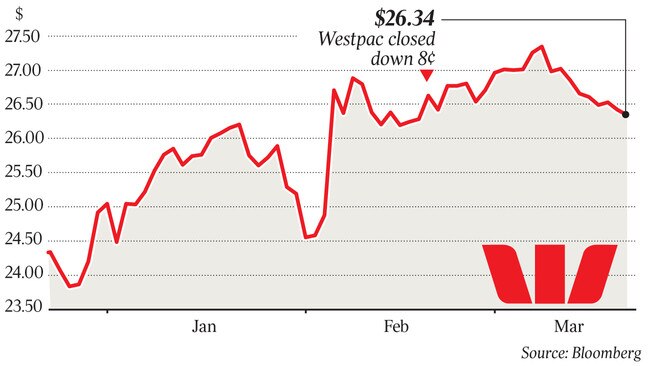

Westpac exit a ‘small positive’

Westpac Bank’s decision to exit its loss-making financial planning unit was broadly supported by analysts yesterday.

Westpac Bank’s decision to exit its loss-making financial planning unit was broadly supported by analysts yesterday, although several raised questions around earnings prospects for its remaining wealth businesses and risks of ongoing advice remediation.

Westpac is selling some of its salaried advisers to boutique Viridian Advisory, and winding down the rest of the division, including its dealer groups, by September 30.

The restructure will result in Westpac’s wealth division, BT Financial Group, being subsumed into the bank’s consumer and business bank, leading to the departure of BT boss Brad Cooper. The head of the consumer bank, George Frazis, will also part ways with Westpac.

The wealth shake-up led analysts to cut their earnings estimates for the year ended September 30, 2019, yesterday, but several ratcheted up their expectations for 2020 slightly as Westpac was ridding itself of a loss-making unit.

UBS analysts labelled the move “logical” but questioned whether Westpac would remain in the investment platform industry over the long term.

“This (advice) business is under significant stress with revenue expected to fall 75 per cent (to just $46 million) in financial year 2019, generating a loss of circa $125m,” they said in a note to clients. “Westpac has recommitted to its platform business (Panorama) following substantial investment over many years. Panorama is profitable, but is a bank such as Westpac a natural owner for this business?

“We would expect much of the wrap platform business to migrate to Panorama over coming years, at which stage Westpac may consider exiting.”

Credit Suisse analysts said the financial advice divestment was a “small positive” for Westpac given the removal of a loss-making business.

They cautioned, however, that despite Westpac saying it would complete paying remediation to aggrieved customers in its salaried planning arm by the fourth quarter, the bank had not disclosed an estimate for its dealer groups. “We currently forecast $250m post-tax in remediation in 2019,” they said.

Citigroup analysts said: “Exiting the advice business makes sense whilst potentially enhancing the stand-alone platforms.”

Westpac is retaining units including life insurance, private wealth and its investment platforms.

Morgan Stanley remained cautious. “We think this simplifies the wealth management business, but the underlying earnings outlook for its residual wealth activities remains uncertain and the potential liability for further remediation costs in unclear,” Morgan Stanley analysts said.

Westpac chief executive Brian Hartzer said the overhaul of the wealth business was expected to be earnings-per-share positive in 2020 due to exiting a “high-cost, loss-making business”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout