Watching out for the bargains ahead

Visibility is now required over the broader damage to this revenue. Key questions arise around what the earnings of listed companies will be and what we might expect going forward.

I expect that the losers will well outstrip the winners — but there will be winners.

Investors need to shut down all the noise and now concentrate on fundamentals. Forget the knee-jerk reaction. In other words, don’t buy shares simply because the market has fallen. That is not a strategy.

I am seeing many posts on social media pointing out forward price-earnings, or PEs, and how attractive these are. This is not the approach to take. Why not? The E, or earnings, is unknown at this stage and there will be downgrades as companies reveal the effect of the crisis. That means it is impossible to know right now how to value many businesses.

As Alan McFarlane, senior partner of Dundas Partners in Edinburgh, has recently noted, this crisis is an intervention by nature: it was not a result of the fallout from bad credit decisions or the consequence of poor economic management.

On a similar theme, Hamish Douglass from Magellan recently referred to what is happening as the “output gap” and spoke of the loss of revenue to businesses as a result of this.

This is the first aspect that is hard to grasp. We simply won’t know what the initial damage of the COVID-19 situation is until the end of April. That will be the time when companies, especially in the US, brief the markets on the effects of the shutdowns seen in the first quarter of 2020 — and the outlook based on how long this will last.

As Douglass also emphasised, the duration of the “output gap” and the change in consumer behaviour will determine the shape and appearance of the economy on the other side of the valley.

McFarlane of Dundas Partners also made some sobering comments: “Recovery will follow, but to focus on that without assessing the depth and width of ‘the valley’ is naive. Economic activity has reduced — a lot. Balance sheets matter more than ever, cash flow just as much. Many companies face the risk of insolvency, not merely loss of profitability. Government help is welcome but cannot on its own get us through this.”

Another move lower in equities should therefore not come as a surprise.

There is a slump in both output and demand and this will not disappear simply because the virus is eradicated. That means it is important to think carefully about the coronavirus period’s impact and implications, in particular how long it will last and the type of damage it will do to the economy.

We need to sit back and analyse the effect. We also need to react — but it is not time for that just yet.

A major crisis usually has a positive effect on both innovation and productivity, and these we are looking out for.

What am I doing? At the moment, I am sitting tight. “Peak fear” will be with us at some time during this second quarter. But change will come, too. When I fundamentally believe it is an opportune time to buy, I will. There has never been a stronger case for conviction management over index-based investing than now.

One positive indicator I am seeing is in the internet economy. It has shown incredible resilience, as has any retailer with an online solution. (Conversely, if a retailer doesn’t have a substantial online solution, I fear it will fail.)

Investors must therefore be choosy as well as patient.

Some other key thoughts for now, that I believe will help frame a future strategy, are:

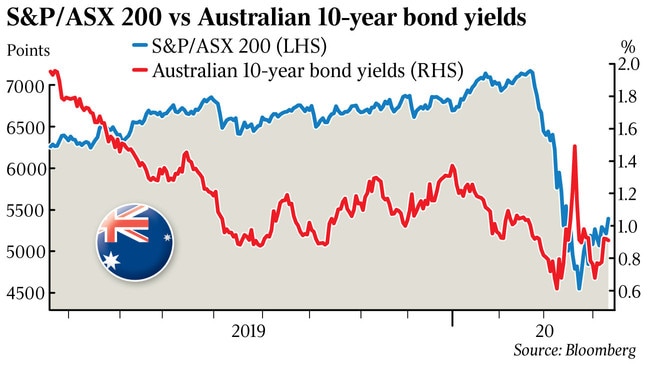

● With bond yields below 1 per cent, you cannot call bonds defensive assets. Investors will buy equities.

● Remember also that sharemarkets always look ahead and will turn before an economy does.

I would like to reiterate a message made in a previous note: please don’t waste this crisis. Human psychology may mean you are hesitant to put cash to work. That is only natural when people are fearful, but I strongly believe many will look back at the second quarter of this calendar year and say: “If only I had invested in the equity markets then.” Look for the signs and, when the time is right, take action.

Will Hamilton is the managing partner of Hamilton Wealth Partners, a Melbourne-based wealth manager.

The initial selldown in the sharemarket was liquidity-driven. But regardless of the asset class, we are now waking up to the reality of the situation.