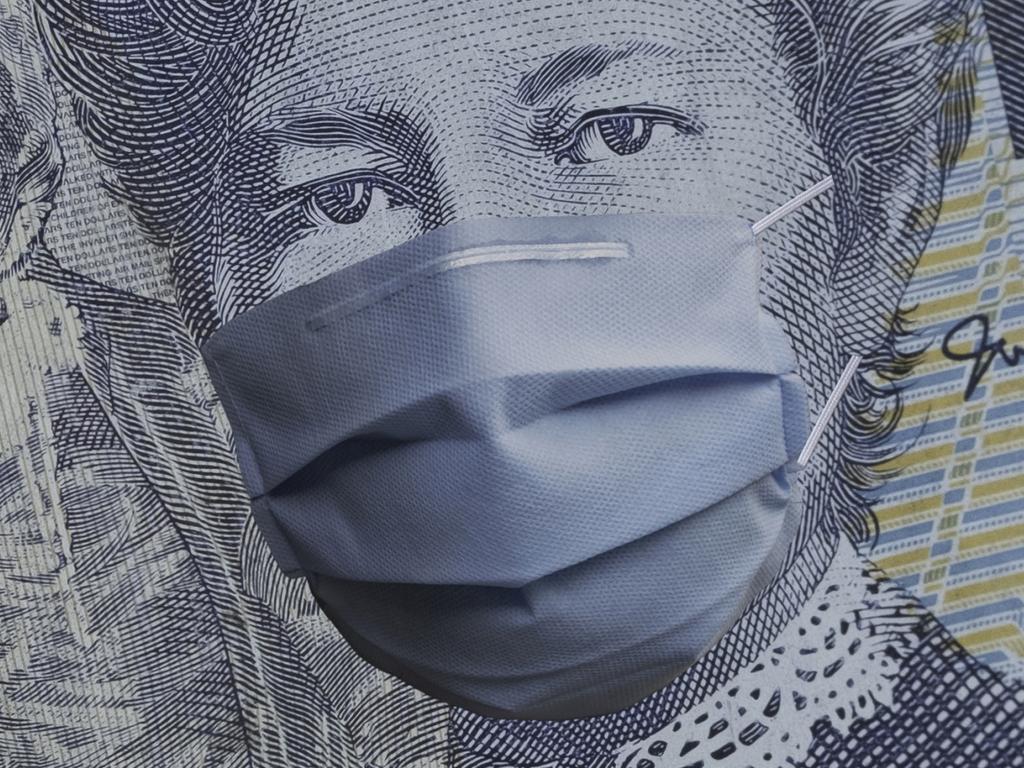

Even some hopes for domestic air travel have been dashed and tourism operators are flat out dealing with cancellations rather than bookings.

Consequently, travel stocks are taking a battering. But as we have seen previously and as many other geographies are experiencing currently, travel bounces back quickly. The sell-off in travel stocks is, if nothing else, an obvious investment opportunity.

During August last year the market differentiated the three primary travel stocks – Flight Centre, Webjet and Corporate Travel Management – across two event axes.

The first axis was whether the company was considered “broken” or not, and the second axis was whether the company was leveraged to the first, slower phase of the recovery or the second and faster phase of the recovery.

During the tentative first phase of the recovery from Australia’s first lockdown, it was obvious that Flight Centre was being treated by the market as broken, Webjet marginally less so, and Corporate Travel Management not at all.

Recall in 2020, as cases of Covid rose domestically and overseas, the March 15 order obliging international arrivals to self-isolate for two weeks. This brought international travel and tourism to a grinding halt.

From that moment, Flight Centre’s CEO and co-founder Graham Turner indicated that the company’s survival was on the line. Several measures to slow cash burn were adopted, including suspending the dividend, cutting costs from nearly a quarter of a billion dollars a month to just $65m, reducing its headcount of 22,000 by 6000 and shuttering 100 of its 944 Australian shopfronts.

By April, a $700m capital raising, a $200m debt package and permanently cutting its retail footprint and headcount revealed just how close to collapse the pandemic had brought one of this country’s best-known brands.

Similarly, Webjet’s deeply discounted capital raising of $231m from institutions and a further $115m from retail investors in April last year determined the low point from which a second-phase recovery would occur.

Corporate Travel Management didn’t raise capital, putting paid to the short-selling thesis of 2019. Its August results announcement triggered the beginning of its recovery.

The second phase out of the pandemic defines the rate of recovery for travel stocks and Corporate Travel Management has the greatest opportunity to demonstrate its recovery potential, Webjet slightly less so and Flight Centre, of course, will be last as it awaits international travel from Australia to recommence.

Importantly, Corporate Travel Management’s share price has only kept pace with the market since the third quarter of 2020. Its share price hasn’t broken out despite taking market share, a 20 per cent-plus accretive deal in the US and being in good financial health. We believe this makes it the preferred opportunity in a sector that is otherwise in disarray.

In terms of performance relative to the market, Webjet is back to where it was in November when we learned the good news about vaccine efficacy levels of more than 95 per cent. That makes Webjet second on our list of preferred exposure to the reopening trade.

For Flight Centre, it’s all about politics. It will recover strongly when quarantine-free international travel resumes.

For now, there is no political advantage (if there ever is) to permitting Covid to enter Australia. During any election, what excuse could the PM offer for infecting Australians? The answer is none.

Today we remain under-vaccinated, and therefore opening international travel would put our health system under unnecessary stress. “Long Covid’’ is also a future political football that prevents reopening early.

The most recent outbreak and lockdowns illustrates there will be bumps along the way for investors in travel stocks. And while the latest outbreak is a setback in expectations of a return to normal, eventually the bulls will be right.

Roger Montgomery is founder and chief investment officer at Montgomery Investment Management

With Australia in the grip of another lockdown, the prospect of restriction-free travel is being pushed further towards the increasingly distant horizon.