Who are the biggest losers as markets suffer heavy fall?

Some of Australia’s richest individuals have lost big chunks of their wealth today.

Some of Australia’s richest individuals on The List — Australia’s Richest 250, published by The Australian, have lost big chunks of their wealth today as markets fall here and overseas.

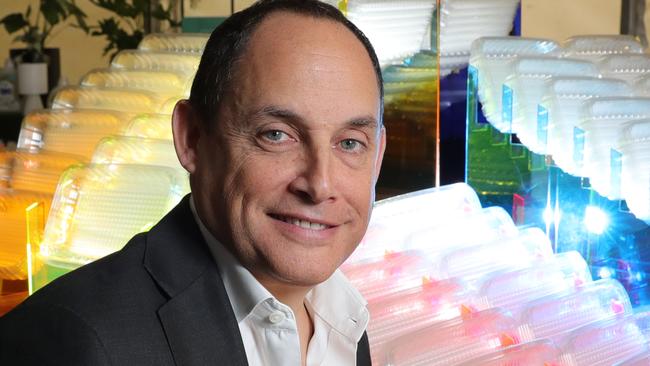

Pact Group Holdings chairman Rafael “Ruffy” Geminder has seen about $75 million wiped from the value of his stake in two days as shares in the packaging company fell heavily following yesterday’s downbeat profit result.

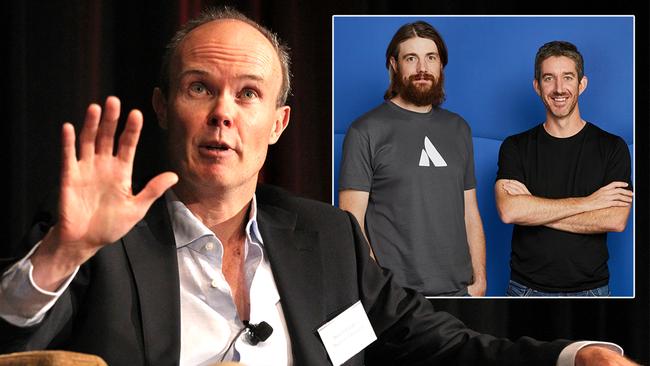

Billionaire fund manager Hamish Douglass has enjoyed a stellar year for his Magellan Financial Group, but its shares have fallen by about 7 per cent today to wipe $85 million from his share wealth. Magellan shares are still up 119 per cent since January 1.

Waste management firm Bingo Industries shares have fallen 20c or almost 8 per cent, cutting the wealth of chief executive Daniel Tartak and his family by $20 million and major shareholder Ian Malouf by $15 million.

But the biggest fall by far has been the $1.37 billion combined wiped off the paper wealth of Atlassian duo Mike Cannon-Brookes and Scott Farquhar.

Shares in their software firm fell 4.9 per cent on the NASDAQ overnight, chopping about $680 million from each of their shareholdings. However, Atlassian shares have risen 56 per cent since January 1.

On the positive side, Super Cheap Retail Group founder Reg Rowe has enjoyed a $25 million increase in his share wealth today after the company released a strong full-year profit result.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout