The flagged coronavirus loans are directed at small business and are well structured but, along with the $15bn from the feds, the RBA offer is for $115bn in support for a $2 trillion economy.

The comparable UK scheme administered by the Bank of England is for $618bn in loans in a $4.5 trillion economy so the UK offer is to underwrite loans up to the value of 14 per cent of the economy — against just 5.3 per cent in Australia.

There are some pluses with the RBA corona loans, such as three years at 0.25 per cent rates and the ancillary moves by the Australian Office of Financial Management to support the securitisation market to help non-bank lenders.

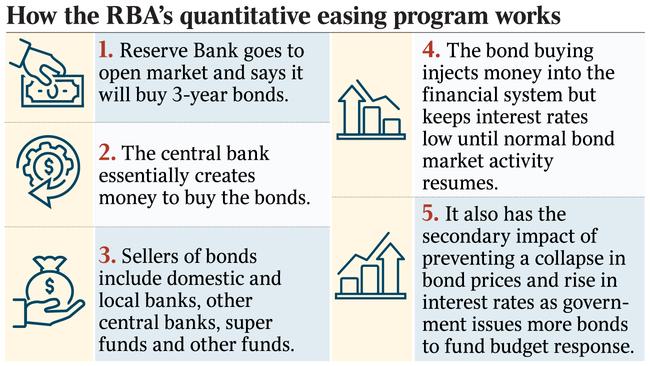

RBA governor Philip Lowe was quick to note that his package is not quantitative easing because he is targeting a yield on three-year notes rather than setting a target of how many bonds he will buy.

This is also clever, because by targeting a yield on the three-year note he will help reduce bank funding costs far more effectively than any cut in official rates.

The knee-jerk reaction on the stockmarket was to push 10-year bonds higher and prices lower, when the reverse should have happened, and the banks’ stock prices fell because their profits will be lower.

The latter is not exactly a news flash in the present environment, which shows the continued confusions prevailing in global financial markets.

The federal government is still to deliver the next leg of the funding package, which is due to be unveiled in the next few days. Negotiations are continuing with the banks over the terms of the 80 per cent government guarantee on loans.

Final comment must await that package, but Lowe’s commitment to support financial markets, and backing by the federal and state governments, are clearly welcome developments.

The fact both credit and equity markets were obviously underwhelmed by the series of announcements shows markets are still trading on the virus and not on economic fundamentals.

Financial markets think the government has more to do. The underlying objective of the package is to provide a bridge through the worst of the health impact, so that when the virus expansion slows, the economy can start recovering quickly.

In the words of AustralianSuper investment chief Mark Delaney, the aim is “to keep the economy whole”.

The government and the banks have one objective, which is to attempt to hold the economy as best as possible until the virus spread slows, which could take six months or more.

Yesterday’s extraordinary action by Qantas to cancel all international flights and mothball 20,000 jobs — two-thirds of its workforce — underlines the havoc the virus containment strategy is having on the economy.

CBA’s reaction to the RBA was also welcome, taking the political risk of not passing on the 25-basis-point cut for its variable home loans and instead cutting fixed rates and also increasing one-year term deposits by 25 basis points.

This makes sense because at these levels a further cut in the variable rate would do little to encourage more home lending. Instead, CBA boss Matt Comyn has added 60 basis points to its one-year deposit rate, which provides some support to depositors.

Given these outnumber borrowers by a factor of three, the move is a good one.

The banks want to protect their home loan books, given system lending at $1.8 trillion is close to the size of the entire economy and the gearing rate is some 200 basis points, so the loan book is highly vulnerable to increases in the number of people unemployed.

CBA, by way of example, has $765bn in loans outstanding, of which $500bn — or 72 per cent — goes to home loans, and just 3 per cent, or $22bn, to small business. This tells you where Comyn’s focus lies, even as he says the aim is to boost small business support.

He has taken a leaf out of Westpac’s book by planning to reset his home loan books to open the chance for borrowers to actually use the extra cash on offer from lower rates rather than simply paying down their loan quicker.

By doing so, he could liberate $3.6bn, according to Comyn, but just how many take up the offer remains to be seen.

Josh Frydenberg rightly argued it was in the banks’ interest to help the economy ride through the certain cuts in employment.

The crisis has seen a remarkable turnaround in the attitude to banks and big business, 12 months ago seen as pariahs but now they are seen as the key delivery system to try to help the economy ride through the pandemic.

The banks are relishing their new-found support, with ANZ’s Shayne Elliott using recent outings to stress the banks’ financial health and capability to help, saying “this is what we do”.

All good. But now is the calm before the health crisis hits, and that’s what has markets spooked.

Wesfarmers shuffle

Amid the coronavirus-dominated news, Wesfarmers boss Rob Scott confided that he is shuffling management ranks, with former Goldman Sachs and Virgin executive David Baxby leaving the building after 30 months.

Baxby assumed the industrial and safety division at the company from Scott. But after his predecessor got the top job, and left him with some issues to solve, Baxby is now looking for a new position elsewhere.

Suffice to say, the division is a dog within the Wesfarmers portfolio, earning just 3.4 per cent on $1.5bn of capital.

Chemical division boss Ian Hansen was promoted to being a direct report to the boss, underlining his key role with the lithium expansion.

Highly regarded executive Tim Bult takes control at industrial safety, reporting to CFO Anthony Gionotti, so bets are now being laid as to whether he will next hit the exit door or the top job.

Former boss Richard Goyder has had a busy week, given he is chair of Qantas and the AFL, both of which have been centre stage amid the coronavirus mayhem.

Goyder’s other job as Woodside chair is also not exactly a walk in the park, given what is happening with oil prices.

Goyder would dispute it, but this week’s events are exhibit A in how his workload is too much for a mere mortal.

Tasty deal for Coles

Coles has acquired Sydney-based ready-to-serve meal provider Jewel Fine Foods in a well-timed deal just as people are leaving restaurants and travelling less due to the coronavirus.

The deal is subject to ACCC approval after it last year rejected an attempt by 23 per cent Woolworths-owned rival B&J City Kitchen to buy the company.

The two were the first and second-placed players in the prepared-food game

The acquisition, Coles’s first as an independent company, brings Jewel out of administration after it hit financial difficulties in 2018, following a $70m expansion to double its cooking space.

If the deal wins ACCC approval it will mean the two big supermarkets will in effect control the $600m prepared-food market, assuming the market definition is strictly defined.

Coles has not disclosed the acquisition price.

The RBA and federal government have made an admirable start to the necessary coronavirus recovery packages, but so far the market consensus is that the effort is woefully inadequate for what is needed.