Super funds drop 9pc in March: Chant West

Super funds have taken their worst monthly and quarterly hit since the introduction of compulsory retirement savings.

After a record 10-year bull run, super funds have suffered their worst monthly and quarterly returns since the introduction of compulsory super nearly three decades ago as the coronavirus crisis crashed through global markets in March.

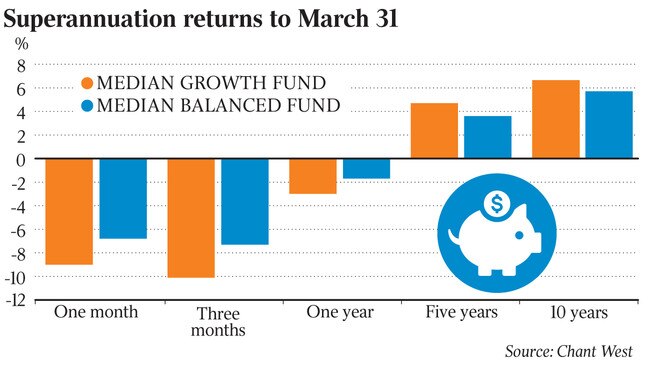

The median growth fund shed 9 per cent in the month, eclipsing the previous worst monthly record — a 6.2 per cent decline in October 2008 — by almost 3 percentage points, and fell 10.1 per cent over the quarter, according to research house Chant West.

The savage short-term hit comes as up to 1.5 million savers are expected to dip into their super as part of the government’s coronavirus rescue package.

ChantWest’s findings follow similar figures published by SuperRatings last week, which indicated an 8.9 per cent fall during March for balanced funds.

As of Friday evening, close to 900,000 Australians had registered their interest in taking part in the scheme, which allows workers to take out $10,000 in savings before June 30, and a further $10,000 between July 1 and September 24. Applications are open through the myGov website from Monday.

The ATO estimated it would take up to four days to process applications, and funds will then have five days to make the payments to workers, as ordered by the prudential regulator.

Treasury forecasts initially indicated 1.3 million savers would draw down $27bn from their nest eggs between now and late September, but experts are predicting the number could soon top $50bn.

“If I look at both the modelling at an industry level by a body like ASFA, as well as from the bottom up with different super funds, we’re anticipating it to be close to double where Treasury’s first estimates were at,” First State Super chief executive Deanne Stewart told The Australian.

“On the whole, super funds are estimating around 15 to 20 per cent of members will seek early access to super,” she said.

“(At First State Super) we’re estimating 10-15 per cent … because if you look at our member base, we’ve got teachers, police officers, nurses, doctors, and they’re really at the frontline (of the coronavirus pandemic).”

While some hard-hit workers would genuinely need access to their nest egg in the coming weeks, Ms Stewart urged savers to consider whether they really needed to dip into their retirement fund.

“Seek advice and determine if it really makes sense; consider super more like a last resort,” she said.

Chant West senior investment research manager Mano Mohankumar expressed similar concerns and warned that workers taking out money today would be crystallising the losses suffered in recent weeks.

“If they take money out they will be doing the very thing we caution against, which is to lock in what at the moment are only paper losses … Those losses, when compounded over many years, will knock a big hole in their eventual nest eggs,” he warned.

For those concerned about the hit to super savings from the recent correction, workers should keep in mind that their savings would grow again when the recovery begins, he said.

“Market corrections do occur, often after a sustained period of growth such as we’ve seen in recent years. Super has had a record run, and it had to come to an end at some time,” he said.

“This downturn is a shock, but it’s reassuring to look at history which shows that in 100 per cent of previous corrections, markets do recover. The timing of when that recovery begins and how long it takes are unknown – but it will happen.

While the median growth fund tumbled 9 per cent in the month, balanced funds fared slightly better, falling 6.8 per cent in March and 7.3 per cent over the quarter. High growth funds, which typically have a greater allocation to equities than balanced or growth funds, shed 10.8 per cent in the month and 13 per cent in the three months through March.

The losses compare to the 27 per cent the Australian sharemarket gave up in February and March and a fall of 20 per cent on international markets over the same period.

“Growth funds, which is where most Australians have their superannuation invested, hold diversified portfolios that are spread across a wide range of growth and defensive asset sectors. This diversification works to cushion the blow during periods of sharemarket weakness,” Mr Mohankumar said.

“This is still a significant reduction in account balances, but it comes on the back of the tremendous 10-year run funds have had since the end of the GFC. Over the 2019 calendar year alone, growth funds returned an exceptional 14.7 per cent, so super funds are actually ahead of where they were at the start of last year, even after what we’ve seen in February and March.”

Financial year to date, growth super funds are down 6.3 per cent and are 3 per cent lower over a one-year period. Over three and five years, growth funds returned 4.2 per cent and 4.7 per cent.

While super funds gave up 10 per cent in the quarter, the median Australian investment manager returned -23.5 per cent in the same period, with the worst performers plunging more than 33 per cent, according to the latest Mercer fund survey.

Even the best performer, Hyperion Australian Growth Fund, fared worse than the median super fund, with a 12.5 per cent decline. Allan Grey Australian Equity Fund and Nikko AM Australian Share CVA 10-25 Plus tied in last place, with a 33.4 per cent decline over the quarter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout