Savers now don’t have to be losers: neobanks are here

Digital banks are now government-guaranteed and offering higher deposit rates. What’s to lose?

I’ve always thought the term “savers are losers” is a deceptive and cynical line designed by spruikers to rake in new funds. Unfortunately, it’s now undeniably true.

Moreover, it has enormous repercussions for investors. It means the idea that you can “live off your savings” is no longer feasible. It means taking risks does not necessarily lead to successful investment, rather risk taking is mandatory to retain the amount of money you thought you had in the first place.

Earlier this week, Dom Hamson of the Plato investment group made this point earnestly and convincingly. Hamson made the point that inflation is at 1.8 per cent and there is no “risk-free” rate that can match that number.

Certainly not at-call cash, or one-year term deposits at the banks or, indeed, 10-year Australian government bonds. There is no playing with numbers here.

Neither is there any distortion of the inflation rate — savers can’t match any inflation rate, underlying, headline. The measure doesn’t matter, the numbers don’t add up.

To be precise, Hamson pointed out that the income you get from these so-called risk-free investments is falling behind inflation for the first time in two decades. As he explained, even with our modest inflation levels your buying power is dropping each year.

Readers reacted with alarm to Hamson’s comments. Many correspondents at The Australian suggested that the sharemarket was now the only place to go and that savers simply had no choice but to take the plunge.

The most entertaining reader comment on the piece came from someone who signed themselves as “Nick”. He said “cheer up and gear up”. Gallows humour, perhaps?

But many people will not put savings in the sharemarket and they sure as hell won’t borrow to boost returns.

Perhaps they can’t afford to lose money. Perhaps they are in advanced old age and they will not consider putting anything at risk. Or perhaps on principle they want at least some of their cash risk free and by risk free they mean “government guaranteed”.

Now the only guaranteed return in our system is bank savings — that is, money with a government sanctioned approved deposit-taking institution (ADI).

To spell it out, bank deposits are guaranteed by the government to the tune of $250,000 per bank per person.

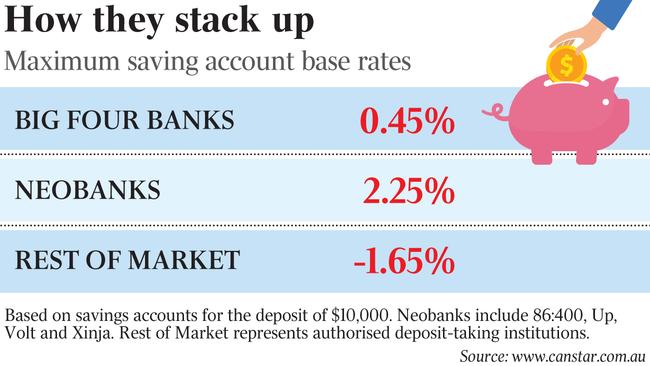

However, the huge frustration among dedicated savers is that our major banks are offering appalling rates on cash — 0.5 per cent or less at call and around 1.5 per cent on many term deposits where your money is locked up for long periods.

Now there is a new breed of banks — called neobanks, an unfortunate moniker that is not going to win over the very people who need them most: conservative and older investors who are dependent on cash.

The names of these banks are awkward and cloyingly fashionable — four that have gained a full banking licence to date are Up, Xinja, Volt and 86 400.

Now here’s the thing — ignore the silly names and tiresome pictures of their executives wearing chinos and T-shirts, they are all ADIs: in the eyes of the law — they are all government-guaranteed. The guarantee is as good for Xinja as it is for Commonwealth Bank.

But the difference is that the new banks, which are also doing home loans and related finance, are offering relatively good deposit rates.

They are offering 2.5 per cent at call on deposits — there are some typical banking arrangements with bonus deals and unusually there are dollar caps on some accounts.

But the rates are literally twice as good and that really matters when we know many people are depending on cash savings.

Self-managed super fund statistics from the tax office are one of the few windows we get into this area.

In the most recent numbers released in December, SMSFs with balances between $200,000 and $500,000 on average had a 30 per cent exposure to cash.

Worryingly, SMSFs in the $100,000-$200,000 range on average had 43 per cent in cash. This is terrible and it is most likely dominated by the oldest investors who have drawn down a lot of funds already.

Once upon a time the “online” bank accounts were the new kids on the block and they offered better rates than the major banks. ING Direct, for example, was a huge success when it arrived in Australia offering higher rates than the big four.

The Dutch-owned global bank imposed itself on top of the local banking system with no branches and surfed the first wave of internet banking. Today the at-call interest rate on ING Direct’s leading savings maximiser account is a miserable 0.25 per cent.

Initially, people were slow to use online-only accounts for a variety of reasons — lack of brand recognition, scepticism on the mechanics of these accounts, trepidation over internet-only access.

Now everybody uses online bank accounts, but the disrupters don’t offer the relatively attractive rates they did when they were trying to break into the market

We are at the same point with the neobanks. Give them a go. The deposit rates are considerably higher than the major banks. They are guaranteed by the government. The rates are better than inflation and, on that basis, savers here will not be losers.

It’s a terrible dilemma for any investor. Saving is now a loss-making proposition.