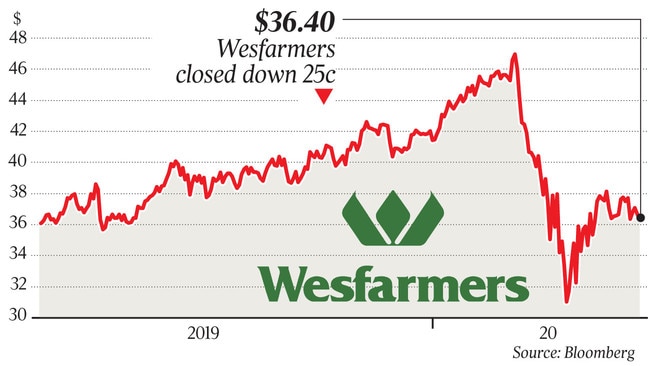

Wesfarmers to step up digital investment

Rob Scott said Wesfarmers would accelerate online investments to bolster its businesses in the ‘new normal’ of the COVID-19 world.

Wesfarmers chief executive Rob Scott said its hardware chain Bunnings — which started an online shopping platform just two years ago — was now “leading the way” in retail, with the conglomerate looking to accelerate its online investments to bolster its businesses in the “new normal” of the COVID-19 world.

While the market last year questioned Mr Scott’s decision to pay $230m for online marketplace Catch Group, questioning if he had overpaid for the private company, the Wesfarmers boss said it was delivering new ideas and skills to the broader group.

Addressing the Macquarie 2020 Conference on Thursday, Mr Scott said Catch Group was experienced strong demand, with shoppers staying at home and shopping online, and its other retail chains Kmart, Target and Officeworks also generating better sales via their online channels.

He said the group was coming up with innovative ideas. Officeworks had started to sell perspex partitions similar to the types being used at supermarkets and other retailers to help with social distancing.

And Wesfarmers was finding opportunities to invest in the online space, with greater investment likely targeted for Bunnings, Kmart and Catch where the online marketplace was already finding capacity constraints at its distribution centres.

But Mr Scott warned the group expected “some moderation” in the ramp-up in sales witnessed in March and April at its retail arms.

Following the demerger of Coles, Bunnings now generates just over 50 per cent of Wesfarmers’ earnings, and with the deteriorating performance of the general merchandise chain Target and its industrials and safety divisions, the hardware chain’s contribution to profit is set to grow.

Mr Scott said Bunnings was leading the way in its rollout of online shopping.

“Kmart and Target ... achieved very strong growth in online sales. It is worth remembering that two years ago Bunnings didn’t have an online transactional capability and now in many ways Bunnings is leading the way around innovation in this area,’’ Mr Scott said.

“The drive and collect model has been a fantastic initiative that has been adopted by Bunnings and Officeworks, which allows a customer to drive their car to a Bunnings warehouse and one of our team members will drop the order off at the back of the boot.”

Wesfarmers had also converted three Kmart stores to “dark stores” to help support the rise in online demand.

“We have been able to win a number of new customers so we are seeing this is driving incremental and incremental customers, not just cannibalising sales that would otherwise occur in the store.’’

Wesfarmers was also learning new digital skills from Catch.

“We have seen very strong growth in sales in the Catch marketplace and we have also learnt a lot about the digital experience that we have been able to roll out in some of our other businesses,’’ he said.

Wesfarmers, which is sitting on more than $2bn in cash following the partial sell-down of its stake in Coles, is looking to invest in online. “We will very much be led by the divisions, and by the customer, in how much we spend and how quickly we spend. We are seeing some great opportunities to invest in the digital space.

“Because a lot of software is cloud-based, the upfront costs associated with a number of these are materially lower than they were five to 10 years ago. So a lot of the investment we are making is more opex (operational) than capex (capital) and you can get quite a lot of bang for your buck in terms of the investment you make.

Turning to trading, Mr Scott said it was likely the strong sales inrease seen through March and April — driven by panic buying and people stocking up before being isolated at home — would begin to moderate.

“It will be unlikely (we’d) see the strong growth in sales that we have experienced in the last couple of months continue. It would be great if they did, but realistically we would expect some moderation.’’

He said the coronavirus pandemic which had seen many factories in China close down had also forced Wesfarmers to consider widening its supply base and consider investing in supply chain technology.