Bruce Gordon: Switched on to media revolution

Forget diversifying your portfolio. Media mogul Bruce Gordon sticks to what he knows best when it comes to stock picking.

Forget diversifying your portfolio. Media mogul Bruce Gordon sticks to what he knows best when it comes to stock picking.

Gordon splits his time between Bermuda and Wollongong, where he owns the private regional broadcaster WIN Corporation, and also has a collection of ASX-listed media stocks that make him one of the biggest investors in media and telco shares in the country.

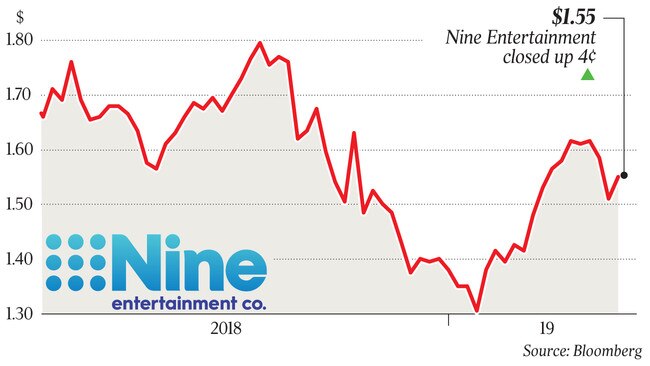

Nine Entertainment Co, which merged Nine’s television assets with Fairfax Media in a $3 billion deal last year, is Gordon’s biggest holding. And it is one of many of Gordon’s holdings that has bounced back strongly in the first month of the year after a tough end to 2018.

Gordon’s shares in Nine are worth more than $350 million, with the stock up about 12 per cent since January 1, with the ASX 200 and All Ordinaries Index each having bounced back by about 4.6 per cent.

Earlier this month, Gordon revealed in a filing to the ASX that he owned about 15 per cent of Nine. He also owns about 15 per cent of regional television broadcaster Prime Media via his private company Birketu, which has risen just 9 per cent since January 1.

But Gordon’s Prime shares are worth about 40 per cent less than when he spent more about $15m topping up his stake in September 2017.

Gordon’s history in the media sector goes back to his teenage days, after leaving school at 14 and a stint at his parents’ Pitt Street fruit barrow in Sydney at which he juggled fruit to attract customers.

From there he became a magician, performing at clubs and local theatres and eventually a show at the Tivoli Theatre.

He moved into management at the theatre, handling advertising and promotions before running television sales for Lucille Ball’s Desilu.

That company was later bought by the international giant Paramount Pictures, which saw Gordon make a move to Asia and then later New York where he became the head of international TV sales.

The Paramount role gave Gordon the financial base from which he bought a major stake in WIN in 1979. He would later buy out all shareholders to privatise it for a total of about $10m.

Since then Gordon has held a variety of media stocks including a long-time shareholding in Ten Network and SP Telemedia, the latter of which merged with billionaire David Teoh’s then private internet services provider TPG for $150m cash and SP shares worth about $95m. Gordon has kept his TPG shares, and has amassed a holding worth about $65m to make it the second-largest stock in his portfolio.

TPG shares are up about 8 per cent this year, as the market waits for the Australian Competition and Consumer Commission to make a decision on the telco’s mooted merger with Vodafone Australia in a deal that could be worth up to $15bn.

The ACCC has said it will release a decision on the transaction on April 11.

Gordon’s Birketu also owns close to 17 per cent of telco and infrastructure services provider BSA Limited. The company provides installation and maintenance services to the broadcast and telco sectors, including subscription and free-to-air TV. BSA shares are down about 5 per cent this year.

Skyfii, a provider of data analytics services, is another Gordon holding. The company’s services are used by shopping centre owners to track consumer habits. Skyfii shares are unchanged since January 1, but are down about 50 per cent since February last year.

Gordon also owns shares in Perth company Orbital Corporation, which has market capitalisation of about $33m and is developing engines and propulsion systems.

Orbital shares are down about 2 per cent since January 1 and have halved since October.

Otherwise, Gordon owns a 10 hectare property in Bermuda, apartments in Sydney and Wollongong, as well as The Scarborough Hotel overlooking the Pacific Ocean and a 50 per cent stake in the rugby league club St George Illawarra. The club is now chaired by Gordon’s son Andrew.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout