Downturn? Investments in fine wines, classic cars are booming

Cars, wine and NFTs are driving a surge in alternative and so-called ‘passion’ investing, Credit Suisse’s head of wealth management has revealed.

NFTs, fine wines and classic cars are driving a boom in alternative and so-called ‘passion’ investing, Credit Suisse has found, with investors diversifying their assets amid rising inflation, the global pandemic and war in Europe.

The report, from Credit Suisse Research Institute in collaboration with Deloitte, found that the metaverse is an emerging frontier for investors, especially for members of Generation Z, ‘digital natives’ who spent an average of eight hours per day on screens in 2020.

New metaverse projects are still relatively small in terms of volumes traded compared to established projects like The Sandbox ($202m) – in which ASX-listed Creso Pharma owns virtual real estate – or Decentraland ($89m), which collectively are receiving the lions‘ share of metaverse investment.

Traditional auction houses Christie’s, Sotheby’s and Phillips have meanwhile all made entries into the crypto art market, with those three auction houses representing almost 10 per cent of crypto art sales.

A digital image by US-based artist Beeple, “Everydays — The First 5000 Days”, sold at a Sotheby’s auction in 2021 for a record-breaking $US69.3m ($98.72m).

The report found that while non-fungible token valuations are currently under pressure, the overall macro trend is still pointing towards growth.

“Like many other collectibles, NFTs benefit from a general increase in wealth, strong investor sentiment and ample liquidity,” the report states. “The year 2022 started with a more challenging backdrop than 2021. The Russia-Ukraine war has unleashed a stagflationary shock for a number of economies that generally speaking translates into weaker investor sentiment. Central banks are tightening monetary policy and withdrawing liquidity. The tech sector altogether is challenged. Investors should therefore expect a temporary consolidation in the NFT sector.

“Eventually, however, the trend toward metaverses and the exploration of these platforms for business and entertainment should continue to move forward with a more fundamental basis rather than the past year’s speculative growth.”

The generational shift from Baby Boomers to new generations more attuned to digital assets, social media and gaming will likely see NFTs continue to grow, the report found.

“We expect Asian users and collectors to shape much of coming trends in digital assets,” the report says. ”More difficult international relations in the wake of the current Russia-Ukraine crisis could also accelerate and enhance digital business and transactions, leading to a spread of NFTs.”

Other booming markets include the classic car market, which has recovered coming out of the pandemic and returned on average 6.2 per cent, fine wines which were up 5.4 per cent, and luxury handbags.

“We continue to see a number of our clients diversifying their portfolios by investing in collectibles,” Michael Marr, head of wealth management for Credit Suisse said. “And I expect we may see some increasing their exposure in the face of volatile listed markets.”

This sentiment was echoed by Shane Galligan, advisor to many of Australia’s wealthiest families. “My clients are some of the largest collectors of world class art and historical artefacts. I am often reminded by them of how they feel about their collectibles, especially art,” he siad.

‘For these ultra-high-net-worth individuals, collectibles are to be enjoyed for their beauty and for the story they tell – they are not seen necessarily seen by them as a store for wealth. That said, if a collectible is enjoyed and appreciated by others, that’s a good thing. If it increases in value, of course that’s a contingent benefit.”

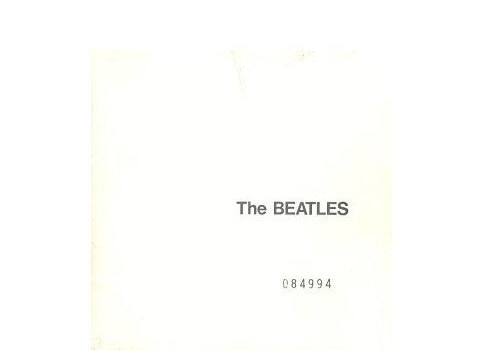

Melbourne-based entrepreneur Stefan Von Imhof is taking advantage of the momentum. Earlier this year he launched Alts 1, a fund that allows investors to own shares in ultra-rare whiskeys and signed Michael Jordan sneakers. Alts 1 recently purchased an ultra-rare Beatles record – pressing 0000002 of The White Album – for $50,000.

The fund will be open for 10 years, and has a limit of 2000 investors who are investing a minimum of $20,000 each. Mr Von Imhof is targeting a 40 per cent investment with the $10m fund.

He said to date, Alts’ investments in video games are up 30 per cent, with comic books up 58 per cent.

“We don’t claim to be experts on all of these new asset classes but things like music rights, sports cards and other collectibles – no one is paying attention to these at the low end.

“Alternative investments are really going mainstream and the timing couldn’t be better, particularly with what’s happening with equity markets recently.

“This is the best time to diversify; in five to 10 years from now it might be really tough to get an edge in these markets – they’re going to be mature – but right now it’s the wild west. And if you have the data, the analysis and the insight, you can do really well.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout