Vaccination not the only sharemarket challenge

Bond yields rising, stimulus programs running out – the risks are out there for sharemarket investors.

The recent weakness in the sharemarket may not meet the definition of a correction or even a setback, but there’s no doubt the wind has been taken out of its sails. High-quality company shares have fallen, in some cases dramatically. Reece is off nearly 30 per cent from its highs, CSL is down nearly 10 per cent and Cochlear is down 15 per cent.

From its August high, on Friday the 13th, the ASX 200 is about 6 per cent weaker.

An ever-present risk in shares is the market falling 10-15 per cent, and more significant is the risk it occurs right after you start investing.

For most readers of this column, however, experience will mean the latest bout of market weakness won’t rate a mention. Nevertheless, it is worth mentioning the concerns.

The questions currently confounding investor anticipation of future returns span a broad range of subjects, from inflation and China’s common prosperity ideology to central bank liquidity and the virus. Ultimately it will be our success tackling the virus that will determine the success of our investments.

One of the biggest dangers to the recovery remains the possibility a strain of Covid-19 emerges with an ability to evade the current crop of vaccines, sending us back to square one.

Such a scenario would be nothing short of disastrous for markets, particularly equities.

To avoid such a catastrophe, the world needs to ramp up vaccine coverage, reducing the number of hosts available for the virus to spread and mutate. More than 6.19 billion doses have been administered across 184 countries so far, enough to fully vaccinate over 40 per cent of the world’s population.

At the current rate of just over 30 million doses per day, it will take six months before three-quarters of the world’s population is covered – enough to begin contemplating herd immunity. That’s six months for another dangerously transmissible variant to emerge.

Meanwhile, the increased transmissibility of the Delta variant has already raised the threshold for possible herd immunity to 90 per cent or 95 per cent, further extending the time vaccines must race against the virus.

–

Beyond vaccines

A vaccine-evading virus isn’t the only risk to economic recovery.

Investors also fear an end to pandemic stimulus. UBS estimates if pandemic stimulus expires “the global fiscal adjustment next year is five times larger than that post GFC”. Nevertheless, UBS also, comfortingly, expects the growth drag from expiring Covid stimulus next year will “likely (be) much less severe … than meets the eye”.

In 2012, 2016 and 2018, I raised the subject of capitalism’s failures. The concentration of wealth is one of the most obvious and potentially destabilising results of leaving capitalism to run its course unfettered.

And now, perhaps surprisingly, it is China – a nation not frequently or commonly associated with capitalism – doing something about it.

China is reining in billionaires, quashing the IPO of Ant Group (a company the size of PayPal), investigating Alibaba for “suspected monopolistic practices”, banning kids from computer games and online purchases on school days, and tightening access to capital: all up, it has wiped more than $US1 trillion off the market value of China’s tech stocks.

There is little doubt China’s goal of common prosperity, which includes sustainable growth, social equality and better control of financial risk, will mean investors must recalibrate their estimates for earnings growth.

Investors are also questioning just how long the current cycle can continue. For stocks to continue rising, earnings must not only rise, they must continue rising, in aggregate, at an above-average clip. That’s a big ask and one of the reasons I have been investing more tactically, looking for those companies that will benefit from a reopening domestically and those with long global runways for growth.

Meanwhile, ideally, global investors also need the US real yield (the difference between interest rates and inflation) to remain negative. This makes equities a more attractive investment alternative.

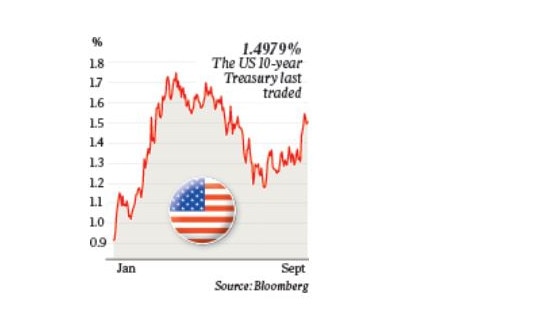

In September, however, across the yield curve, real rates have been rising. Using real yields on Treasury Inflation Protected Securities (TIPS) at “constant maturity” as a proxy, US five-year Treasuries have risen from -1.7 per cent to -1.51 per cent at the time of writing. The 10-year rate has risen from -1.03 to -0.84 per cent, and the 30-year rate has risen from -0.31 to -0.2 per cent.

Investors would also prefer if inflation remains transitory. I believe lower inflation is structural. A significant diminution in the proportion of labour that is unionised and a massive amplification of investment in automation will more than offset any short-term upward pressure on wages.

Meanwhile that labour market tightening – and the concurrent wage pressure – will also be relieved by immigration. And a switch to spending on services, and away from goods, will also relieve the inflationary pressures produced by demand for finished goods.

But of course, to spend more on services and less on goods, we need to reopen. The quality of future investment returns will therefore ultimately be won or lost in the laboratory.

Roger Montgomery is founder and chief investment officer at Montgomery Asset Management

www.montinvest.com

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout