President-elect Joe Biden faces uphill battle on economy, pandemic

Joe Biden will inherit an economy in “pretty terrible shape” when he becomes the next president of the US.

Joe Biden will inherit an economy in “pretty terrible shape” when he becomes the next president of the US, and his immediate focus on tackling the COVID-19 crisis could deliver a short, sharp economic hit, experts say.

As daily US coronavirus cases scale fresh records, AMP Capital chief economist Shane Oliver suggested Mr Biden may follow the Australian path to control the virus when he assumes the presidency on January 20.

“I think Biden’s going to take an Australian approach. Fauci was probably going to get sacked under Trump, whereas he, or someone like him, will probably be elevated under Biden,” Mr Oliver said.

“He’ll listen to the experts. And if the experts say you’ve got to shut areas down, then he may do that.”

It could end up being a lockdown-lite situation like parts of Europe were going through, Mr Oliver said.

“That would have an impact on the US economy like the Australian lockdown did here,” he said.

The best-case scenario for Mr Biden would be that he inherited an economy in the early stages of a fragile recovery, economist Saul Eslake said.

“The worst-case scenario is that the virus runs rampant and he inherits an economy that’s in a shutdown,” he warned. An Australia-style lockdown would prolong the US recession, he said.

Describing the state of the US economy as “pretty terrible”, Mr Eslake pointed to economic growth deteriorating in the fourth quarter.

“It’s not as bad as it was in the June quarter and there was a recovery in the third quarter.

“But with the rate of employment growth slowing, and the virus now spreading rapidly, economic growth in the fourth quarter will be weaker,” Mr Eslake said.

Figures released on Friday night showed US employment rose by 0.5 per cent in October, the same level as in September. That compares with increases of about 2.5 per cent per month, on average, between May and August.

“(GDP) may not decline outright, but it’s certainly falling. It’s certainly going to be slower. And the US is seeing record numbers of coronavirus cases, so Biden could decide, like Britain has reluctantly done, that they’ve got to do a lockdown,” Ms Eslake said.

“I don’t know (if they will); I just tend to assume that if governments are making decisions based on health advice, they make the right decisions.”

Mr Biden in his victory speech said he would name a group of leading scientists and experts as transition advisers to help come up with an action plan that he will implement once he is president.

Any lockdown in the US would hurt the economy but could push the Senate to potentially agree on a bigger stimulus package, Mr Oliver said.

“If a lockdown did happen, I think it would put pressure on the Senate to agree more stimulus, so there’s offsets to it.

“Then once you’ve come out the other side, and if a vaccine has come along by then, the US recovery would be more assured than the current situation would suggest.”

While Mr Biden has claimed victory in his White House bid, the outcome for the Senate won’t be known until January, when Georgia holds two run-off elections. Experts see Republicans retaining control of the Senate, while Democrats will hold their majority in the House.

Oxford Economics’ chief US economist Gregory Daco warned a split congress would deliver policy gridlock in 2021, making it difficult for Mr Biden to advance his fiscal tax and spending proposals. A non-peaceful transfer of power was a risk to monitor, he said.

Lendlease’s US chief executive Denis Hickey, meanwhile, expressed the hope that the election result could see a return to more bipartisanship in America.

He warned that a lack of bipartisanship in recent years had held the US economy back from achieving its full potential.

He said Lendlease had operated in the US for almost 50 years.

“During that time, we built a strong track record of working proactively with all administrations,” he said.

“However, during the last decade, we’ve observed an increasingly large gap emerge between major political parties.

“My hope is the election result will be a catalyst for Democrats and Republicans alike to adopt a more collaborative approach to deliver economic, social and geopolitical policy that benefits all Americans.”

Lendlease is working on several major projects in the US including a mixed-use development for Google in San Jose in California, a $20bn project called Downtown West.

This is part of a long-term partnership with Google announced last year to redevelop land owned by the tech giant, including in Mountain View and Sunnyvale.

It has also just announced the purchase of a 90 per cent interest in a site in Brooklyn, New York, in partnership with Aware Super, where it will build 800 residential apartments in a project worth some $1bn, its first urbanisation project in the New York area.

The company recently sold a US telecoms tower platform, including a portfolio of mobile phone towers and others under construction, to Apollo Global Management.

The sale is part of a move by Lendlease to sell off non-core assets in the US to invest in new urbanisation projects such as those in California and Brooklyn.

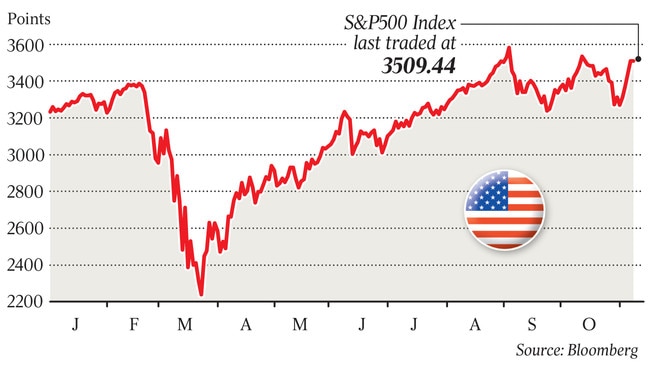

While the US policy outlook is cloudier without the predicted “Blue Wave” sweep, a Biden presidency and a split Congress was a win for markets, according to Tribeca Investment Partners’ Jun Bei Liu.

“The market can finally look forward with (the election) out of the way. We will have some stimulus, the virus situation may become a little bit better over the next year, and we will have vaccine use coming through.

“Alongside that we will have lower interest rates and the US Fed potentially needing to do more. So all of that combined is very positive for the equity market for the near term and I wouldn’t be surprised if it leads to a Santa rally,” she said.

Companies leveraged to the recovery story, including Aristocrat and Star, would fare best in the coming year, she said.

“Their earnings will grow enormously. We know reasonably confidently in six to 12 months these companies will be back to full capacity and will experience a pretty rapid return of earnings.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout