Wacky investments can deliver more than just strange looks

Some investments may seem truly wacky but it hasn’t stopped some savvy owners from making big money on them.

Investors are taking a walk on the weird side as some shy away from traditional places to park their wealth.

Unusual investments are popping up in portfolios, especially self-managed superannuation, and some have delivered stellar returns that greatly outshine mainstream assets such as shares, property and cash.

However, the risks – and often the costs – can be great for those who do not understand the asset or its market forces, and potential investors are being urged to educate themselves.

Craig Leonard, the managing director of Australian Pink Diamond Investments and director of Wealth Storage Vault Services, says many of his clients want “tangible assets they can control”.

“They don’t trust banks, currency markets and stock exchanges,” he says.

“Tangible assets are great – people like to touch and feel.”

Here are six investment options for those willing to take a punt on the peculiar.

1. DESIGNER HANDBAGS

Leonard says people can buy a brand new Hermes handbag, after being on a two-year waiting list, for $18,000.

“If they place an ad the next day for $35,000, they will sell it,” he says.

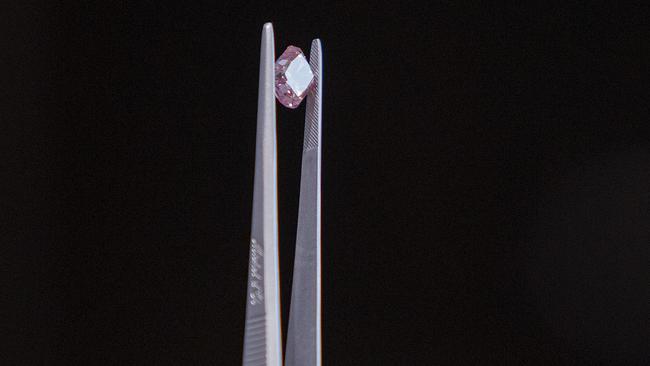

2. PINK DIAMONDS

Since the 2020 closure of Western Australia’s Argyle Diamond mine, the value of certified Argyle pink diamonds has multiplied, Leonard says.

Pink diamond prices can range from $7000 to several million dollars, depending on the stone, and since 2005 have delivered average annual returns near 30 per cent, he says.

“Only 1 per cent of clients actually purchase Argyle pink diamonds for jewellery – the other 99 per cent buy it as a personal investment.”

3. CRYPTO

Cryptocurrencies are now relatively common, but still weird in many people’s minds. Thousands of digital currencies flooded the world in recent years, as did their equally-weird digital asset cousins NFTs.

MBA Financial Strategists director Darren James says people had spare cash in the early days of the pandemic and “that’s why crypto went as hard as it did”. Crypto and NFT prices initially soared but have since sunk heavily, and nobody knows where they will go next.

4. VINTAGE AND CLASSIC CARS

Fancy a 1983 Porsche for $600,000, or a 1965 Aston Martin for $1.8 million? James says the values of collectors’ cars have “rocketed in the last couple of years”.

The prices of homegrown Holden V8s have jumped since the classic Aussie brand stopped manufacturing in 2017. “People have gone berserk for anything with a Holden badge,” James says.

5. TOYS AND BOOKS

Hot Wheels toy cars have become a hugely popular collectable brand in 2022, according to a new report by online marketplace StockX, while Leonard says certain children’s novelty items can deliver great prices.

“The first Superman comic book was sold for $3.2 million, the most expensive Beanie Baby price fetched $600,000 and the most expensive Pokemon card ever sold was auctioned for $900,000,” Leonard says.

6. HORSE SEMEN

“Did you know that depending on the stallion, horse semen is one of the most expensive liquids on earth?” Leonard says.

“One gallon of a gold medal winning horse is worth $4.7 million … in the horse breeding industry genetics are very important,” Leonard said.

If you prefer cows over horses, Wagyu cattle is a booming investment, and famous US investor and author Robert Kiyosaki has joined the party, buying a Japanese wagyu bull

“I don’t want to own the cattle – I just want to own the semen,” Kiyosaki revealed in July.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout