Although there was a later recovery, many US and global institutions clearly believe Americans have elected a madman as President and the world is headed into a deep global recession.

Today I deliver controversial but underlying good news, there is an economic justification for what Trump is doing, and he is not mad.

Indeed, there has been a drastic decline in the size of the US economy compared to the rest of the world and unless the decline is arrested the US will eventually lose its reserve currency status and its defence capacity will be dramatically reduced. This looming long term crisis is behind the Trump actions and the “Make America Great Again” slogan.

This does not mean he is right and he will achieve his aims. Clearly there is high risk and there will be repercussions, but describing his economic strategies actions as crazy seriously misleads.

To help our readers understand what is happening, on Monday I set out how the Trump strategy has been structured, which has been confirmed by the rush of countries now looking to have talks with the US.

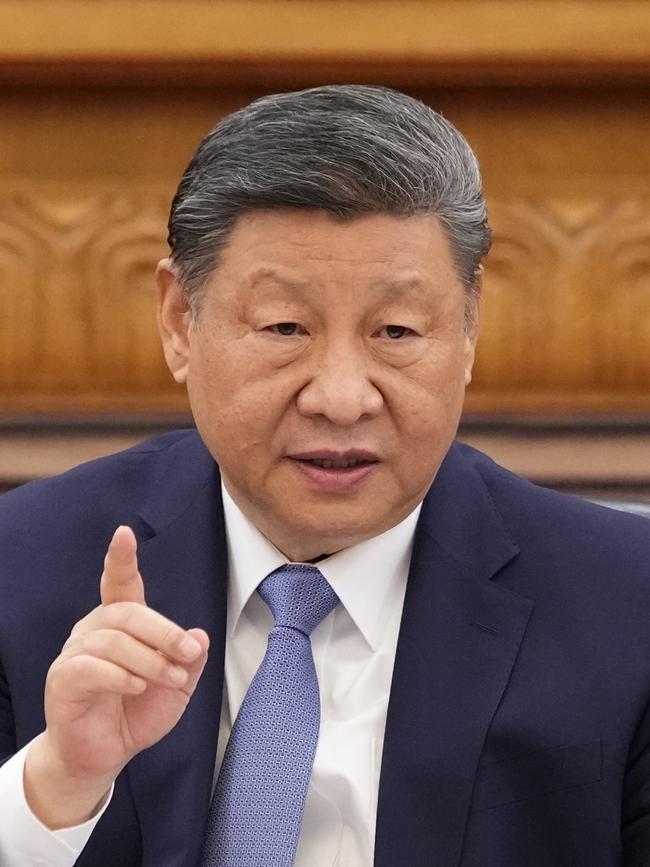

Those discussions will often cover the massive rise in Chinese automated industrial capacity, led by electric cars, which threatens manufacturing in Europe, Japan and Korea as well as the US.

Relations between China and the US are deteriorating, contributing to a further fall in the Australian dollar.

Behind the Trump tariffs and the country-to-country discussions are serious global economic and defence issues which are rarely discussed.

The best economic explanation I can find for the Trump strategies is contained in a recent 41-page essay by Hudson Bay Financial senior strategist Stephen Miran.

Previously, Miran served as senior adviser for economic policy at the US Department of the Treasury.

Miran explains America’s status as reserve currency carries the burden of an overvalued currency, which erodes the competitiveness of its export sector. America wants to retain its status as the world reserve currency, but is unwilling to bear the pain created by the hollowing out of its industrial base created by reserve currency structures.

Because America provides reserve assets to the world, there is massive global demand for US dollars and treasury securities, which is not rooted in balancing trade or in optimising risk-adjusted returns. These trillions of dollars of capital inflow artificially boost the US dollar.

Then, the US spends the money on low-priced imported goods, which decimates American manufacturing and surrounding service industries. This creates great hardship in selected geographic areas, but buoyancy in the financial sector.

American exports are curbed not only by the high dollar, but because many countries have tariffs and other protection systems. The combination means the rest of the world grows at the expense of the US, which has massive current account deficits.

Accordingly, the US’s share of global GDP halved from 40 per cent of global GDP in the 1960s to 21 per cent in 2012, and has recovered slightly to its present level of 26 per cent.

Eventually, there is a “tipping point” where the deficits and economic shrinking become large enough to induce credit risk in the reserve asset. The reserve country may then lose reserve status, ushering in a wave of global instability.

The US is nowhere near this point, but unless action is taken it will become an issue, adding to the current community pain in selected areas.

Of course, having the US dollar as the world currency gives the US great financial power to sanction countries — as Russia discovered.

China and other countries are looking to provide a reserve currency (and gain the power) but at this stage they don’t have the structural stability of the US.

In his first term as President, starting in 2017, Trump undertook a small attempt at reducing the US community pain arising from currency reserve status with a lift in tariffs. He discovered it did not lift inflation.

In the 2018-2019 Trump tariff experience, the effective tariff rate on Chinese imports increased by 17.9 percentage points. But, the Chinese renminbi depreciated against the dollar over this period by 13.7 per cent, so the after-tariff US dollar import price rose by only 4.1 per cent.

In other words, the currency move offset more than three quarters of the tariff, explaining the negligible upward pressure on inflation. That experience inspired Trump’s current belief 10 per cent tariff rises will be absorbed by currency variations while reducing the pain of being the reserve currency.

However, later the protection provided by the first Trump tariffs was decimated because many Chinese companies began exporting goods or components to third countries, (including Mexico and Canada), engaging in some minor processing and then re-exporting to the US.

The majority of Chinese manufactured goods escaped the US tariff this way, which explains many of the current Trump penalty tariffs, including those placed on Mexico and Canada.

These issues will be discussed country by country, but there is another aspect to the economic scenarios outside normal trade.

America provides a global defence shield to liberal democracies, and in exchange, America receives both the benefits and burdens of reserve status.

President Trump believes European and other countries are taking advantage of America in both defence and trade measures, creating a strain on the American export sector and the socio-economic problems which follow.

As the economic burdens on America grow with global GDP outpacing American GDP, America is finding it more difficult to underwrite global security, because its current account deficit grows and its capability to produce equipment is hollowing out.

The US wants its defence burden reduced by increased expenditure from those benefiting from the American security umbrella. This includes Australia.

Miran concludes as the reserve currency/defence bargain becomes less appealing it “brings us to the present, whereby there is growing consensus in America to change the relationship”.

When US trading opened on the third day of the Donald Trump tariff-induced share market slump, there was a further sell down.