The top 10 stocks you might buy

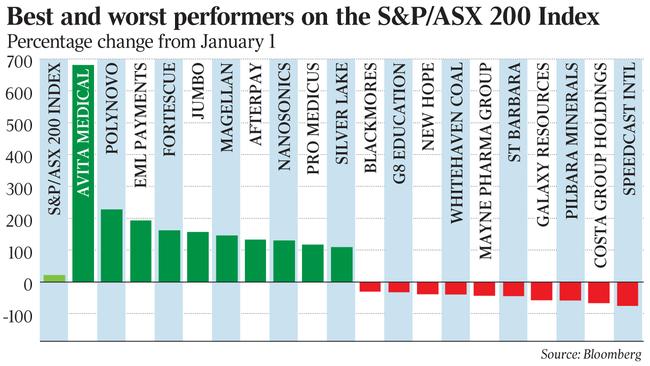

Tech and healthcare stocks held a tight grip on the Top 10 within the ASX 200 in 2019.

More often than not, we end up with a handful of lucky miners or tiny fast-growing companies that very few investors hold. Statistically, it is much more likely that you may own — or some day own — a stock from among the S&P/ASX 200, which represents the vast majority of the ASX capitalisation.

Tech and healthcare stocks held a tight grip on the Top 10 within the ASX 200 in 2019, as they did last year and will no doubt do again in 2020. More broadly, just about every one of these major stocks offers something to consider for the active investor.

Avita Medical

An overnight success story in 17 years, Avita’s skin regeneration technology came to attention when Professor Fiona Wood won Australian of the Year in 2002. But it was late last year the all-powerful US Food and Drug Administration finally gave approval to its flagship Recell spray product. Why did the share price soar in 2019? Recell kits will sell in the US on a gross margin of 90 per cent!

Tech and healthcare investors have to be patient. The years of zero revenue and mounting expenses are stressful for all concerned ... but when it pays off, it pays off big time.

PolyNovo

The second top-performing ASX 200 stock is also in the skin repair business. This group, associated with serial entrepreneur David Williams, has stunned the medical world with the success of its NovoSorb product for the treatment of burns.

Regulatory approval in key markets is the outstanding marker of commercial success for medical and biotechnology companies. The market is awash with great technology but very little gets full regulatory approval.

EML Payments

Payments technology is one of the hottest areas in the market. EML Payments quickly specialised in the area of private-label gift cards. This year the group pulled off two big deals: a 200-property deal with the US shopping mall giant the Simon Group, and the British acquisition of Prepaid Financial Services.

The buzz around fintechs has a compelling logic. Traditional banking is simply waiting to be cherry-picked.

Fortescue

Stoked by a powerful — and unexpected — lift in the iron ore price to almost $US100 a tonne, Fortescue has soared in tandem. The pure-play WA operation mines some iron ore that is not as high grade as Rio or BHP’s products, but when commodity prices jump such concerns evaporate.

Our top iron ore miners manufacture the commodity for about $US14 a tonne; they sell it for more than $US90. Never underestimate this sector and never underestimate Fortescue.

Jumbo Interactive

Once upon a time traditional gambling stocks paid out big time: Crown, TAB and Aristocrat have all shot out the lights in their day. This year it’s the turn of Jumbo Interactive, the lotteries ticketing group that managed to double profits over the year — no surprise that the share price doubled too.

In gambling “the house always wins” and the share price can shine for an extended period. Investing in gambling stocks at the right point in their growth cycle is the key.

Magellan Financial Group

Stock-picking fund managers are meant to be facing extinction as exchange-traded funds take over. But try telling that to the Magellan Financial Group, which has specialised in chaperoning local retail investors into global sharemarkets. This year the fund manager shot ahead while arch-rival Platinum somehow managed to go backwards.

Active fund managers can beat passive investors if they have the skills and leadership.

Afterpay

It’s not really a tech stock — more like an old-fashioned consumer finance play — but the “buy now, pay later” sensation has done it again in 2019, shooting the lights out with the share price doubling again over the year.

The jury is not so much out on Afterpay as widely divided, with investment bank UBS clinging to its $17.60 valuation while Morgan Stanley reckons the stock could go to $44 (meanwhile, the stock is trading somewhere around $30). Any company — even a loss-making company — which has rapidly accumulated more than 2 million customers will be significant globally and its share price will reflect that growth.

Nanosonics

The diversified medical device group, which is best known for its ultrasound disinfectant, managed to double profits this year, along with offering a balance sheet with no debt and cash on hand of around $70m. (That’s about four times more that its annual profit of $13m!)

Profitable medical devices companies with standout products are one of the secret sauces of the Australian sharemarket.

Pro Medicus

You might have heard of Pro Medicus for the simple reason the group has been around since the 1980s. But in late 2018 the health imaging group signed its biggest deal ever, with a US hospital group, and since then the share price has been powered by rocket fuel.

The troubled US health system is also the most lucrative in the world. Australian companies that can break America can just as easily break sharemarket records.

Silver Lake Resources

After several years of strong gold prices — and a powerful US dollar, which boosts the fortunes of Australian listed gold miners — you might have expected more gold miners at the top of the heap. But only well-run, acquisitive Silver Lake, which is backed by some of the leading stockbrokers, makes the cut.

The underlying positive dynamics for gold do little to pinpoint which gold miners make the money — it’s down to management.

A warning

This top 10 list may drift in the final days to December 31 but it is unlikely to change substantially. Separately, if you are worried the wider market is overpriced after a 20 per cent lift this year, then many healthcare and biotech stocks are very overpriced.

For the record, the 10 worst stocks in the S&P/ASX 200 were a motley crew, dotted with coal miners, lithium miners and agribusiness stocks.

Here’s the list in order of disappointment: Blackmores, G8 Education, New Hope, Whitehaven, Mayne Pharma, St Barbara, Galaxy Resources, Pilbara Metals, Costa Group and Speedcast International, which holds the unwanted title of “worst ASX 200 stock of the year”, down 75 per cent.

We often see Top 10 stock lists at this time of the year. Yet it’s rarely useful to investors when we select the handful of winners from more than 2000 stocks across the entire market.