But the good news and consumer and business confidence have come at a record price in historical terms and political compromise.

The life-and-death question for the Morrison Coalition government – which will be answered at the next election – is whether the public accepts that this huge cost is a fair price to pay.

In the short term the answer will be overwhelmingly yes, yet in the longer term, beyond the next election, the true price will become apparent as it becomes clear that there will be a crippling debt for a decade at least.

There is also a darker hue beyond the dawn when the initial heat of the big spend begins to cool and the “future demand” that has been dragged forward into housing construction and business leaves a shortfall.

Make no mistake, the aim of saving millions of jobs has been achieved.

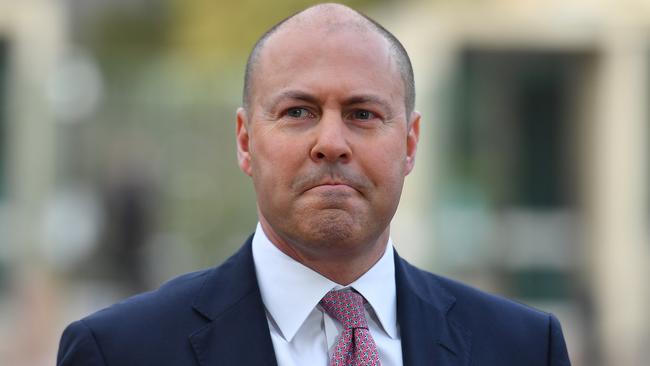

Jobs, Josh Frydenberg’s stated priority, were sustained during the COVID-19 pandemic with the biggest single fiscal program in Australia’s history, are still growing and are forecast to grow even more with unemployment falling to 4.5 per cent by 2023-24.

This is the Treasurer’s victory, not just in lowering unemployment but also in defying Labor’s challenge that the 2020 budget would fail “its central task” if unemployment was “too high for too long”.

What’s more, Frydenberg’s determination to cut off the $84bn JobKeeper program has not seen employment fall off a cliff as Labor suggested.

Coupled with business and personal tax cut stimulus, early access to superannuation, investment incentives, job welfare and housing industry support the Morrison government was the first economy to return to pre-pandemic levels of employment.

In his budget speech Frydenberg was upbeat: “At 5.6 per cent, unemployment today is lower than when we came to government. This is remarkable.”

“JobKeeper kept 3.8 million people in their job,” he said.

The budget also contained the positive forecasts for unemployment, falling from 5.6 to 5 and then to 4.75 per cent and then again to 4.5 per cent in 2023-24.

But, because of global uncertainties, return to recession in the eurozone, a blowout in the deadline for vaccinations, negative immigration and a drop in demand as stimulus dries up, other forecasts for 2023-24 are not as optimistic.

Growth in GDP declines from 4.25 per cent to 2.25, inflation grows from 1.75 per cent to 2.5, household spending declines from 5.5 to 4 and dwelling investment falls from its robust 2.5 per cent to minus 1.5 per cent.

Then there is the debt and deficit in 2023-24: $920bn and $79.5bn. That’s the darkness beyond the dawn.

This is a false dawn budget. There is rosy hope and optimism in the short term, with a world-leading Australian pandemic recovery in lives and livelihoods.