Coronavirus: Residential investment property’s darkest hour

A new report about the prospects for the housing market make for sobering reading. The writing’s on the wall.

Sharply lower new investor lending figures are the writing on the wall. Quite simply, many investors have lost heart on residential property.

The heart of the problem is that the numbers on running a residential investment property — which barely stacked up when things were “normal” — are now shattered by the prospect of falling house prices.

There is little point in seeking views from the property industry on the subject — absolutely everyone in the industry is invested in an endlessly rising market.

But the big banks are in an exceptionally useful position to shine a light on the national market. An ANZ report on the sector this week makes for a sobering read.

The bank expects a drop from top to bottom in the national residential market of 10 per cent.

That may not sound too bad, but keep in mind the bank in January was forecasting an 8 per cent increase for 2020. Worse still, the bank says Sydney and Melbourne could see 13 per cent falls that will run into next year.

As investors, we have to put this scenario beside the negative year we endured in 2019, which means a negative return on property prices for two out of the past three years.

Moreover, it surely is the nail in the coffin of the popular myth that property “doubles every seven years”, or even on a more basic level that property will come through as an investment because the ultimate profit you make on the price rise will more than compensate for those endless maintenance bills and tiny rental yields.

ANZ spells out the varied reasons for what it calls “a derailing of the housing recovery” — high unemployment and a related downturn in income. Importantly, ANZ makes the point that the official unemployment rate does not really tell us how bad things are for the key players in the markets: home loan borrowers and renters.

“Already, nearly a third of Australian households have reported a deterioration in finances due to the pandemic — this does not capture the scale of cuts to hours and wages,” it says.

In other words, it is not just unemployment but underemployment that is going to carve into the confidence in the housing market.

The bank also points to the wider issue that falling population growth will constrain demand.

It’s not complicated — closed borders, the bank says, will “remove the largest source of population growth”. Net migration is set to fall by 85 per cent.

Although investors may compete at auctions with home buyers to acquire property, later they need those home buyers to be actively underpinning the wider market at all times.

New negatives

In many ways these are the fundamental issues you might expect in a recession or in a “recessionary environment”, which we are certainly facing whether we formally register two consecutive quarters of negative GDP growth or not.

But it is in the new negative factors that have emerged in recent months that investors and potential investors will find most challenging.

Until recently, the consolation of residential property investors was that strong rental demand meant there was just about sufficient cash flow to keep the show on the road.

This is about to change.

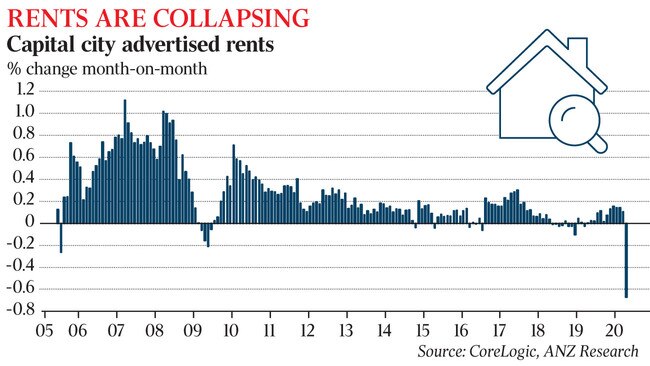

Property research group CoreLogic this week said that rental listings were up by a stunning one-third in city centres — in Melbourne they are up 36 per cent, in Sydney 34 per cent — and rents are starting to fall.

To get the full extent of this picture, we must add the still elevated levels of completions of new high-rise apartments.

On top of that there is one more negative: the Airbnb conversion issue. There are an estimated 150,000 Airbnb rentals that are heavily dependent on tourism. There is effectively no tourism just now and international tourism is some way off. Industry analysts expect at least a third of these Airbnb listings to join the conventional rental market.

In short, to quote ANZ, “rents are collapsing”.

Meanwhile, adding an element of genuine danger to the residential property proposal is the national ban on residential property evictions due to last six months.

Very few property investors find themselves involved in evictions — they only make up an estimated 4 per cent of all disputes. But the reality of the situation is that tenants who will not pay rent do not have to worry about the ultimate threat that property owners can use in a crisis.

The percentage of tenants not paying rent during this crisis is thought to be less than 5 per cent.

But it is one more negative for residential property. No wonder the residential property sector is not witnessing anything like the renewed interest in the sharemarket: it’s dismal.

James Kirby will present Your Portfolio, a series of Facebook live Q&A sessions each Wednesday at 7.30pm starting on May 13.

Unlike the sharemarket, where investors are so keen on “bargain hunting” that the market regulator has been prompted to issue a warning, the residential property market is watching investors bolt for the doors.