Why Wall Street really likes the surprising US election outcome

A divided house is just fine for earnings outlook.

After election results that ran mostly counter to prevailing expectations, last week major stock averages enjoyed their best week since April.

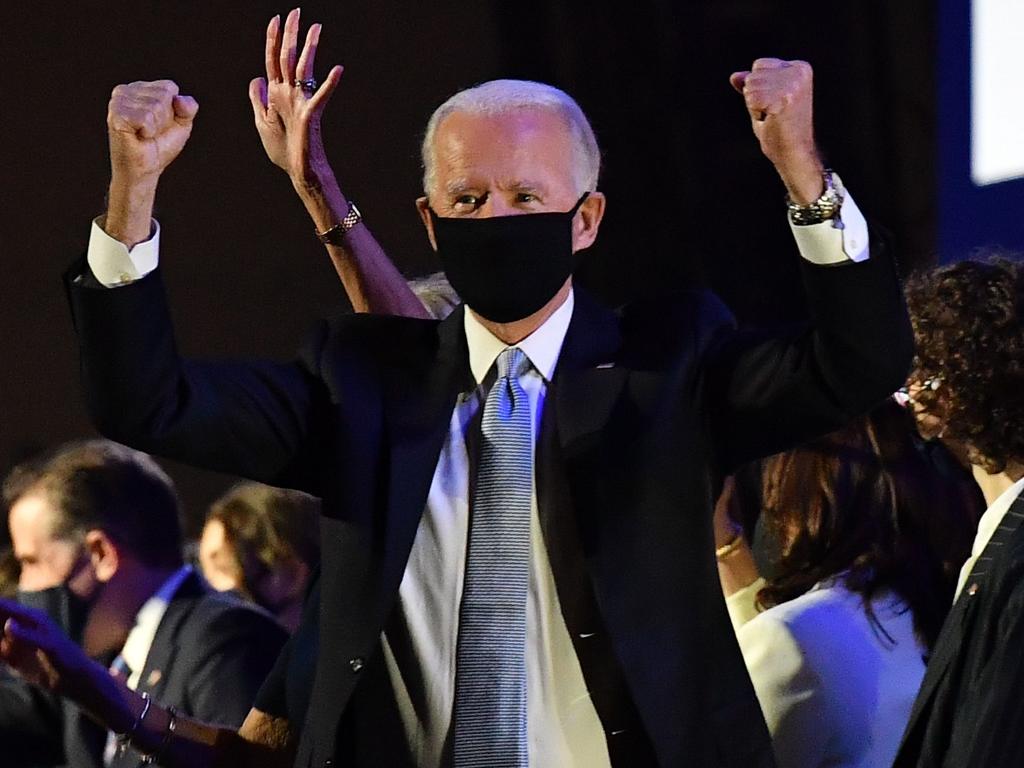

While Democrat Joe Biden appeared on the verge of winning the presidency, the vaunted blue wave failed to materialise. The Senate is likely to remain in the Republicans’ control, with Mitch McConnell, fresh off an easy re-election victory, probably continuing as majority leader. Meanwhile, Democrats lost, rather than gained, seats in the House.

Investors supposedly would have been cool with a blue wave, even though it would mean higher taxes, although this column suggested a few weeks ago they should be careful what they wished for.

But it turned out they like the purple mixture of an apparent narrow Biden win with a probable GOP Senate and a Democratic House even better, and responded by pushing up both the S&P 500 index and the Dow Jones Industrial Average by about 7 per cent and the Nasdaq Composite by 9 per cent on the week.

“The one thing to make investors confident is that there’s not going to be tax increases and that the costly progressive agenda is not in the cards,” says Julian Emanuel, chief strategist for BTIG.

“With the fog of the election lifting, the market likes the prospect of a divided government,” adds John Brady, managing director of global institutional sales at R.J. O’Brien.

Equity futures ended the week on a strong note, as the path for President Donald Trump to secure re-election was narrowing, with Biden ahead in the key battlegrounds of Arizona, Nevada, Pennsylvania and Georgia.

But the January 5 run-off elections for both Senate seats in Georgia could prove particularly contentious, given that they ultimately could determine which party controls the upper chamber.

Listen to Money Cafe: Market is pricing in a Biden win; A lot more than a rate cut from the RBA

As politics at long last fades as a factor, the renewed surge in COVID-19 cases looms large for Wall Street.

For now, the combination of ample government spending and liquidity should help to cope with the northern autumn and winter of 2020-21, Emanuel says. Even without renewed mandated lockdowns, however, people are apt to hunker down voluntarily. The coronavirus could spread further as falling temperatures keep people indoors.

In turn, that could dampen the labour market’s recovery, which continued to be evident in the October employment data released on Friday. Non-farm payrolls rose by a net 638,000, a bit better than economists’ guesses, with 906,000 jobs added in the private sector and government payrolls falling by 268,000.

Leisure and hospitality payrolls rose by 271,000, with two-thirds of the jobs in bars and restaurants. Those businesses would be vulnerable to renewed closures if COVID-19 keeps us home again.

The net decline in government payrolls in part reflected the loss of 147,000 temporary jobs held by US census workers. More important, 159,000 state and local education jobs were lost. In the past 12 months, non-census government positions have slid by 1.2 million, mostly state and local education jobs, MFR chief US economist Joshua Shapiro writes in a client note.

Unlike earlier this year, the promise of vaccines and wider availability of therapeutic drugs looks to be just over the horizon in 2021.

So, next year potentially could see a resumption of earnings growth, Emanuel says.

Along with a return to “more considered centrism in politics and society as a whole”, that could be the basis of new highs for stocks.

But patience will be needed until those factors come together, he emphasises.

We’ll only know in retrospect when that happens.

Barron’s

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout