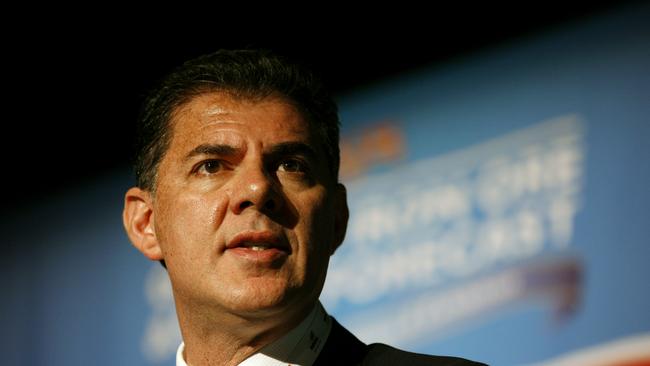

Wesfarmers’ Michael Chaney slams Washington’s ‘appalling’ imposition of tariffs

Wesfarmers chairman Michael Chaney fears the untold damage Donald Trump’s tariffs are inflicting on the global economy, describing Washington’s behaviour as ‘appalling’.

Wesfarmers chairman Michael Chaney has attacked Donald Trump’s tariffs bombshell over concern it will inflict major damage to the global economy as ructions over the trade war ripple through markets and stoke recession fears.

Mr Chaney, one of Australia’s top business figures and a former Woodside Energy chairman, told The Australian he was shocked at Washington’s sweeping tariff crackdown.

“President Trump’s actions on tariffs are appalling and demonstrate a complete ignorance of economics and of the benefits of free trade,” Mr Chaney said.

“The problem is that Trump is so unpredictable and one doesn’t know what is going to happen. And it’s the uncertainty that results in economic damage in every country.

“Some other countries will retaliate and, as we saw in the late 1920s, that can lead to very poor economic outcomes across the world.”

Wesfarmers is one of the country’s largest private-sector employers, with low-cost retail businesses Kmart, Target, Bunnings and Officeworks.

Anthony Albanese has held out hopes that Australia may be able to carve out a better deal or exemption from the tariffs, and Mr Chaney said he was optimistic concessions could be cut.

“Australia’s response has been appropriate and it appears there may be some room to negotiate reductions as time goes by,” Mr Chaney said.

Fallout from the tariff impost has started to seep through as analysts crunch how the move might damage deals and business sentiment.

Liontown Resources CEO Tony Ottaviano said the market reaction to the tariffs had been indiscriminate and kneejerk.

Mr Ottaviano said it appeared investors had disregarded tariff exemptions on lithium and other minerals.

Pure-play lithium miners Pilbara Minerals and Liontown are trading at four-year lows, while lithium producers such as Mineral Resources and IGO have sunk to multi-year lows.

Shares in Liontown have slumped just over 15 per cent to 47.5c over two days. Pilbara Minerals’ fall was almost 12 per cent, to $1.37, since Trump’s “Liberation Day” tariff revelations on Thursday, while Mineral Resources suffered a steeper 19 per cent two-day plunge to $18.95. IGO shares fell a more modest 8 per cent to $3.46.

Mr Ottaviano acknowledged that investors were worried about the knock-on effect of the tariffs on the global economy and lithium demand in a market that remained in oversupply.

He said demand growth remained strong in electric vehicles and battery storage in China and other markets outside the US.

Liontown has offtake agreement with Korea’s LG Energy, US carmaker Ford and Elon Musk’s Tesla.

Tesla sales have plunged 13 per cent in the three months to March 31 and its showrooms in the US and Europe have been targeted by protesters angry over Trump administration policies.

Mr Ottaviano said he was restricted in what he could say about the Tesla offtake deal, but said “at a working level it’s business as usual”.

Trump supporter Gina Rinehart is Liontown’s biggest shareholder with a 19.9 per cent stake. She acquired most of her stake at more $2.50 a share in 2023.

Woodside could also face delays selling a stake in its $US16bn ($25.7bn) Louisiana LNG venture as buyers seek clarity on any fallout from Mr Trump’s sweeping tariffs, Jarden said.

The producer is in talks to sell up to half of the US project in a potential blockbuster deal.

Two of the rumoured buyers are Japanese – Tokyo Gas and JERA – and Mr Trump’s decision to impose a 24 per cent tariff on the Asian nation could complicate any selldown.

“In the near term, Woodside is seeking to sell down equity in the project; there is a risk that prospective buyers will need time to understand the implications of these tariffs – and the risk their countries implement reciprocal tariffs on the US – before making a commitment to investing in the project,” Jarden said.

Woodside has US engineering giant Bechtel on hand to build the mooted three-train facility, which is subject to a final investment decision by June.

The plant’s location in a foreign trade zone means it will not have to pay tariffs on equipment imported from overseas during construction. However, Jarden notes there is a requirement to pay the owed tariffs from revenues generated post start-up.

“It is unclear to us whether Woodside will be ultimately liable for the payment of tariffs, or if its EPC contractor, Bechtel, will be responsible,” it said.

Woodside shares shed 12 per cent over Thursday and Friday to $20.43, while Santos had a similar plunge, closing at $5.95.

Bloomberg reported tech giant Microsoft had pulled back on data centre projects worldwide including Australia amid uncertainty over AI take-up.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout