Super funds deliver slim January gain, but uncertainty ahead: SuperRatings

Super funds have notched up a tenth straight month of post-crash gains but are not out of the woods yet, analysts warn.

Superannuation funds have notched up a 11th straight month of gains as they bounce back from last year’s pandemic shock, but they are not out of the woods yet.

Research organisation SuperRatings found January produced a 0.4 per cent return for both the median balanced option and the median growth option, in what analysts termed “a small but positive result”.

The median capital stable option eked out a 0.1 per cent gain, SuperRatings data showed.

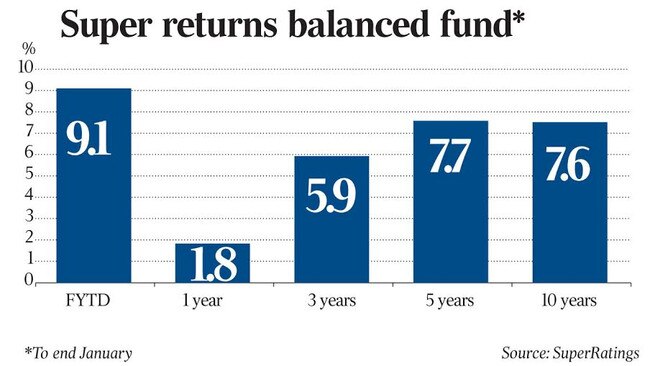

Over the financial year to date median balanced options have returned 9.1 per cent, reflecting the speed at which the market has picked itself up off the floor after crashing in March 2020.

SuperRatings said current trends indicate the superannuation market is “in good health and well positioned for 2021” despite the emergence of new COVID-19 variants and rolling lockdowns that have hit most Australian states in recent weeks and months.

SuperRatings chief Kirby Rappell said superannuation holders should prepare for a bumpy ride.

“Super funds have had a promising start to 2021, but the pandemic isn’t over yet,” Mr Rappell said.

“Movements in financial markets are still closely tied to how governments are managing new COVID-19 cases, as well as the timing and efficacy of vaccines. In short, we expect more ups and downs in the market, and super funds are not immune.”

SuperRatings says overall, its growth index has delivered a 10.8 per cent return in the financial year to date, but this comes on the back of a huge parabolic shift in the market in 2020. Across one year the growth index is up only 1.7 per cent, after last year’s crash.

Pension returns have also proven resilient in the face of wild market swings.

SuperRatings’ estimates show the pension growth index has delivered a 11.9 per cent return for the financial year. However, again, this is cut to only a 2 per cent growth for the year, after the massive market movements last March.

“One thing that was reinforced in 2020 is that Australia’s superannuation system is built to withstand market storms and even pandemics,” Mr Rappell said.

“Overall funds are focused on the risks and opportunities that lie ahead. To date, they have shown the ability to manage their investment positions and provide the additional support that many members need in this environment.”

But Super Consumer Australia director Xavier O’Halloran said it was important to look beyond the January gains that continue to buoy super funds.

“You don’t want people focused too much on what’s happening quarter to quarter or month to month,” he said.

“It’s a long term game. It’s designed to be the savings for the last 20-30 years of your life.”

The SuperRatings data reveals its SR50 Growth index has pulled in an 8.2 per cent return over 10 years.

This was well up on the 4.9 per cent 10 year return delivered by the SR50 Capital Stable Index.

Mr O’Halloran said the swings in fund balances demonstrated the need to avoid trying to time the market, warning those who switched to cash as the market plummeted likely missed out on the corresponding rebound that followed.

“You’ve got time to ride these bumps, it was a really big year of fluctuations,” he said.

“Time in the market is better than timing in the market.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout