What if interest rates stop going down?

The prospect of better economic conditions next year is changing the landscape for investors.

Market trading invariably anticipates the picture we face in the months ahead — and this mini-bull run is anticipating better conditions in the new year.

As the sharemarket furiously signals an economic upswing next year, rising house prices and falling expectations for further rate cuts are combining to make investors look at their portfolios to examine what it might mean if this is the bottom of the rate cycle.

And even if this is not the very bottom of this extraordinary cycle, we are very close.

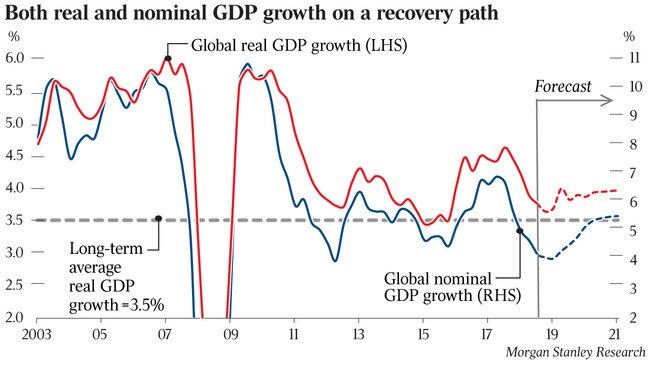

Certainly, the world’s biggest finance houses are thinking that way, as both UBS and Morgan Stanley have now put out reports cautiously forecasting an uplift next year. Admittedly, these forecasts come with a basket of caveats that note risks are “to the downside”. Nonetheless, Morgan Stanley chief economist Chetan Ahya said this week: “Investment growth should kick in with a modest rise in the June quarter of 2020 as corporate confidence stabilises and demand for goods and services picks up.”

This tepid global upturn might be weaker than investors would like to see, and might also be later than policymakers would have wished, but a strengthening economy ultimately will put an end to rate cuts.

This is not to challenge the consensus that we are facing an era of low rates, rather it is to make the simple point that rate cuts are dwindling as a macro driver.

Though global players such as Morgan Stanley suggest a recovery next year, they offer a mixed picture on the outlook for rates as some central banks keep cutting and others start to hold.

But as the investment bank concludes: “After easing for much of 2019, monetary policy is now more limited than before.” As investors, unless we consider this scenario seriously we run the risk of working on a wealth strategy based on the rear-view mirror.

Rate cuts have lifted all boats in recent times: house prices, bond markets and sharemarkets have risen in equal measure. However, the beginning of the end for rate cuts point to a very different era than the one we have just sailed through.

It might seem arcane, but the bond market is actually the window to our wider investing market. Moreover, investors will definitely start paying more attention to bonds as billions of investor savings pour into a range of new-style ASX-listed bond funds. These funds might have achieved double-digit returns in recent times, but the vast bulk of the lift came from bond prices jumping when rates were unexpectedly cut again this year. If you are betting that that will happen again in the year ahead, you are betting against the chief economists at the world’s biggest banks.

Note, too, that even the US Fed is now saying it is comfortable with current interest rate settings, while it is clear our own Reserve Bank has a willingness to explore other avenues — such as quantitative easing — as an alternative to sending official rates any lower.

The canary in the coalmine for a reset on interest rates is always the US corporate credit market, especially the “junk” or high-yield bond market, where often struggling companies offer bonds at high rates to try to survive.

As Pilar Gomez-Bravo, the MFS director of fixed income, Europe, observed recently on high-yield bond markets: “There’s an art to knowing when to leave the party … In fact, it’s over — people are desperate and they’re hunting down the after-party. We probably only have a few hours left.” Gomez-Bravo was talking of her own plucky decision to take money out of the US high-yield bond market, even though the play remains profitable.

So, what would this new world look like where global rate cuts no longer feed the world’s economy?

Cash rates should stop falling: this could hardly be seen as a bonus for anybody exposed to cash deposits, but it may mean a slowdown in the exit from cash that has been energised with each successive rate cut.

Such an outcome would have a strong chance of putting our current bounce in house prices into slower gear. Prices may move higher, but buyers are less and less able to stump up for million-dollar mortgages. Consider this: we have a household debt-servicing mortgage ratio just now of 15.8 per cent — that ratio has floated up close to the level it was in 2008. But in 2008, rates were 7.25 per cent.

If households are this stretched when rates are at rock bottom, what are the chances they can borrow more if rates move even a touch higher? As Kieran Davies from NAB’s market economics team argues: “Weak incomes and already high levels of debt could constrain further borrowing.”

Which leaves active investors nowhere to turn except the demanding world beyond residential property, fixed income or cash, where shares and alternatives — such as private equity and hedge funds — will dominate. It’s not a cosy or reliable place to be, but you have to be there if you want the best chance of making money in the months ahead.

And recovery or no recovery, the chances that we see another 20 per cent rise on the sharemarkets for another year are slim.

Consider for a moment what is happening inside investment markets — the sharemarket is powering higher, suggesting it will gain about 20 per cent this calendar year both here and in the US.