TPG’s David Teoh riding high after his Vodafone merger victory

The telco titan’s court victory means TPG has risen while the rest of the market has dropped dramatically.

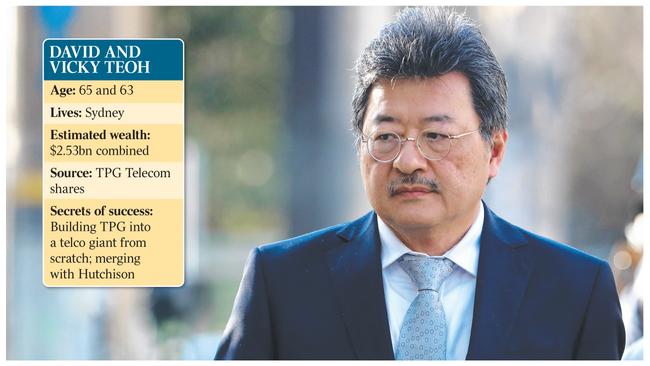

David Teoh is defying market gloom thanks to his court victory last month, which seems to have made a rare public appearance by the shy billionaire worth it.

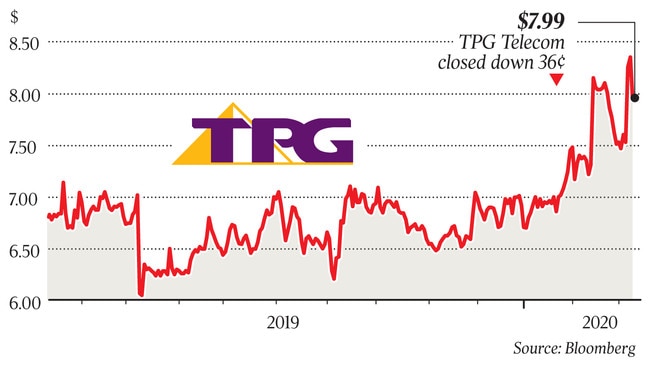

Shares in his TPG Telecom are up around 20 per cent since the start of the year, making it one of the better-performing stocks on the ASX in a market awash with red ink and plunging stock prices.

TPG fell about 4 per cent during trading on Monday morning, though that figure was half of what the entire market had plunged in the same time, according to Bloomberg data.

The telecom’s share price rise is due to Teoh getting his $15bn merger with Vodafone Hutchison Australia across the line, despite protests from the Australian Consumer & Competition Commission.

The ACCC had taken Federal Court action against the deal, arguing Teoh was going to build a new mobile phone network.

Teoh’s appearance at the Federal Court last September was greeted with much fanfare, with media packs falling over themselves to get a glimpse — and a long-cherished photo — of a billionaire who has gone to great lengths over several decades to shun the limelight.

He managed to convince the court that TPG was in no position to roll out a network, and that stopping a previous rollout was not a tactic to gain a green light for the merger. It remains to be seen whether TPG will now press ahead, though Teoh has dropped hints he will now “speed up” investment in 5G.

TPG has been an almost 35-year labour of love for Teoh, who moved his family from Malaysia to Australia in 1986, beginning his business career with what was then Total Peripherals Group.

It sold custom-built computers to government departments and later became an internet services provider, becoming a pioneer in the then fledgling Australian internet scene.

Teoh has since made a string of purchases, including SP Telemedia, AAPT, iiNet and PIPE Networks as he has relentlessly built one of the county’s biggest telcos.

He and wife Vicky hold their wealth mostly in TPG shares, though the Teoh family also own other shares and commercial property assets.

One of the family’s shareholdings is Macquarie Telecom, which has focused more in recent years on data centres, cloud and cyber security services. It has signed key contracts with government departments and agencies and begun work on a big data centre development at Sydney’s Macquarie Park. Macquarie Telecom shares are up about 6 per cent since January 1.

The Teoh family shares in Macquarie Telecom are held in Vicky Teoh’s name, a common theme with several of their public shareholdings.

She is, for example, listed among the top 20 shareholders in AIC Mines, a gold and copper explorer with assets in Western Australia. The company was born out of the merger between Intrepid Mines and AIC Resources in April last year, and its major asset is the Marymia exploration project which covers 3200sq km about 160km south of Newman in WA.

AIC shares are down about 20 per cent since the beginning of this year.

Vicky Teoh is also a shareholder in Vita Life Sciences which sells over-the-counter pharmaceuticals, pills and other health products in Australia and across southeast and east Asia.

Its brands include Herbs of Gold, VitaHealth, VitaScience and VitaLife.

Vicky Teoh became a shareholder in 2016, but Vita Life shares are down about 3 per cent since January 1.

Then there is Red 5, an Australian gold producer that operates the Darlot and King of the Hills (KOTH) gold mines in the Eastern Goldfields region of WA. David Teoh has previously been among the company’s top 20 shareholders, though his stake has slipped below the top 20 threshold now. Red 5 shares are down 6 per cent this year.

Otherwise, Teoh and his family have extensive property assets. The family paid $53m for 529 Kent Street in the Sydney CBD in 2017, a building that houses the flagship restaurant of celebrity chef Wakuda Tetsuya, Tetsuya’s. Teoh’s family also owns the site adjoining it, 320-334 Sussex Street, which they bought for $4.8m in 2011.

There is also a considerable portfolio of industrial land holdings in Chatswood in Sydney’s northern suburbs and a commercial building in Macquarie Park.

In total, the Teoh family’s property holdings are estimated by The Australian at more than $200m for research purposes for the annual edition of The List — Australia’s Richest 250.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout