Some Woolworths shareholders face ESG dilemma

For shareholders of one of the most widely held stocks in the market, it might be hard to wave goodbye to pubs and pokies.

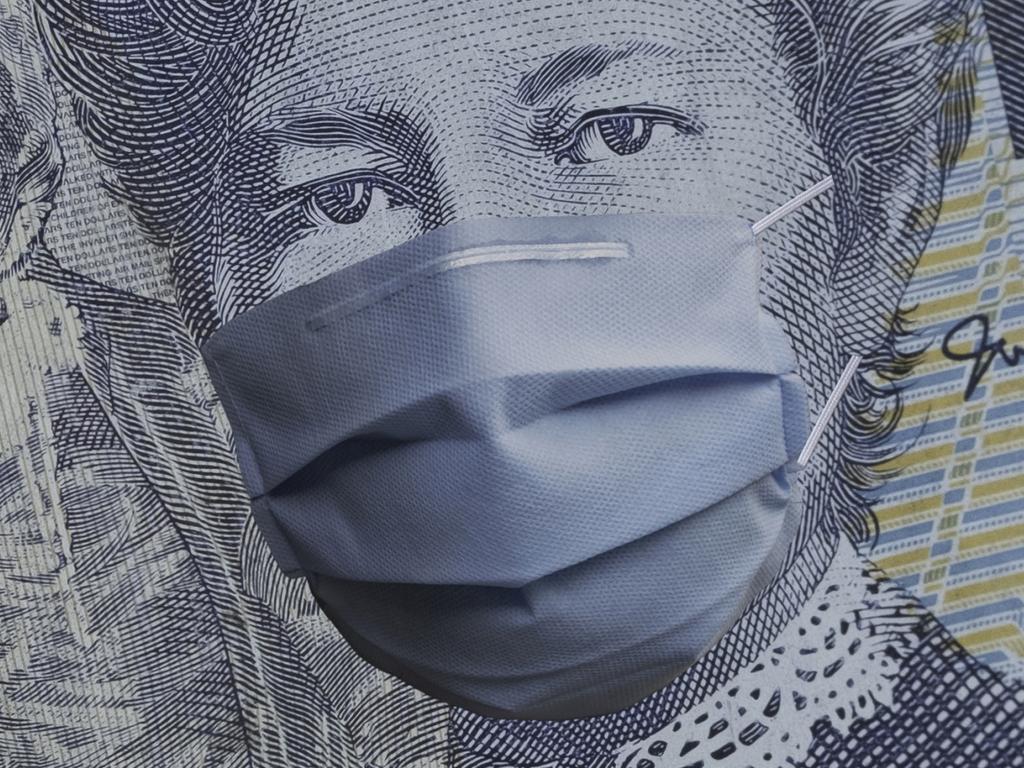

In a new era in which environmental, social and governance (ESG) considerations have been enshrined in the way fundies pick their shares, the so-called “sin” stocks had been largely discounted as relics of the past.

Until Woolworths’ spin-off Endeavour Group came along, that is.

By virtue of Endeavour’s sheer size and pure-play focus on booze and pokies, the bifurcation creates an awkward dilemma for “saintly” Woolworths holders who tolerated the sinful stuff as a minority contributor to the grocer’s earnings (about 27 per cent of underlying profits).

Woolies holders have received one Endeavour share for every Woolies share held. The dilemma is whether to dump the wayward cousin – which they can now do – but miss out on what’s likely to be reliable earnings and dividends in a turbulent economic climate.

In the last couple of years, spectacular capital growth has derived from ESG-friendly sectors such as renewable energy, electric vehicles, hydrogen and battery metals such as lithium, graphite and cobalt (as long it’s not mined in the Congo).

Shares in ESG talisman Australian Ethical have gained 19 per cent over the past year and 850 per cent over five years.

A leader in battery technology, Novonix has seen it shares gain 150 per cent over 12 months and 665 per cent over five years for a heady circa $900m market cap.

Shares in the Nasdaq-listed Tesla, the world’s biggest electric-vehicle maker and the most popular US share held by Australians, have gained 230 per cent and 1450 per cent over one and five years respectively.

The number of sinful ASX exposures have shrunk over the years, with the beer companies in foreign hands, the payday lenders (largely) changing their spots and the tobacco companies having deserted our bourse decades ago.

Endeavour cuts through any ambiguity with its chain of Dan Murphy’s and BWS stores and 332 hotels alive to the malevolent whirring of 12,364 pokies, what could be seen as the most destructive devices to humankind with the possible exception of the Gatling gun.

The investor jury is still out on the merits of the June 24 Endeavour listing. As of the end of financial year, Woolies shares changed hands for $38.13 while Endeavour shares were worth $6.29 (valuing the entity at more than $11bn).

Pre-split, Woolies shares were worth $48, which implies shareholders are 8 per cent underwater in what’s been a ratty overall market.

In theory, Woolworths shares will outperform Endeavour’s because they now can appeal to ESG mandates.

The trouble is that Woolworths retains a 14.6 per cent Endeavour stake, so until that stake is divested the grocer cannot don an angelic halo. Endeavour will also pay Woolies $564m a year for ongoing for logistics and other support.

There’s always a value judgment involved in the saintly delineation and it’s rarely clear-cut. The banks, for instance, have funded dodgy stuff over the years but now largely conform to ESG charters such as the global Equator Principles.

(In its advertising, the unlisted Australia Bank channels Greta Thunberg by depicting its bigger rivals as tree-chopping, coal-mining and tobacco-supporting juggernauts.)

Even BHP’s AGMs are sounding more like Greenpeace love-ins as the world’s biggest miner prepares to exit coal.

But BHP remains one of the world’s biggest uranium producers, albeit with its Olympic Dam mine contributing only a small portion of its total earnings.

Elsewhere on the ASX, the gambling sector accounts for the lion’s share of sinful exposures, with Crown Resorts scoring an epic fail on so many ESG tests.

Yet Crown shares have gained 37 per cent over the year and are steady on pre-Covid levels despite the rolling lockdowns.

Over the year, shares in fellow gambling dens Star Entertainment and SkyCity Entertainment (the Auckland casino) have surged 23 per cent and 37 per cent respectively.

Shares in online wagering house PointsBet have skyrocketed 140 per cent over the past year and 500 per cent over five years, courtesy of both the local online wagering boom and its presence in the liberalising sports betting market.

PointsBet this week was due to be joined on the ASX by BlueBet Holdings, which was doing the rounds for $80m to fund local and US expansion.

Special mention also to BetMakers, which runs the backroom wagering systems. BetMakers shares surged 160 per cent on the year, and were 290 per cent higher when the minnow last month announced a puzzling $4bn takeover offer for Tabcorp.

Overseas, the shares in the London-listed Flutter Entertainment, the world’s second biggest gambling company, have gained 5700 per cent over five years and we’re sure the spectacular return is not because the company has renovated its offices to reduce its carbon footprint.

While booze, smokes and the punt are the original sins, new vice leaders – shall we say, dare we say vice captains? – are emerging in the fossil-fuel sector, notably steaming coal.

On balance, investors are likely to ascribe more generous valuations to the companies that solve the world’s pressing problems, notably those pertaining to carbon abatement and reducing plastics and chemical use.

Having said that, the small-cap renewables space has been littered with failures over the last decade, notably in the geothermal and wave-energy sectors.

As Endeavour’s solid earnings profile shows, many well-intentioned investors from good homes will be quietly hoping there’s room for horns among the halos.

Tim Boreham edits The New Criterion

tim@independentresearch.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout