Labor doing nothing to help RBA tame inflation dragon

In December 1982, inflation was 11.3 per cent and unemployment 9.2 per cent. Fast forward more than four decades and Australia has an inflation problem again.

This a problem borne of both external factors but also from 20- plus years of commonwealth, state and territory economic policy malpractice. The bill for overly loose monetary policy, extensive regulation, excessive spending and malinvestment has come due.

This inflation problem was not caused by the Albanese government, but it has fallen upon it to contribute to its resolution, while minimising general economic damage. Yet there is no sign of any desire to undertake the necessary inflation-fighting actions.

On the contrary, the government continues to operate from the same policy playbook that got us into this mess.

Treasurer Jim Chalmers, responding to the latest RBA interest rate increase, commented it would make “life harder for people who were already doing it tough”. Six months ago, following the RBA’s last increase to 4.10 per cent Chalmers similarly said the increase would “make life much harder for people with a mortgage”.

Meanwhile, in the period between interest rate rises, the Albanese government has done nothing to support the RBA’s inflation-fighting efforts. On the contrary, the government has continued to implement inflation stimulating policies.

Australian governments give life to the observation that governments don’t solve problems; they subsidise them. Much like a nation cannot tax itself to prosperity, it cannot subsidise inflation away. And subsidies seem to be the principal economic strategy of the Albanese government.

More precisely, to effect policies to increase prices with one hand and to then provide subsidies with the other when the earlier policies achieve their price-increasing effect.

In response to the rising cost of childcare following increased regulatory interventions, the government has increased childcare subsidies. In response to housing price inflation stimulated by significant immigration numbers, the government has increased housing construction subsidies.

In response to the rising cost of health care because of medical central planning, the government has increased Medicare subsidies. In response to the rising cost of energy flowing from poorly designed and implemented emissions-reduction policies, the government proposed to increase energy subsidies. In response to the slow suffocation of industry flowing from productivity and competitiveness-sapping taxes and regulations, the government proposes to provide industrial subsidies.

The only winners from this policy schizophrenia are the battalions of bureaucrats administering these schemes and press officers drafting the media releases.

One does not need to search too widely to see the likely direction of the RBA’s next interest rate movement. Smack on the top of the RBA’s home page are two numbers – 4.35 per cent cash rate target and 5.4 per cent inflation. These two numbers combine to infer a negative 1.05 per cent real interest rate, far from a restrictive monetary policy posture necessary to beat down inflation to the RBA’s target of 2 to 3 per cent.

Even the words of RBA governor Michele Bullock, accompanying the RBA’s Melbourne Cup day interest rate increase, suggest the most likely direction of interest rates are biased towards an increase, given that she noted inflation was “still too high and is proving more persistent than expected a few months ago”.

The historical evidence is clear and categorical. Reducing inflation requires not just monetary tightening but also reduced government spending, tax cuts, deregulation and a productivity agenda. This is how inflation was defeated in the US and Britain in the 1980s.

This is how it was defeated in Australia in the ’80s and ’90s. And this is why, if current policy settings don’t change, inflation and interest rates will be higher for longer.

In the closing of her monetary policy decision statement, Bullock said: “The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.” It is a shame that such resolve and determination is not shared by the Albanese government, thus making the job of the RBA even harder.

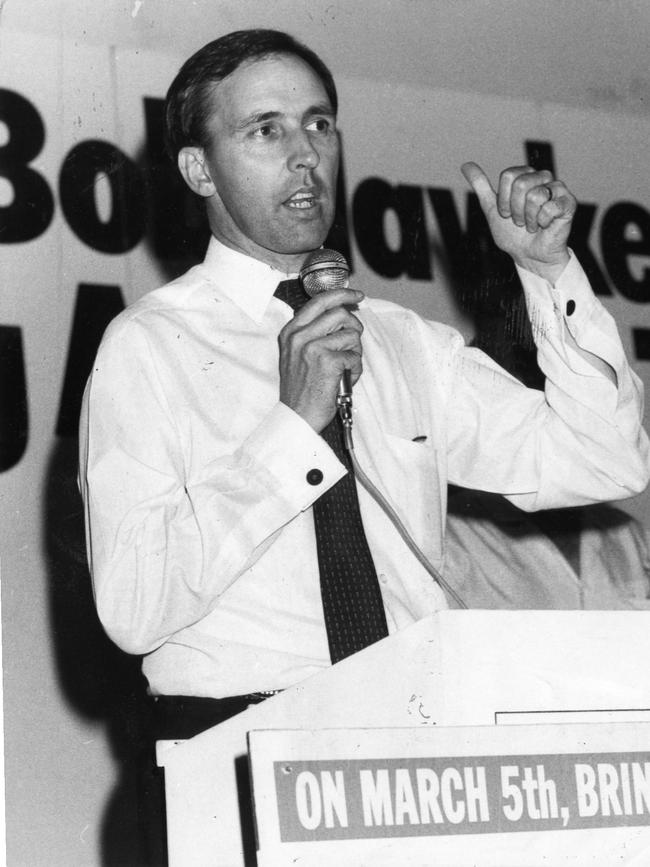

Chalmers wrote his 2004 PhD dissertation on the prime ministership of Paul Keating. It can only be left to the imagination to speculate what the current economic settings might be had he written his thesis on the treasurership of Keating, who inherited the inflation and recession mess in 1983.

Dimitri Burshtein is a principal at Eminence Advisory and a former government policy analyst.

In the 1982 boxing movie Rocky III, Rocky Balboa’s nemesis, Clubber Lang, is asked to make a prediction for their upcoming bout. Lang’s response was simple: “Pain.” Such is the intersection between life and art that, in the same year, Australians were experiencing their own pain, living through a significant recession.