And if you are one of those types who like to invest on the front foot choosing growth options you could be up about 30 per cent since those faraway days in March 2020, when it looked like the markets had tanked. That rebound more or less covers the 30 per cent plunge we saw in shares this time last year.

Looking back at it all, it was the least-worst type of sharemarket crash. The V-shaped one that is over before you know it. They hurt, of course, but they don’t hurt as much as the long, slow painful types such as the GFC, when the markets fell 50 per cent over a period of 17 months.

So it looks like everybody who held on tight has turned out fine. Except, that is, the unlucky ones who took out “early superannuation” in the emergency scheme last year.

We are not talking here about those who used their super for essential spending, but rather the half a million younger workers who took out all their super in that scheme. The chances that they have been back in the market and have restored their savings are slim indeed.

In fact, the “early super” cohort is not the only constituency that has been wrong-footed by the market rebound.

There is another group: it’s probably older and it certainly has more to lose — cautious investors in so-called balanced or conservative funds are losing out, and this trend may continue for some time.

Let’s start by looking a little more closely at these latest super returns for the nine months to March 30. Yes, they are strong — and they needed to be. The year to March 30, 2020 was dreadful.

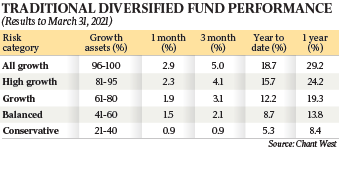

If we take each of the main categories in the Chant West performance tables and look at how they are doing so far, the numbers diverge dramatically — if you had all your money in a high-growth fund you would be up 19 per cent in nine months, and you would have made almost four times more money than if you were in a conservative fund, which only managed 5 per cent.

“It’s a tough time to be a conservative investor,” says Ian Fryer, general manager at Chant West.

“We saw plenty of people move to defensive positions in the depths of the crisis, which was a completely understandable move — the thing is they have to deal with the markets as they are unfolding now.”

Fryer’s picture of conservative investors left behind as risk takers bask in the sharemarket’s rewards is repeated across the investment spectrum.

Put simply, shares and other risk assets are offering outsized returns, but traditionally conservative, safer investments such as cash and bonds are very weak, occasionally bordering on hopeless.

So what to do?

Fryer points out there are opportunities that sit between the flat but safe returns in bonds and high-risk shares. He points to floating rate bonds, absolute return funds and debt funds.

If you have a terrific fund manager or you are a skilled operator of your own self-managed super fund, this is a time where portfolio construction is crucial.

It just so happens we got a rare view into what these experts are thinking thanks to the annual portfolio construction forum run by a doyen of the game, Graham Rich.

Rich and his circle make a number of key assumptions these days, the most important of which is “cash allocation is dead”.

As Chris Rands, portfolio manager at Nikko Asset Management (Sydney), told the forum: “Structural factors are in place which will ensure that the cash rate cannot rise over the medium term.”

Importantly, many portfolio construction specialists now allow that the age-old benchmark of the 60-40 rule that investors swore by for generations will not work today.

Under that rule, you had 60 per cent in growth assets such as shares and 40 per cent in fixed assets such as bonds. The new number is 72-28, according to Thomas Poullaouec, head of multi-asset solutions Asia-Pacific at T. Rowe Price (Hong Kong).

In other words, these experts are going back to the drawing board and recalibrating the very essentials of portfolio construction — taking more risk but also, reassuringly, being optimistic that this riskier market will continue to reward risk takers for some time yet.

As former Lazard Asset management Asia-Pacific CEO Rob Prugue put it: “Preserving money in this market is not going to do it for investors: It’s not going to get you inflation plus 3 per cent or whatever.

“But at the same time I’d be wary of being on the wrong side of a major value creation opportunity too early.”

Hey! What a recovery, eh? Your super fund should have made at least 12 per cent over the past nine months.