Vested interests hammer DIY funds

THE staggering success of DIY superannuation in Australia has caught many off guard.

THE staggering success of DIY superannuation in Australia has caught many off guard.

With assets of more than $530 billion, almost a million members and a growth rate of 10 per cent a year, it’s hardly a surprise that enemies have been made.

With the public submissions to the Murray financial services inquiry, those enemies are in plain sight. And while federal Treasury is invariably portrayed as harbouring a “razor gang’’ hell-bent on stripping self-managed super funds of their privileges, it’s been conspicuous by its absence.

If this group does exist, it’s had nothing to add to the publicly stated position of Treasury in the inquiry, which is broadly neutral on the subject.

The clear adversary of DIY funds is the gigantic enterprise known as Industry Superfunds Australia, the umbrella body representing industry super funds for five million Australians.

It’s beyond dispute that industry funds have served many of their members very well. Their scale and professionalism is impressive and their low fees have been crucial in producing solid returns for millions of Australians in recent years. But, my word, do they have it in for DIY funds or what?

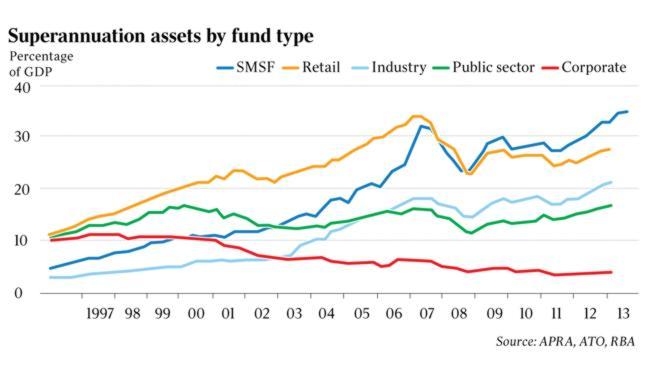

As the relative power of industry funds in the superannuation market fades relentlessly in the face of the healthy rise in numbers of people taking more responsibility for their own funds, the ISA’s critique of DIY funds smacks of self-interest writ large.

Granted, DIY funds have their flaws. They hold too much cash and rarely invest overseas. In terms of doing good for the wider economy, they have their limits.

In other words, their capital formation is not as effective as the billion-dollar funds. Moreover, it’s probably true that the current hunt for dividends will discourage companies from putting capital to work in a more productive manner.

These are logical criticisms, but they are not enough for the industry funds, which have extended their submissions into a frenzy of criticism. They suggest that DIY funds could represent a systemic risk because they act “pro-cyclically” (that is they buy when markets are going up) though this behaviour is hardly unique to DIY funds.

Then there’s the clam that the DIY system can lead to “inferior outcomes from the standpoint of aggregate public welfare”. Yes, folks, more people running their own super funds and not drawing a state pension somehow weakens the welfare system.

But nothing beats the alarming claim that Australia’s army of DIY operators are getting too old to manage their money. Truly, no stone has been left unturned here. The issue of dementia is raised in relation to cognitive functions as if this issue is particular to DIY operators. Here’s a direct quote from the same section: “Researchers have observed that financial skills decline in the years before development of Alzheimer’s’’. This is desperate material. Is the implication older people should hand money over to institution funds? That’s what it looks like.

It’s a pity the ISA had to unfurl its bias against the DIY sector so broadly, because, to begin with, the public debate is already tilted against this under-represented constituency of investors who run their own funds.

Sure, there are professional groups servicing the sector, such as the SMSF Professionals Association, and a few groups aiming to represent the sector, such as the SMSFs Owners’ Alliance. But when it comes to real power in Canberra, DIY funds do not have a seat at the table and it’s awfully clear that they need one. Needless to say, similar sentiments would be regularly shared by corporate and institutional retail funds.

It’s fortunate in this context that federal Treasury has not in fact taken the cudgel to DIY funds. Similarly, if the Reserve Bank has concerns that DIY funds are a source of systemic risk, or that they are a negative in terms of public welfare, not to mention making decisions in poor mental health, well it is not saying so either.

The one area the RBA pinpoints as a problem in its own Murray inquiry submission is the rising allocation to property within DIY funds now that the government has allowed SMSF members to borrow for property under certain conditions. The bank says “at least some of the increase in property investments by SMSFs is a new source of demand the could potentially exacerbate property price cycles’’.

Obviously, these submissions do not perfectly represent the views of the organisations that put their name to them, but they do act as a splendid window into what key players are thinking.

We don’t want to believe the investment system is rigged in favour of anyone in particular — the rich, the poor, the dedicated DIY operator or the worker in an industry fund. But it’s beyond doubt the odds can be stacked against the individual when it comes to successful investing. This is why encouragement of our broadly healthy DIY system is to be encouraged.

Just in case you have any residual doubts that big institutions often aggressively seek to do what’s best for the institution rather than the customers, there is one other Murray submission worth mentioning. It comes from an AMP-accredited financial planner named Rhys Wood of Elite Wealth Solutions of Beenleigh, Queensland.

The Rhys submission runs to only eight pages, as opposed to ISA’s 264 pages.

It lacks the clout of institutional submissions.

There are no appendices, no cross-references to learned reports that suit his purpose, but it does contain this line: “Bias within the financial services industry remains a major detriment to the financial prosperity of our nation. This bias is created on many levels, primarily due to the influence financial advice institutions have over the advice process and the financial products recommended to the customer.”

There you have it, even insiders know the system is tilted in favour of big institutions. DIY funds represent a break with a rotten past.

Let’s hope they are not crushed by vengeful rivals.

James Kirby is managing editor of Eureka Report.

Trial Eureka Report free for 21 days. Register now at www.eurekareport.com.au