With the prospect of a year of tension between the optimistic inflation forecasts of the Treasury in the budget and a more pragmatic Reserve Bank emerging in the lead up to the next election, one wonders if it is worth the Treasurer’s effort to push ahead with the idea of second board for the Reserve Bank.

The idea of having two boards for the central bank – one focused on setting monetary policy and a second overseeing governance issues – came out of the three person review of the bank released last year headed by Canadian central banker, Carolyn Wilkins. It was seized on by the Treasurer who quickly accepted the recommendations of the committee despite the lack of a real argument for what is quite a radical move with no great justification for the change.

But the proposal now seems to have been stuck in the Senate with the Opposition raising concerns that the Treasurer could use the move to “stack” the monetary policy setting board with like-minded members.

The Opposition originally approached the idea of Reserve Bank “reform” with a bipartisan spirit but more recently began to raise questions about what it felt might be the Treasurer’s motives for the change.

The idea of the RBA having two boards (or three if you count the fact that it also oversees the Payment Systems Board) has got lukewarm support from the economics fraternity and some strong criticism from others including former Reserve Bank governor Ian Macfarlane.

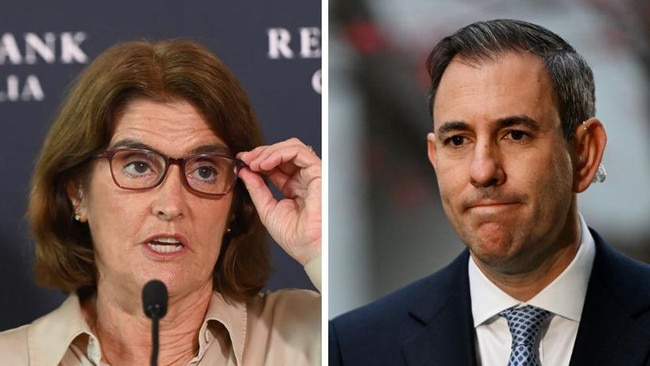

The Reserve Bank has already implemented many of the recommendations for change made by the review and supported by Treasurer Jim Chalmers – including the move to six-weekly meetings of the board, held over two days, with press conferences to be held by the governor after every meetings and statements made in the name of the Reserve Bank board and not just the Governor.

Under the proposal, the two nine-member boards would have a similar composition – the governor, deputy governor, the Secretary of the Treasury, and six independent members appointed by the Treasurer.

The creation of the new governance board creates the opportunity for Chalmers to make six new appointments in total to the boards.

The tension in the Senate with the Opposition has come around the potential for some current members of the board, the key committee setting interest rates, to move over to the more innocuous governance board.

This would open up slots for the Treasurer to appoint more people of his own choosing to the monetary policy board.

So far Chalmers has made two appointments to the current Reserve Bank (two out of the six independent members) – appointments which have come up in the natural course of business when a board member’s term has expired.

As critics of the two-board proposal point out, both of these are former staffers at the ACTU – the former president of the Fair Work Commission, Iain Ross, and company director, Elana Rubin, so what does it say about the others he might appoint under the new structure?

If the two-board concept is passed by parliament as Chalmers wants, the question is how many of the four other existing independent members of the powerful monetary policy board would be moved over to the governance board, leaving slots open for the Treasurer to make more of his own appointments to the monetary policy setting board.

This question is now even more relevant given the clear fallout from the budget that the government and the RBA could now be on different paths when it comes to the outlook for inflation – and thus the potential for rate cuts in the lead up to the election.

Confident that the proposals would get the support of the Senate, Chalmers originally indicated that he hoped the dual-board structure would be in place by July 1 but this is now impossible.

The proposed legislation says the new structure cannot operate until at least three months after it comes into force.

The Treasury even began advertising for board members months ago.

With the legislation stuck in the Senate with no clear path forward the question is how much political capital Chalmers wants to spend getting his proposal through – at a time when there is already a lot on the government’s plate.

But with rising criticism by the economics community of the budget’s inflation forecasts, one could argue that there may be even more incentive for Chalmers to have more of his own appointees on the board.

Critics of the budget’s more optimistic inflation forecast than the RBA, on the basis that the budget contained measures designed to artificially hold down prices such as the $300 a household energy rebate, were already emerging before the budget.

They included former RBA board member Professor Warwick McKibbin, who described the proposal to hold down the reported inflation rate with moves such as the $300 energy subsidy as “political trickery”.

Reducing inflation is critical for the Australian economy with the job not done yet despite the RBA’s rate hikes of the past two years.

Commenting on the budget on Wednesday, the chief executive of the National Australia Bank, Andrew Irvine, said “delivering targeted measures to support Australians to manage cost of living pressures and help businesses grow” was crucial.

“At the same time, it is important that stubborn inflation is curbed as it continues to hurt every household and business,” he said.

While the Treasurer of the day gets to appoint RBA board members as well the governor and deputy governor, it is important for the Reserve Bank to be seen to be independent of government.

Just how Michele Bullock’s RBA navigates the increasing political and economic pressures between now and the next election will be watched carefully, given the controversy over the inflationary potential of the budget.

If Chalmers pushes ahead with more changes to the RBA, the political stakes and the potential for the RBA’s hard fought independence to come under scrutiny will be even higher.