900,000 race to register for early access to superannuation during coronavirus crisis

Fears grow that superannuation cash grab will exceed $50bn, well beyond government estimates.

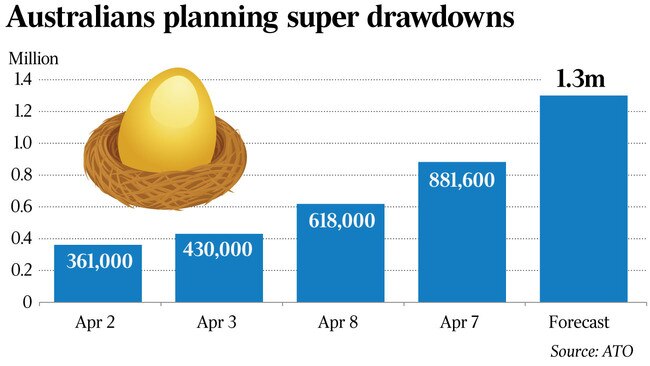

Almost 900,000 people have raced to register for early access to their superannuation funds, adding to fears that the amount withdrawn could massively exceed government projections.

Latest Australian Taxation Office figures revealed over 260,000 Australian’s had registered for the early drawdown scheme over the past week, bringing the total number of people registered to 880,000.

With almost 70 per cent of the government’s initial 1.3 million estimates already registered, the number of people accessing their nest egg early will add to industry concerns about the total figure that could be withdrawn.

The early drawdown scheme allows workers to access up to $20,000 in a bid to ease financial pressures brought on by the coronavirus crisis: with $10,000 available from super funds before July, and another $10,000 between July and October.

Despite the government projecting that $27bn would be withdrawn under the scheme, with more than 1.5 million workers expected to apply when the scheme opens on Monday, the superannuation sector fears the total amount could exceed $50bn.

The soaring figure will compound mounting pressure on superannuation funds, that will most likely be forced to sell off assets in order to fund the drawdown, fuelling concerns about the long-term liquidity positions of smaller industry funds.

On Thursday, foreshadowing any hesitancy about handing over funds, the prudential regulator told super funds they were required to hand over early release payments within five days of a determination of the tax office.

However, the Australian Prudential Regulation Authority did concede that time frames could be well beyond that if the funds come under pressure from the expected high volume of applications.

Assistant superannuation minister Jane Hume welcomed the guidance from APRA and said the government expected super funds to pay members as quickly as possible.

“We understand this is a very challenging time for all Australians,’’ she said. “These measures will ensure that Australians impacted by the COVID-19 pandemic will receive this vital financial support as quickly as possible.

“This is an opportunity for the super funds to demonstrate their commitment to their members at the time they need it the most,” she said.

Of the smaller funds, certain industry funds that cater specifically to members in the shuttered retail, hospitality, tourism and entertainment sectors, face a triple hit to their cash flow. With asset values tanking, contributions stalling from laid off workers, and hardship withdrawals hitting their cash reserves.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout