The single biggest factor holding back property

Property investors are being distracted from the numbers that matter in the lending market.

For property investors trying to gauge the key factors for our market in the months ahead, the candidates seem endless: we hear about the importance of maintaining JobKeeper, or the unemployment rate, or overseas migration etc.

But in the end one thing matters most — credit growth will be the sole driver of property price growth in the short run.

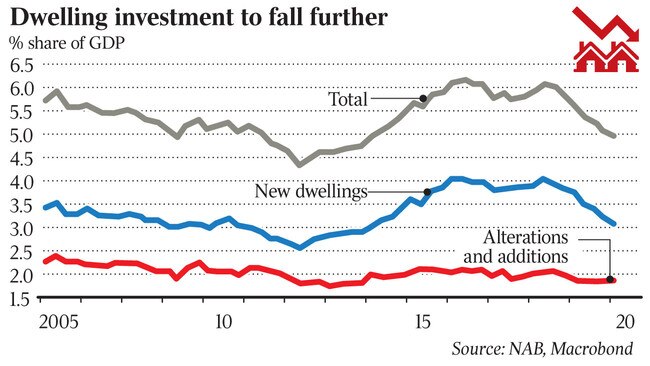

The government recently announced its HomeBuilder stimulus package. It provides a $25,000 cash grant for owner-occupiers who build a new home or substantially renovate their existing home this year. It is only available if the owner’s family pre-tax income is less than $200,000 a year, or $125,000 for singles. There is also a limit on the value of the home.

This package will have limited effect for two reasons.

First, if you are uncertain about whether to commit to a major home build or renovation, is a $25,000 grant really going to encourage you to do it this year? For example, maybe you are concerned about your job security or future income levels. A grant of this size probably does little to reduce these concerns.

Second, most people finance renovations or a construction of a new home by taking out new borrowings. If the banks continue to have a reduced appetite to lend to homeowners, then very few people will have the $150,000 they would need on hand to be able to access this cash grant.

Based on the latest data released by the ABS, lending for owner-occupier purposes fell by 5 per cent in the month of April. I anticipate that volumes for May and June will fall further. Some lenders have suggested that monthly volumes are currently down by more than 40 per cent.

Lending volumes have fallen for two principal reasons.

The banks have been tightening credit policies throughout the COVID-19 pandemic. Some of this tightening has been specific to COVID-19 such as requiring borrowers to declare that they do not expected to be financially affected by COVID-19, re-verifying employment only a few days prior to a loan settling, while disqualifying borrowers employed within certain industries heavily affected by the COVID-19 shutdown such as tourism.

Other tightening is more generalised and driven by concerns about the future health of the economy and the property market. This includes reducing loan to value ratios (LVRs) requesting Business Activity Statements the day after the quarterly period ends (most businesses usually have two months to prepare and lodge these statements with the ATO) and so on.

In my view, credit availability effectively is at its tightest in a generation.

Inside the banks, management is dealing with significant operational and processing challenges that have resulted in processing times blowing out. These operational challenges have been caused by a number of factors. Bank staff have had to spend a lot of time talking to borrowers and businesses throughout the crisis because the banks have been providing loan repayment pauses and other support. Separately, COVID-19 lockdowns in India and The Philippines have crippled the banks’ offshore processing facilities. This means Australian-based staff have had to pick up the slack while working from home, which can create its own productivity challenges.

In ANZ’s half-yearly results presentation, CEO Shayne Elliott acknowledged that approval times had been less than adequate. Recent communication from ANZ confirms borrowers have to wait 20 days before the bank is even able to look at a new application.

These two factors have conspired to dramatically reduce the flow of credit into the property market. As I have written in these pages previously, there is a strong historic link between credit supply and property price growth.

So far property prices have weathered the COVID-19 storm very well and I expect they will continue to do so to. The reason is that there are fewer properties available for sale at the moment. The volumes of buyers, despite the abovementioned challenges, has continued to exceed supply of property. Unless that changes — and I don’t expect it will — prices should hold firm.

Many market commentators’ question what will happen to property prices after September, when JobKeeper finishes and loan repayment pauses end. It is likely that we will see an increase in “forced sales”.

However, the government will almost certainly provide additional targeted stimulus to severely affected industries. In addition, I expect the banks to be amenable to providing borrowers who continue to be affected by COVID-19 with additional support, including further partial or full mortgage repayment pauses.

The upshot is that I believe house prices will be preserved because of very low volumes and the banks and government taking action to minimise any forced sales.

However, I do not expect property prices to start appreciating again until lending volumes recover. That solely hinges on the banks’ appetite for lending.

Given banking profits are already under huge pressure, I expect the banks will be keen to minimise any increases in loan arrears and default rates. As such, I don’t anticipate that credit will start to loosen until some time next year, when the full impact of COVID-19 is known.

Astute buyers who are either cashed-up or already have access to finance are well positioned to take advantage of opportunities should they arise.

Stuart Wemyss is an independent financial adviser and author of Investopoly & Rules of the Lending Game.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout