RBA says bank ‘loyalty tax’ costs borrowers around $1000 a year

RBA reignites the bank ‘loyalty tax’ debate, saying borrowers with older loans pay a lot more in interest.

Banks’ loyal mortgage customers are being slugged about $1000 a year more in interest payments compared to new borrowers, the RBA says.

The claim, made on Friday as the RBA issued its quarterly monetary policy statement, which also provided new data on home loan interest rates, could see more political pressure for the banks over the so-called “loyalty tax” some say existing customers are forced to pay.

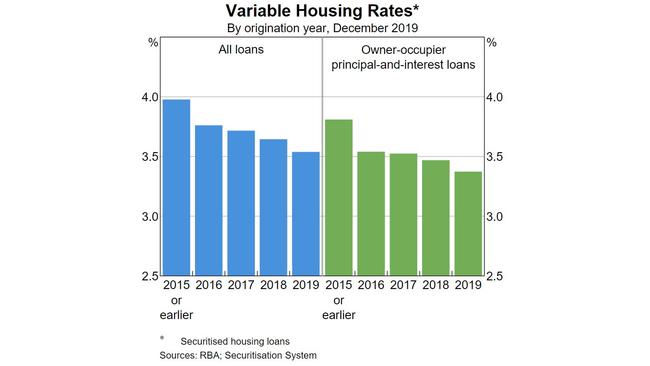

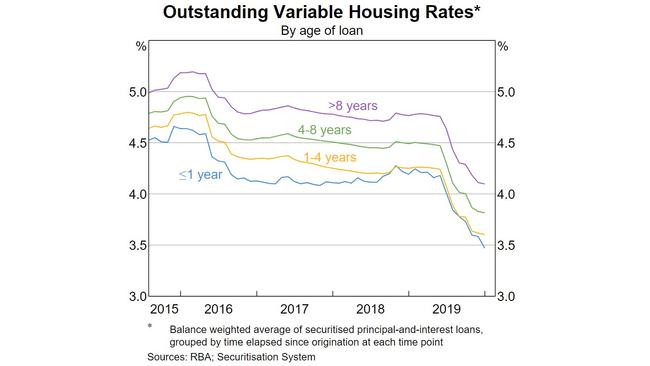

The RBA’s data showed that the differential between rates on new and older loans increased with the age of the mortgage.

“Just under half of all variable-rate home loans in the Reserve Bank’s Securitisation Dataset were originated four or more years ago. Currently, these loans have an interest rate that is around 40 basis points higher than new loans,” the RBA said. “For a loan balance of $250,000, this difference implies an extra $1,000 of interest payments per year.”

The difference in loan rates had been dubbed a “loyalty tax” by some politicians, including Treasurer Josh Frydenberg, who have likened the banking industry to the energy sector.

The banks have defended the claims saying older mortgages reflect the funding costs and other factors at the time the loan was written.

Last year, Commonwealth Bank of Australia chief executive Matt Comyn hit back at suggestions of a “loyalty tax”, arguing in many cases it made sense that different interest rates were charged to customers.

He joined his peers at Westpac and ANZ Bank at welcoming the competition regulator’s new probe on mortgages, saying it was “a good opportunity” for the banks to put forward more information on interest rate pricing decisions.

But CBA disputed the idea that existing bank customers are paying interest rates that are 30 basis points or more higher than discounted home loan rates designed to lure new borrowers.

“It’s actually, from our perspective, substantially less than that,” Mr Comyn said.

Deep discounts

The RBA’s analysis also pointed to steep discounting by banks and other lenders to win new customers.

“Indeed, in recent years, the average discounts relative to SVRs (standard variable rates) offered by major banks on new variable-rate mortgages have grown, widening from around 100 basis points in 2015 to more than 150 basis points in 2019,” it said.

The central bank said some of the 40 basis point difference between older and newer mortgages could be explained by a shift in the mix of different types of variable-rate mortgages.

“In particular, the share of interest-only and investor loans in new lending has declined noticeably in recent years and these tend to have higher interest rates than other loans. Nevertheless, even within given types of mortgages, older mortgages still tend to have higher interest rates than new mortgages.”

The RBA looked at the interest rates small businesses were being charged and found they were typically paying more than their larger counterparts.

“However, small-business borrowers pay significantly lower interest rates on loans secured by residential property compared with their other loans. This is consistent with the security provided by their property reducing the risk for lenders relative to unsecured finance.”