But a recent survey of sole traders in this country – exclusively obtained by The Australian – suggests the new Labor government has significant policy work to do to address disadvantages for women among the self-employed, alongside an under-utilisation of superannuation more broadly.

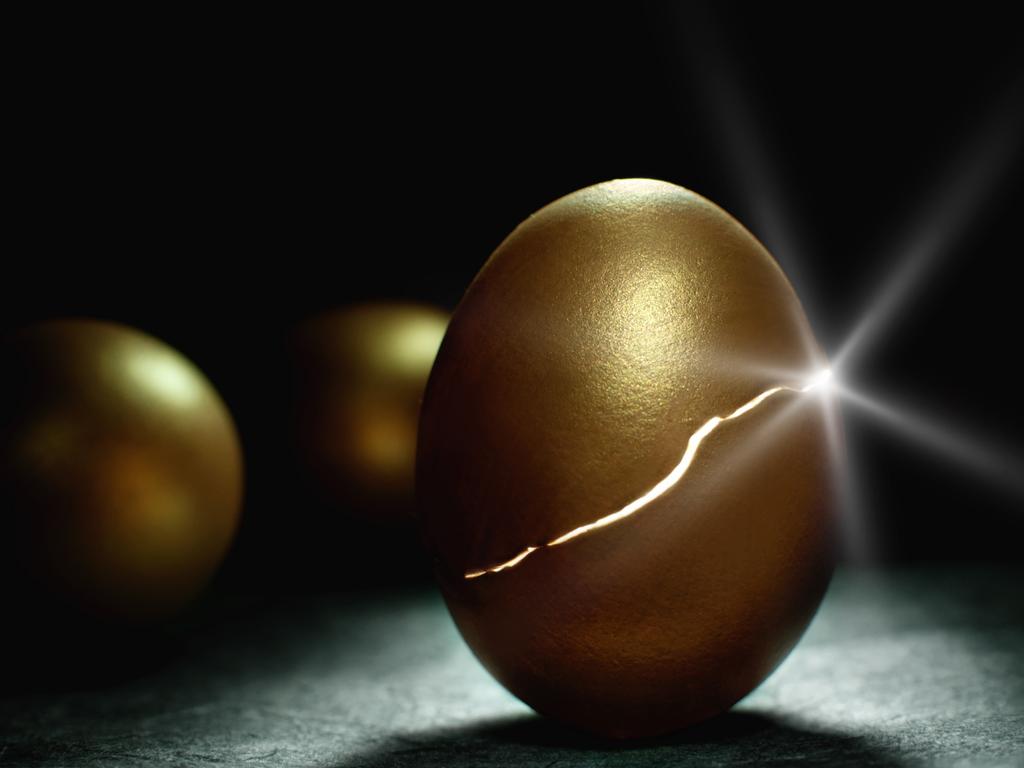

The Hnry Sole Trader Pulse, the only nationwide survey of self-employed people in Australia, found that nearly a quarter of the sector (24 per cent) was planning to cancel or delay their super contributions in order to survive an era of rising inflation and costs of doing business.

The same data set highlighted that nearly half of all self-employed Australians (43 per cent) had never even made super contributions to begin with. Sole traders are the only worker cohort not required to accumulate superannuation, a situation that has been the case across both major parties’ time in government.

Perhaps this is something Labor needs to look at changing? There are 1.5m sole traders with an ABN in Australia and the sector is growing at a rate of 50,000 people per year. It’s unsurprising growth given that in a post-Covid world, people value more flexibility and autonomy in their working lives, alongside the increasingly decentralised economy domestically.

There is also a gender problem when it comes to the lack of super among the self-employed. The Hnry survey found that women are more likely than men to cut back on super (31 per cent versus 20 per cent), further disadvantaging women in retirement. We already know that women’s superannuation nest eggs are lower than those of men because of factors such as time out of the workforce when having children.

The increasing economic clouds on the horizon are a problem for all Australian businesses, but the self-employed are particularly vulnerable to the changing economic climate. With traditionally smaller cash reserves and business interests often underpinned by personal life investments, the survey data should especially concern a Labor government. The new government is keen to highlight that it’s interesting in protecting workers can be dynamic beyond the traditional employee employer relationship of a bygone era. More working class Australians are self-employed now than ever before.

As the industrial relations minister Tony Burke rises to address the National Press Club today – spruiking Labor’s IR laws which have passed the House of Representatives and now go before the Senate – attention needs to be paid to what can be done to alleviate the strain which is seeing self-employed Australians mortgage away their financial futures in retirement in order to survive the present economic malaise.

While compulsory super for the sector might seem like the obvious answer, in the current economic climate it could make a difficult situation even harder for sole traders. Rather, such a move is something to look at in the medium to longer term, once the current economic crisis is behind us.

Right now the self-employed need government to help invest in digital technology, which can help alleviate the cost pressures on administration and expenses for example, so that the self-employed won’t have to trade away their super to keep businesses afloat.

We know that Labor has flagged the importance of investing in the digital economy as a key priority. Let us hope we see tangible evidence of that next May when Treasurer Jim Chalmers delivers what will be his second budget just 12 months after assuming office.

Peter van Onselen is professor of politics and public policy at The University of Western Australia and Griffith University.

Labor claims to be the party that cares about superannuation, women and workers rights. Not unfairly by the way. After all, it introduced compulsory superannuation back in the days of Paul Keating, Labor remains the only major party to use quotas to ensure equal parliamentary representation of men and women (having also beefed up childcare funding and introduced paid maternity leave when last in government) and Labor’s ideological interest in providing worker safeguards in the industrial relations space is well known.