Simple financial planning might be the difference between retirement at 65 or 75

By 2029 the last baby boomer will have reached retirement age. But many will still be in the workforce.

Generally, we have done a decent job looking after our finances leading into retirement. However, more Australians work past the official retirement age today (14 per cent) than did a decade ago (9 per cent). In international comparison, not too many Aussies work past the age of 65 (in the US 20 per cent of the 65+ cohort still works and in New Zealand that figure even is 24 per cent).

READ MORE: Boomers not ready to down tools, writes Bernard Salt

Some Aussies continue work of need, their nest egg simply isn’t big enough yet, some do it because they enjoy the purpose and challenges that work provides them with.

By 2029 the last baby boomer (born between 1946 and 1963) will have reached retirement age. That doesn’t of course mean that every boomer will have retired. Based on current and projected figures I’d estimate that about 540,000 Aussie boomers will still be part of the workforce by 2029 — even about 6000 very resilient members of the pre-boomer generation will still hold a job by then. Combined, these generations will make up about 4 per cent of the total Australian workforce.

The type of jobs that the 65+ cohort will hold in 2029 will probably be somewhat like the jobs that retirees hold today. The most common job for our retirement aged workers at the 2016 census was retail assistant. This is hardly surprising as this is also the most common job in Australia.

Our friends at the Australian Bureau of Statistics assign every job a skill level; that’s a number from 1 to 5 indicating how much formal training you must go through before you can work in a certain job. Looking at the 20 most common jobs for the 65+ cohort in 2016 we see plenty of low-skilled (skill levels 4 and 5) jobs. This suggests most could-be retirees work out of necessity.

Most commonly that necessity implies the need for more income. However, the large share of farmers in the 65+ workforce equally implies that they simply can’t find a younger farmer to take over the farm. Farmers who aren’t willing to give up the farm therefore are forced to choose between retirement, which means giving up the farm, and keeping the farm but continuing to work.

Maybe the fact that Australians retire later now was always to be expected. We stay at school for longer and consequently start earning and saving for retirement later in life.

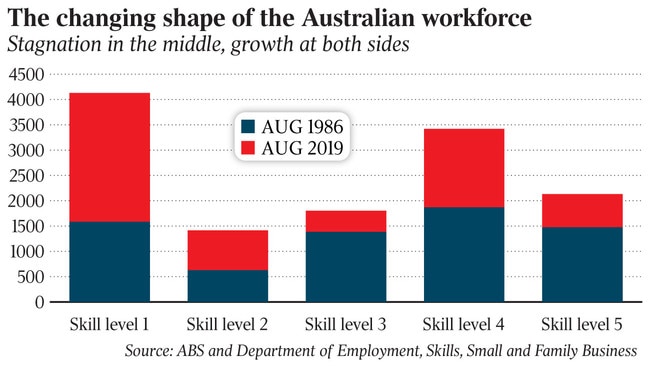

Most importantly, we created very few skill-level 3 jobs since 1986. Strong job growth occurred at both sides from the centre. We don’t need to worry too much about the retirement planning of all those new skill-level 1 workers. Sure, all doctors, engineers and teachers in this category need to plan carefully for retirement, but I am much more worried about the retirement plans of the growing number of skill-level 4 workers.

Taxi drivers, aged-care workers and forklift drivers must plan very carefully for retirement to make the 9.5 per cent of compulsory superannuation saving suffice for two or three decades of retirement.

The median annual salary for an aged-care worker is about $36,000 according to the 2016 census. It’s quite likely that, without a careful financial plan, an aged-care worker won’t have any choice but to work past the age of 65 — not ideal for a job that is physically exhausting.

Our basic sense of social justice still suggests that work past 65 should be done out of the desire to stay engaged in work rather than by economic hardship. I see low-skilled workers most in need of a financial planner and most unlikely to receive such help. On average over the last 33 years we created 66,000 skill-level 4 and 5 jobs every single year. These workers need careful career and financial planning now.

Financial planning early in a career can be an incredibly powerful tool to fight the growing problem of economic hardship among our 65+ cohort. Good advice doesn’t come free, of course, but with the help of smart robo-advice (chatbots and algorithms), cheap advice can be provided at scale. A relatively simple technology solution might make the difference between retirement at 65 or at 75.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout