 schools across the country will benefit from a share of $32m in grants to upgrade school infrastructure and equipment.

● Mental health – 500 additional psychology placements and training with $260.2m in psychosocial support and $136m for survivors of torture and trauma.

● $119m for the National Gallery, $76m for the National Museum of Australia, $36.5m to the National Archives. Australia’s nine ‘national collecting institutions’ will get $535.3m over four years for urgent repairs and improvements.

● AFL fans in Tasmania — courtesy of a $240m handout to go to a $740m stadium in Hobart.

● Sydney Harbour — $45.2m for ‘critical repair work’.

● $163.4m for the Australian Institute of Marine Science.

LOSERS:

● Offshore oil and gas companies will cop $2.4bn in extra taxes under changes to the Petroleum Resource Rent Tax — under a review that was started by the Morrison government.

● From January 1, 2024, a global and domestic minimum tax rate of 15pc will be introduced on Australian multinationals and the local operations of large foreign multinationals that operate here. In January 2025 that will be expanded to cover foreign multinationals that operate in Australia.

● In a throwback to “beer and smokes” budgets of old, the government has announced tax hikes of 5pc annually for the next three years. A 25-pack of durries could soon set you back more than $50.

● Under recently announced changes to vape laws, they will be banned from sale everywhere except pharmacies.

● $29.5m will be spent on smoking and vape support as the government cracks down on the sector.

● Loose-leaf tobacco will be taxed equally to cigarettes from September 1, 2023.

● A crackdown on fraud and unethical practices is designed to rein in costs of the $34bn-a-year scheme.

● $48.3m will be dedicated to fighting fraud within the system.

● From July 1, 2025, superannuation balances over $3m face a tax hike from 15pc to 30pc.

● With net government debt to hit $700bn by 2026/27, interest payments alone are heading toward $26bn a year.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout